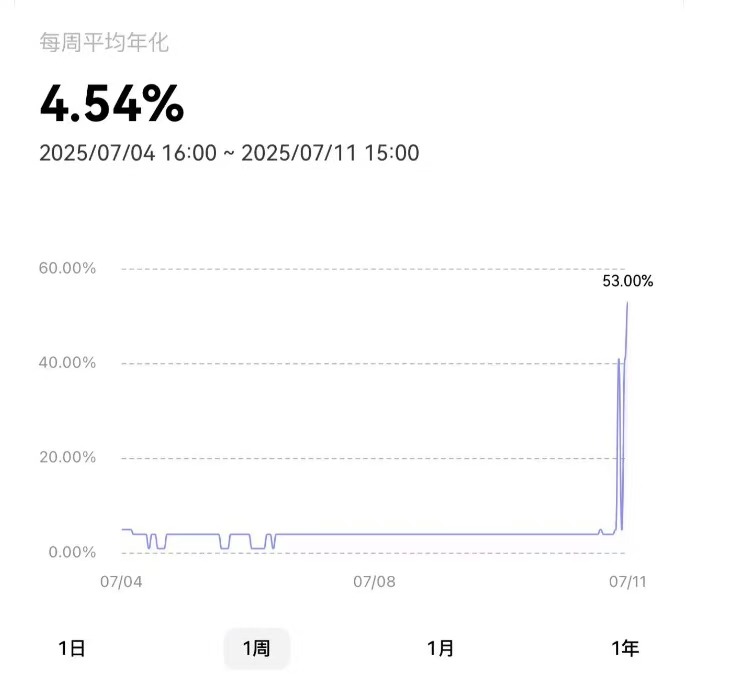

Rates of interest on OKX’s USDT “Easy Earn” versatile financial savings product surged from 5% to 53% within the noon Asian buying and selling hours on Friday, as Bitcoin and the crypto market tasted volatility for the primary time in Q3 2025.

In response to market analysts, the spike is among the highest short-term worth hikes for the yield-bearing product in current months. Traditionally, related jumps have coincided with Bitcoin’s worth rally.

OKX USDT Easy Earn Versatile charges. Supply: OKX

On November 10, 2024, the financial savings product reached a 44% fee when Bitcoin opened at $76,677, and the coin went on to succeed in $90,000 in simply days. Now, with Bitcoin buying and selling at $118,500, an intraday enhance of 6.5%, traders appear unsure about taking income over the potential of a continued market run.

Bitcoin worth dooms brief sellers

In response to Coinglass knowledge, over $1.14 billion in brief positions had been liquidated over the previous 24 hours. The liquidations got here towards the backdrop of Bitcoin’s ascent above $118,000. The Crypto Concern & Greed Index is at 67, which means the market is in a state of extreme shopping for.

When the biggest coin by market cap reached $113,000 throughout the US market buying and selling shut, Bitcoin transfers from miners to exchanges rose to three,900 cash, the primary uptick seen since Could 23.

Miners maintain onto their cash except costs go as much as a degree that justifies promoting, primarily to cowl the price of mining operations. They may be in search of to comprehend income earlier than the top of the “US crypto week,” when many anticipate worth corrections to happen.

CryptoQuant’s UTXO knowledge reveals that solely 15% of the market consists of holders who purchased Bitcoin previously month, down from 30% throughout earlier worth highs. This lower signifies that the present uptrend is below the management of present holders reasonably than by contemporary capital inflows.

SOPR and trade exercise point out warning

The Bitcoin Spent Output Revenue Ratio (SOPR) for short-term holders exhibits that current consumers aren’t promoting, and are as a substitute serving to maintain downward strain on costs low.

Knowledge from Santiment reveals that since June, balances have dropped by 21% to 315,830 BTC. The development is extra profound when wanting on the previous 5 years, throughout which 1.88 million Bitcoins, or 61% of exchange-held cash, have moved into self-custody wallets.

Lengthy-term holders are comfy putting their property exterior of exchanges to cut back the probabilities of any large-scale sell-offs.

On the derivatives market entrance, open curiosity (OI) has gone as much as $41.177 billion, a 5.67% enhance. Greater OI means there’s extra liquidity and a spotlight within the futures market, and goes hand-in-hand with elevated volatility.

Glassnode: Market exercise to develop additional

Late Thursday, Glassnode shared a chart on X that confirmed a $4.4 billion bounce in Bitcoin’s realized cap, a metric that tracks the worth of cash based mostly on their final transfer, after the worth crossed $113,000.

In contrast to market cap, Realized Cap displays precise capital inflows – solely rising when cash transfer at increased costs. The $4.4B bounce as $BTC broke a brand new ATH above $112K confirms actual conviction behind the transfer, not simply speculative markup: https://t.co/2CkVmgTmet pic.twitter.com/xtDARvgcdH

— glassnode (@glassnode) July 10, 2025

Per the market evaluation platform, realized cap will increase solely when cash change arms at increased costs, by precise capital inflows, not speculative valuation.

Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, a chart comparability of the market cap to realized cap, is at 2.2. Earlier market tops in March and December 2024 noticed the MVRV ratio exceed 2.7. Trying on the two figures, market watchers imagine the coin should still not have reached the height of the run but.

Market analyst Axel Adler Jr. defined that an inflection level for promoting takes place when MVRV reaches 2.75, a degree that may see Bitcoin clock $130,900, about 17% above its $108,000 all-time excessive.