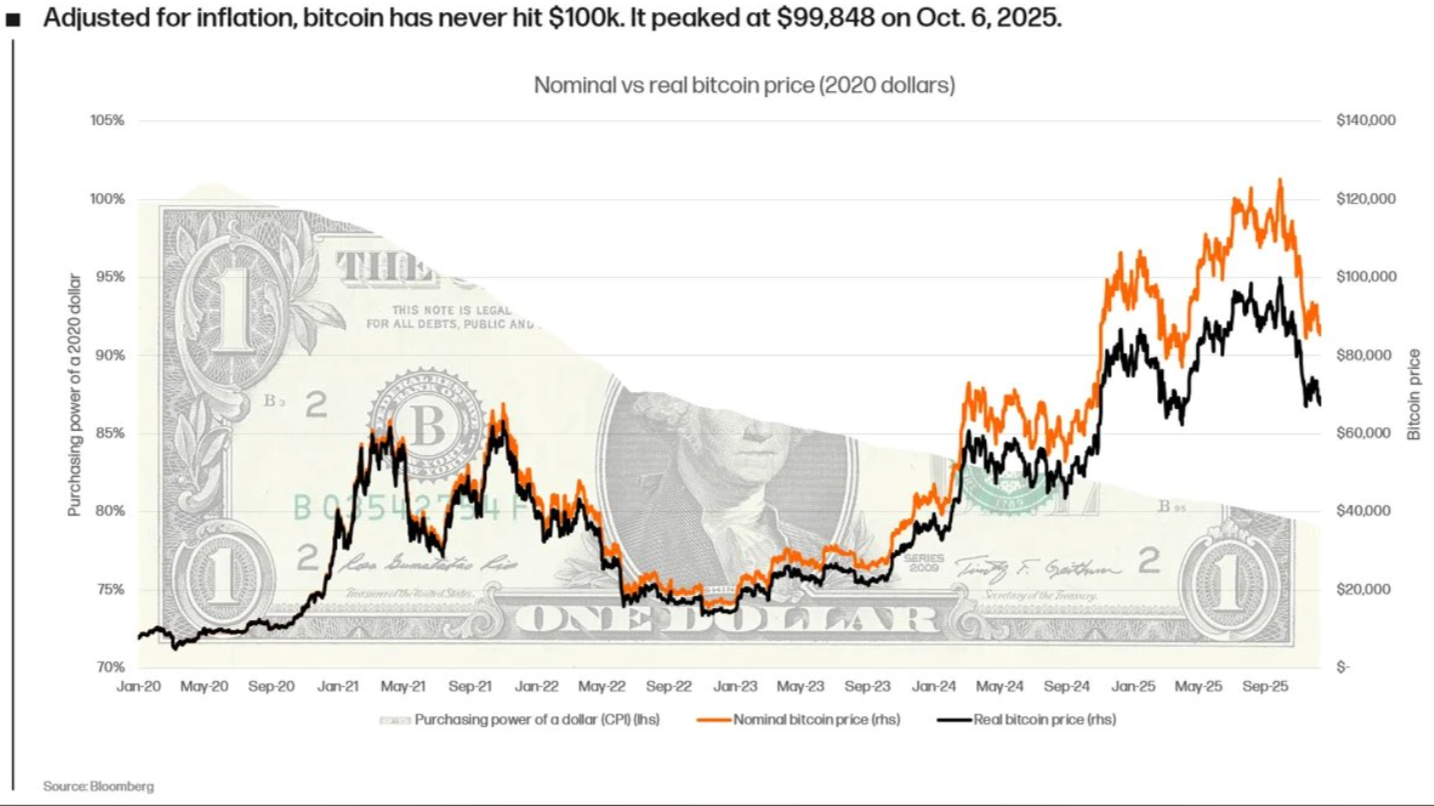

Bitcoin BTC$87,842.41 might have traded above $126,000 in October, however in response to Alex Thorn, world head of analysis at Galaxy Digital, its true worth — as soon as inflation is factored in — by no means crossed the six-figure mark.

“If you happen to regulate the worth of bitcoin for inflation utilizing 2020 {dollars}, BTC by no means crossed $100K,” Thorn wrote in a submit on X. “It really topped at $99,848 in 2020 greenback phrases.”

Thorn is declaring the distinction between nominal and actual costs. The nominal value displays what bitcoin price on the time, in that yr’s {dollars}. The true value, however, adjusts for inflation — giving a extra correct sense of the asset’s buying energy in comparison with a continuing yr like 2020.

Why select the start of 2020 as a begin? Thorn stated that was simply earlier than the Fed’s massive print in response to Covid.

Attainable takeaways

The information may give fodder to each bulls and bears. Bulls would possibly say bitcoin’s run greater from the 2022 lows is not fairly as parabolic as beforehand thought. Which may thus counsel lots much less froth at that nominal $126,000 excessive in October and much more room for the bull transfer to proceed.

Bears, however, would possibly say bitcoin’s weaker inflation-adjusted efficiency means the asset is not dwelling as much as its promoting as a hedge in opposition to greenback printing. Follow gold, they may add, although the yellow steel — on a sizzling run proper now — has had its personal points outperforming inflation in current a long time.