Bitcoin’s (BTC) restoration in early 2026 could not final lengthy, as new information factors to mounting potential promoting strain. Merchants holding Lengthy positions may have to think about opposing circumstances to attenuate danger.

On-chain information exhibits Bitcoin whales are growing their exercise on exchanges. This conduct is particularly dangerous in a low-volume setting.

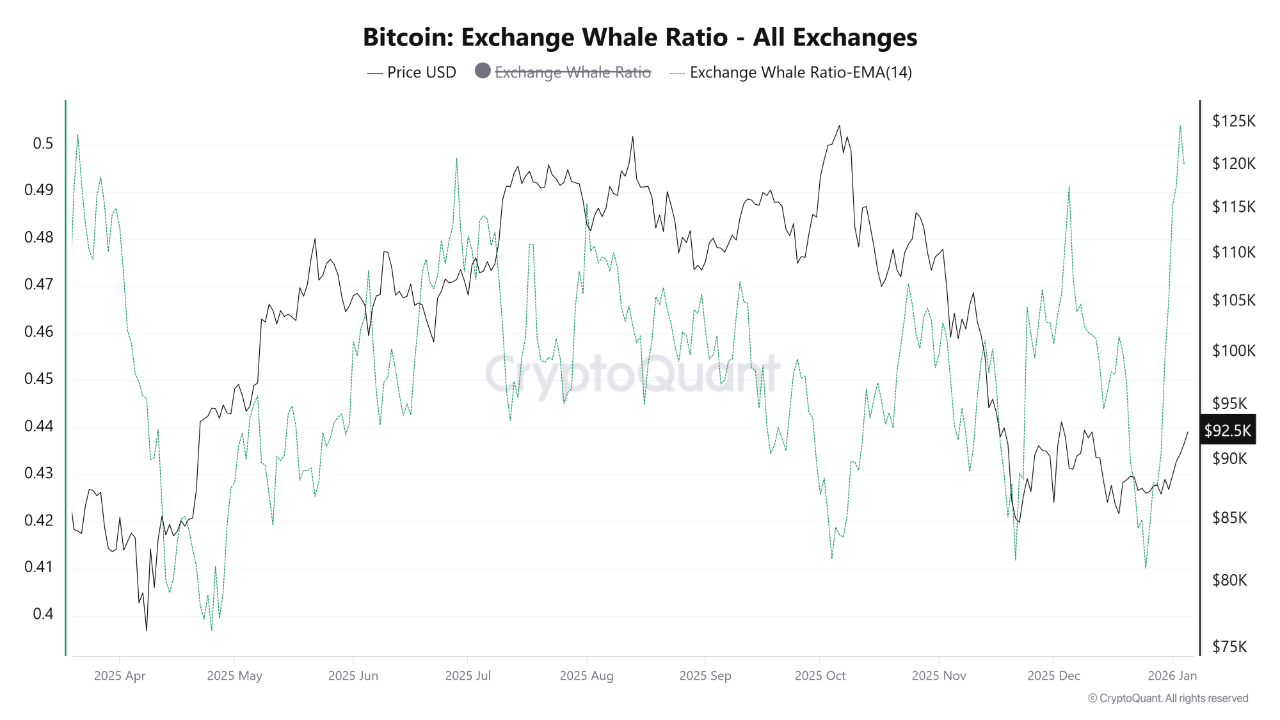

Bitcoin Whale Influx Ratio Spikes in January

One of the vital alarming indicators is the All Exchanges Whale Ratio (EMA14), which has climbed to its highest stage in ten months.

This metric represents the ratio of the highest 10 inflows to whole change inflows. Excessive values point out that whales are utilizing exchanges closely.

Bitcoin Trade Whale Ratio. Supply: CryptoQuant

Though Bitcoin change reserves proceed to development downward as a consequence of demand from DATs and ETFs, the sudden surge on this ratio could function an early warning. It means that BTC balances on exchanges may begin rising once more.

“This improvement coincides with Bitcoin’s value trying a restoration after a corrective part. The sample suggests a possible technique by whales to capitalize on buy-side liquidity to take income and use the present market as exit liquidity,” CryptoOnchain, an analyst at CryptoQuant, commented.

Moreover, more and more fragile market liquidity heightens the chance of sharp value swings and heightened volatility.

Bitcoin and Altcoin Spot Quantity. Supply: Glassnode

Based on a submit by Glassnode on X, spot buying and selling quantity for Bitcoin and altcoins has fallen to its lowest stage since November 2023.

“This weakening demand contrasts sharply with upside strikes throughout the market. It highlights more and more skinny liquidity circumstances behind current value power,” Glassnode reported.

In a low-liquidity setting, solely restricted shopping for strain is required to push costs larger. Conversely, average promoting strain can simply set off giant draw back strikes.

If whales on exchanges start promoting as instructed, mixed with skinny liquidity, Bitcoin’s greater than 6% rebound and the ten% restoration in whole altcoin market capitalization may quickly come to an finish.

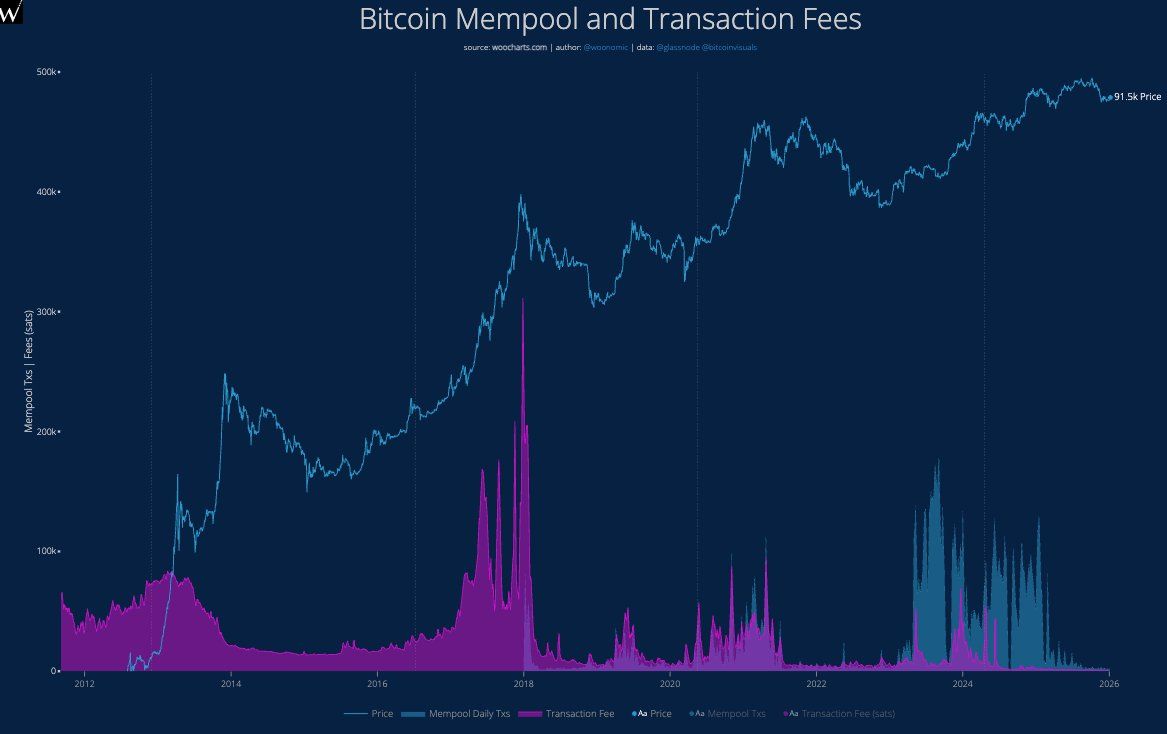

Moreover, analyst Willy Woo famous a pointy decline in Bitcoin transaction charges, describing the market as a “ghost city.”

Charts monitoring the mempool and transaction charges present on-chain exercise at report lows. Each indicators have dropped sharply, reflecting a decline in transactions. Decreased on-chain exercise implies weaker capital inflows and outflows, making the market much less dynamic.

Bitcoin Mempool and Transaction Charges. Supply: Willy Woo

Woo expects a possible short-term pump in January as liquidity hits a neighborhood backside. Nevertheless, the longer-term outlook stays bearish as a result of lack of actual exercise.

Within the quick time period, some analysts anticipate Bitcoin to right towards the $90,000 and $88,500 zones. These ranges additionally align with a newly shaped CME hole.

The submit Bitcoin Whales Speed up Trade Exercise in Early 2026 Amid More and more Fragile Liquidity appeared first on BeInCrypto.