Bitcoin (BTC) begins the 12 months with a shift in possession. Even after 16 years have confirmed the long-term holding outlook, the brand new cohorts of consumers face the problem of a better price foundation.

Bitcoin is dealing with a shift in possession, as long-term holders liquidated a few of their holdings. The run-up to $108K precipitated a few of the older holders to comprehend good points, because the property moved into new wallets aged below three months.

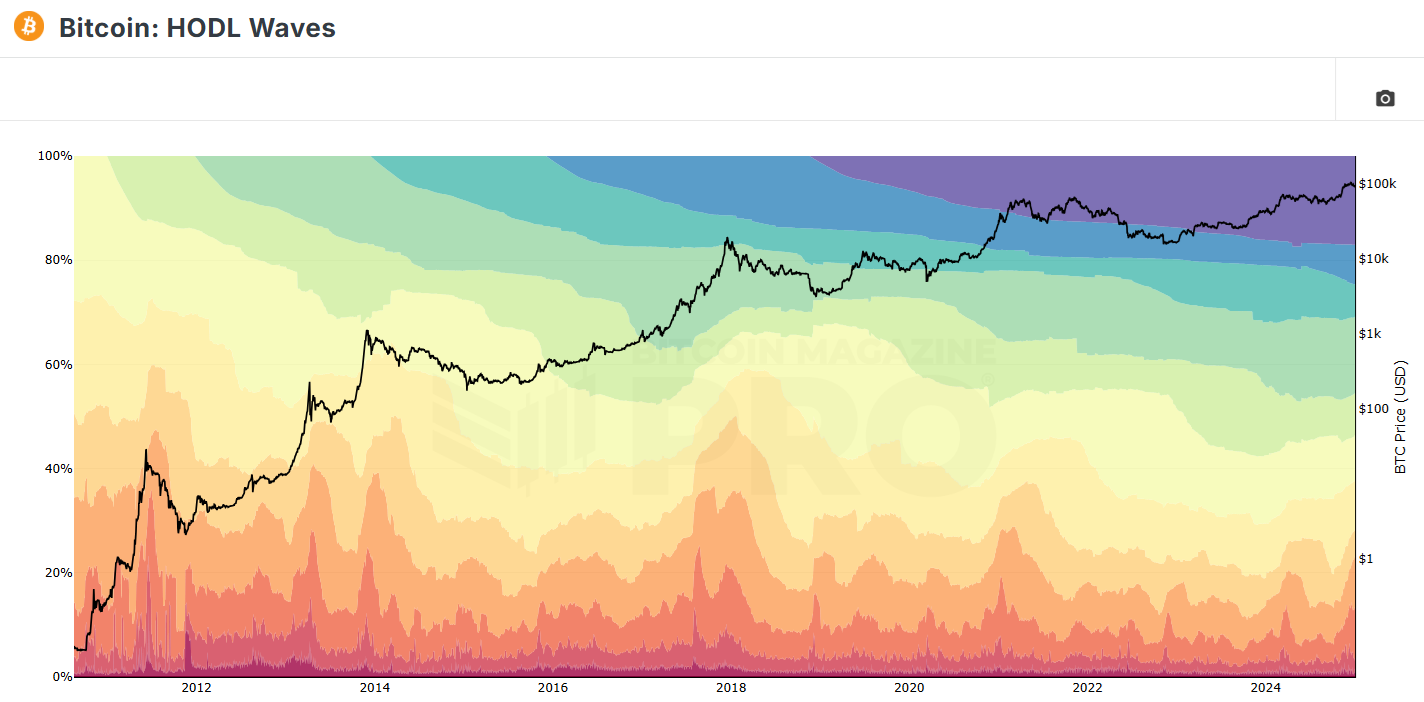

The general pattern for BTC is for wallets to pattern to long-term accumulation. In December, that stability shifted, although solely a small a part of BTC modified arms. Even these cash, nonetheless, are sufficient to trigger promoting stress, in case a few of the consumers panic.

The previous few weeks revealed the pattern of shifting between long-term and short-term holders. Prior to now, a shift like that signaled a market native prime, as extra skilled merchants took income and locked of their good points.

This time round, BTC can also be down from its peak, leaving a brand new cohort of holders to trip out the turbulence of 2025. Within the quick time period, the BTC value is safely above the short-term holders’ realized value. Many of the consumers are within the cash, aside from a small cohort shopping for above $98,000 per BTC.

Prior to now few weeks, consumers had been a mixture of unknown whales, ETF offers, in addition to renewed shopping for by MicroStrategy and Mara Holdings. All of these consumers could have assorted motivations and time horizons. The massive unknown stays short-term whales aiming to lock in short-term good points.

Within the second half of 2024, the typical price foundation for all BTC holders elevated to over $40K. Earlier than that, the fee foundation inched as much as round $23,000 in the beginning of the 12 months. The price foundation is rising extra slowly, tampered by the lengthy interval of accumulation through the protracted bear markets.

The info by Cryptoquant additionally coincide with the ‘hodl wave’ pattern, the place the latest cohorts are quickly increasing their holdings. All pockets cohorts newer than six months noticed a speedy climb in reserves.

BTC new holders gathered cash prior to now three months, taking a few of the provide from older cohorts. | Supply: Bitcoin Journal Professional

The short-term holders of wallets within the 1-3 months vary had probably the most speedy growth, not too long ago making use of the dip towards $93,000 to build up extra cash. The short-term shopping for habits recollects the earlier market native peak in March. For now, the pattern of short-term shopping for has not damaged or reversed and will sign bullish expectations for Q1.

Primarily based on the long-term value outlook, unbiased of investor choices, BTC is in one other accumulation zone. The Rainbow Chart is nowhere near a market prime, signaling extra new all-time highs. Nonetheless, the current cohorts can react to a drawdown, if the worth approaches their ache zone.

Quick-term holders nonetheless have 10% in revenue

After a number of sluggish days, BTC recovered to $98,513.40, rising to a dominance of 53.3%. At this value vary, even short-term holders have a median unrealized achieve of 10%, based mostly on Glassnode information.

With the short-term holder index at 1.1%, the holders should not dealing with any ache, however are holding with a comparatively skinny margin. The index itself doesn’t predict habits, however the 1.0 stage is intently watched.

Prior to now 12 months, the short-term holding index ranged between 0.85% and 1.44%, achieved through the March peak. Through the November value peak, short-term holders had common good points of 35%.

The 1.0 stage often serves as a help for the worth however has traditionally flipped to resistance. Through the This autumn development cycle, the 1.0 short-term holder index corresponds to a BTC value of $87,000, signaling the present ranges should not inflicting ache to holders. That help stage could also be key for retaining BTC in its increased vary and avoiding a drawdown to $70,000.

Miners stay a few of the most secure holders, nonetheless retaining over 1.9M cash. Miners have a a lot decrease common price foundation, which is extraordinarily low for a few of the earlier farms and companies. Regardless of the overall bullish pattern, most company BTC treasuries have stopped including new cash within the quick time period, aside from current shopping for introduced by MicroStrategy and Mara Holdings.