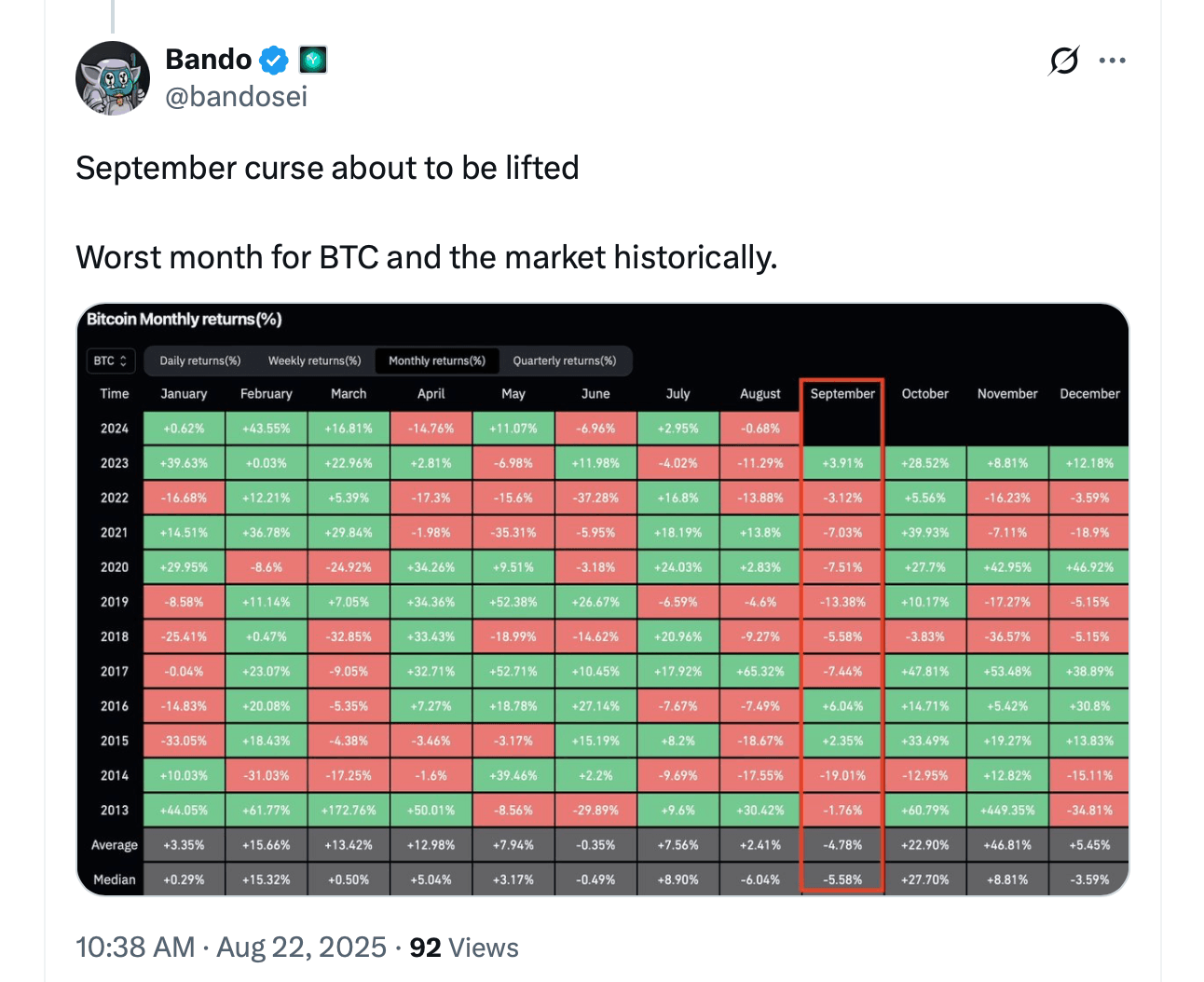

From 2013 by means of 2024, bitcoin’s September observe document has leaned detrimental, and with August winding down, chatter throughout social media is crammed as soon as once more with speak of a “September curse.”

From Repo Spikes to Tax Drains: September’s Combine May Batter Bitcoin Once more

September 2025 is simply three days out, and as common, merchants are already weighing bitcoin’s prospects for the month. Historic information from coinglass.com reveals the coin has typically struggled in September.

It managed good points final 12 months and in 2023, 2016, and 2015. Traditionally, bitcoin closes September decrease about 67% of the time, a sample that continues to spark dialog.

“In your data, September has lengthy been the worst month for bitcoin returns. Excellent time to stack low-cost,” one person commented on X on Monday. Trendspider added to the combo, “September isn’t simply robust for shares. It’s been one in all BTC’s weakest months since 2015.”

Illya Gerasymchuk famous that repo charges usually climb and borrowing slows at quarter-end, which incorporates the month of September. The X account added that Sept. 15 marks the company tax deadline within the U.S., an element that drains international liquidity and infrequently weighs on asset costs like cryptocurrencies.

Some imagine, this time round, will probably be completely different as a result of sure components.

However whereas September is usually a drag, October and the fourth quarter as an entire have usually introduced constructive momentum. Bitcoin has closed October within the inexperienced 83% of the time. Very like the “September curse,” October has earned its personal lore, typically residing as much as the nickname “Uptober.” The streak started in 2013 with a blistering +60.79%.

2014 slipped −12.95%, however 2015 roared again with +33.49%, and 2016 tacked on +14.71%. The 2017 rally surged +47.81%, whereas 2018 noticed a modest dip of −3.83%. Energy returned in 2019 with +10.17%, carried by means of 2020’s +27.7% and 2021’s +39.93%, and even leaner stretches confirmed good points: 2022 notched +5.56%, 2023 added +28.52%, and 2024 wrapped with a gradual +10.76%.