The Bitcoin RSI towards gold has dropped to 30 for less than the fourth time in Bitcoin’s historical past, indicating BTC is extremely undervalued relative to gold.

The newest improvement comes as Bitcoin (BTC) continues to underperform towards gold (XAU) for over six months. Particularly, after hovering to achieve 37 ounces (oz) of gold in August 2025, it has been downhill for BTC, witnessing 5 consecutive months of declines towards gold since then, and on the right track for a sixth month-to-month loss.

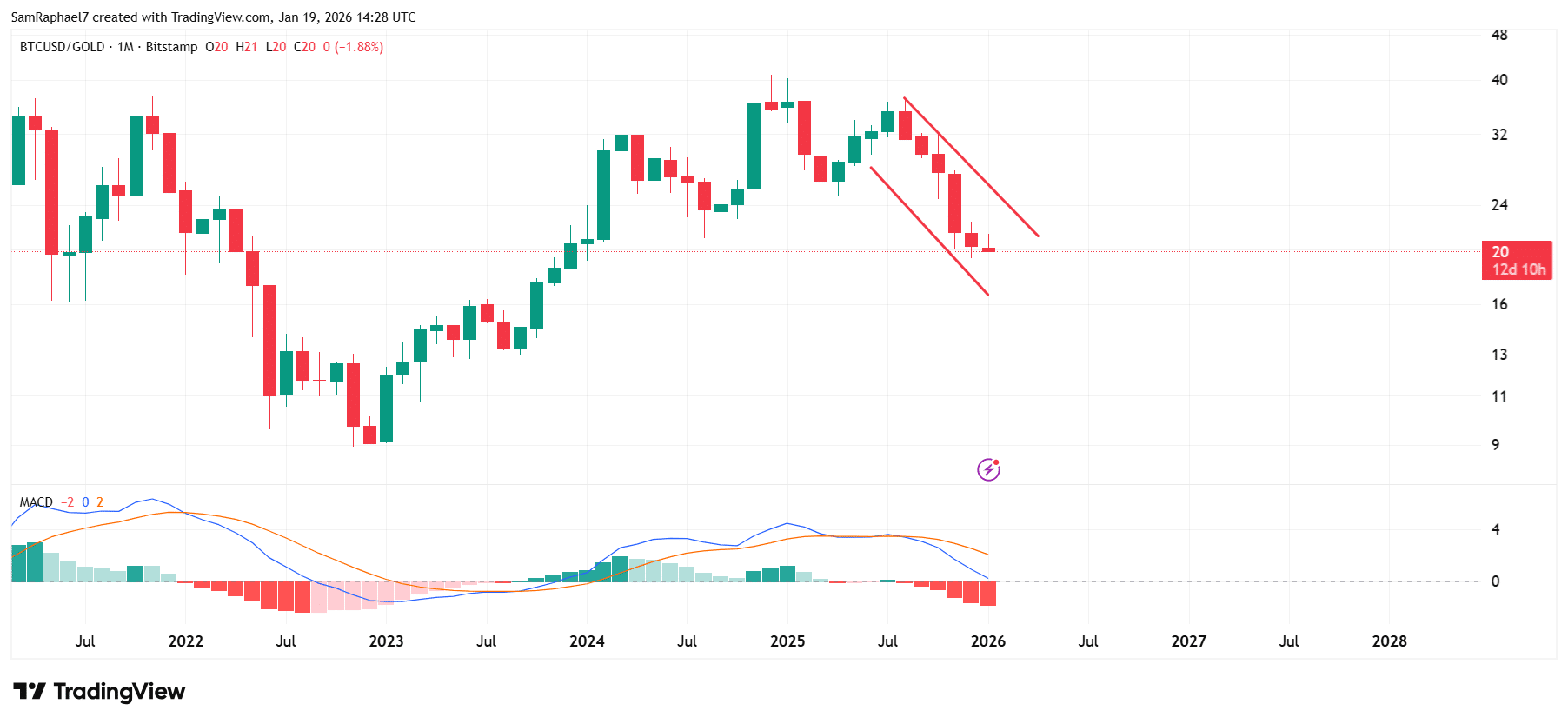

Amid this decline, BTC has now collapsed to twenty ounces of gold, trapped inside a falling channel sample on the month-to-month chart. Nonetheless, market knowledge now confirms that the BTC/XAU pair has now hit an RSI low of 30 for the fourth time in historical past, confirming that BTC is now undervalued towards gold.

Key Factors

- For the reason that rally to 37 ounces of gold in August 2025, Bitcoin has continued to drop towards gold.

- This drop has translated to 5 consecutive month-to-month losses, as BTC struggles whereas gold constantly data new all-time highs.

- With BTC collapsing to twenty ounces of gold amid this decline, the 1W RSI on the BTC/XAU pair has dropped to 30.

- That is solely the fourth time in historical past this indicator has hit 30, with every of the three earlier instances resulting in a Bitcoin rebound.

Bitcoin Struggles Towards Gold

Michaël van de Poppe, a veteran analyst, spotlighted this latest improvement whereas analyzing Bitcoin’s present worth motion amid the continuing downtrend. For context, after recovering to retest $98,000 by Jan. 14, BTC has seen persistent declines, with the newest drop to $92,000 resulting in $785 million in lengthy liquidations.

This downward push, triggered by macroeconomic uncertainties surrounding Trump’s newest tariff bulletins, has exacerbated Bitcoin’s downtrend towards gold, which started in August 2025, after BTC claimed the height of 37 ounces of gold.

Bitcoin has now collapsed practically 46% to 20 ounces of gold, recording 5 consecutive month-to-month candle losses since then. With this decline, BTC has now entered a falling channel construction on the 1-month chart towards gold, however the newest improvement might renew hopes of a rebound.

Bitcoin RSI Towards Gold Hits 30

Particularly, the Bitcoin 1W RSI towards gold has now hit an excessive low of 30, in line with chart knowledge offered by van de Poppe. The analyst confirmed that this represents solely the fourth time in historical past that the RSI would drop to this stage.

For context, BTC has traditionally discovered long-term bottoms versus the yellow metallic on this space. Every prior prevalence preceded a powerful interval of outperformance, that means sellers have been largely exhausted, and worth buyers started positioning for the following cycle.

Furthermore, the creating falling channel on the 1-month BTC/XAU chart bolsters that narrative. Notably, falling channels sometimes type throughout corrective phases and resolve with a bullish breakout as momentum flips again to the upside.

Bitcoin Falling Channel Towards Gold

Historic Context

Knowledge from van de Poppe’s chart additionally confirms that each one the earlier instances this occurred have been throughout Bitcoin bear markets. Particularly, the final time the RSI hit such a low was in November 2022 on the again of the FTX collapse. Shortly after this, Bitcoin recovered from 9 ounces of gold to a excessive of 34 by March 2024.

Bitcoin RSI Towards Gold Drops to 30 | Michael van de Poppe

Earlier than then, the weekly RSI had dropped to 29.15 in December 2018 through the bear market on the time, as BTC traded for 3 ounces of gold. What adopted was a restoration to 10 ounces by June 2019. In the meantime, the earliest prevalence performed out in January 2015, as the RSI hit 27.65. One other uptrend emerged shortly after.