Bitcoin’s momentum is stalling as main traders scale back publicity and institutional inflows shrink. With billions in whale selloffs and cautious company buys, the asset is dealing with a crucial check at $110K.

Abstract

- Whales have dumped over 100,000 BTC in current weeks, the most important selloff since 2022, intensifying downward stress on value.

- Institutional BTC purchases have slowed, with Technique’s month-to-month buys plunging from 134,000 in November 2024 to only 3,700 in August.

- Bitcoin is consolidating between $110K–$115K, with low quantity and weak pattern indicators.

Bitcoin (BTC) is dealing with mounting stress across the $110,000 mark, with knowledge exhibiting a pointy decline in whale accumulation and weakening institutional demand.

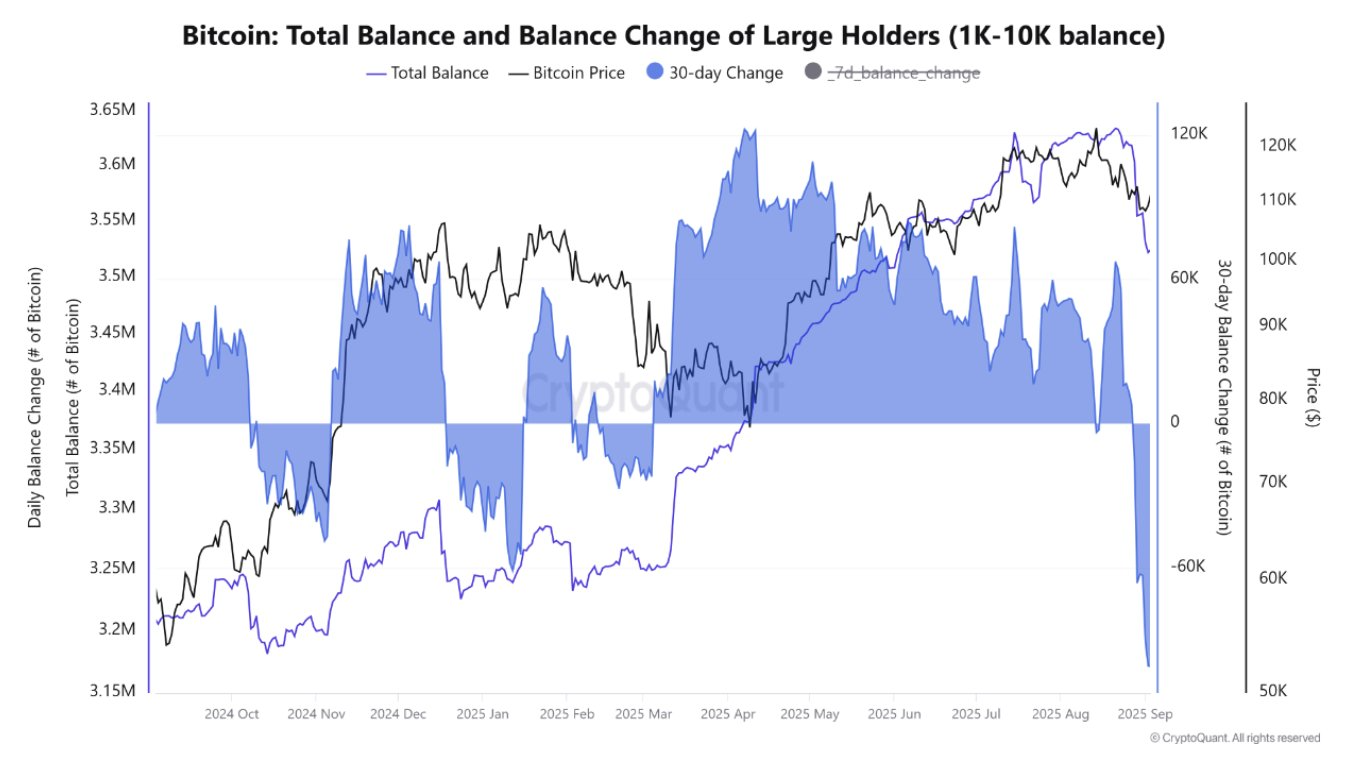

Bitcoin whale sell-off hits highest stage since 2022

In response to CryptoQuant analyst Caueconomy, the Bitcoin market is experiencing the most important wave of whale selloffs since 2022. Prior to now 30 days alone, whale reserves have declined by greater than 100,000 BTC, equal to roughly $11.1 billion at present costs.

Bitcoin Whale Holdings | Supply: CryptoQuant

“This promoting stress has been penalizing the worth construction within the quick time period, finally pushing costs under $108,000,” Caueconomy famous.

These massive holders look like decreasing publicity amid rising market uncertainty. Caueconomy additionally warned that the pattern is just not over, stating that present whale portfolios are nonetheless in decline, which may proceed to weigh on Bitcoin over the approaching weeks.

You may additionally like: Bitcoin, altcoins rise as cooling labor market fails to spook danger commerce

Including to the priority, one other analyst Maartun revealed on Monday that long-term holders offloaded 241,000 BTC, one of many largest since early 2025. The sheer scale of this selloff means that even seasoned holders are starting to lock in income or scale back danger publicity.

Institutional exercise cools regardless of document holdings

A separate pattern of declining institutional curiosity can be unfolding. Though Bitcoin treasuries at present maintain a document 840,000 BTC in 2025, the expansion fee has sharply declined. In response to CryptoQuant, Technique, the largest holder with 637,000 BTC, skilled a lower in its month-to-month purchases, which had been 134,000 BTC in November 2024 and solely 3,700 BTC in August 2025.

Bitcoin buys by different corporations additionally slowed throughout this era, reaching solely 14,800 BTC, far under this yr’s peak of 66,000 BTC. Though the variety of transactions continues to be excessive, the dimensions of these purchases is shrinking. Technique’s common transaction dimension dropped to 1,200 BTC, whereas others averaged simply 343 BTC, down 86% from early 2025 ranges.

This pattern suggests warning and presumably liquidity constraints. Establishments are nonetheless lively, however they’re shopping for much less per transaction, exhibiting hesitance in present market situations regardless of headline holdings being at all-time highs.

Worth motion indicators range-bound buying and selling as bulls lose steam

Bitcoin is buying and selling at press time at $111,134, per market knowledge from crypto.information. The crypto market large is down over 10% from its all-time excessive of $124,128 and stays in a spread of consolidation between $110,000 and $115,000. Within the meantime, technical indicators are giving impartial indicators. The ADX (Common Directional Index) is 16.10, which signifies a weak course in step with the present sideways motion.

BTC’s Worth Chart | Supply: crypto.information

BTC should overcome $115,000 to proceed the bullish pattern, with $120,000 or $125,000 as potential targets. Conversely, a decline under $110,000 can pull BTC to the $105,000 mark as soon as once more.

You may additionally like: Bitcoin bull Michael Saylor makes debut on Bloomberg Billionaires Index