Bitcoin’s (BTC) new bearish sentiment and historic worth motion recommend that the maiden cryptocurrency could also be coming into a recent downturn cycle.

This outlook, shared by outstanding on-line cryptocurrency analyst TradingShot in a TradingView publish on November 11, got here as Bitcoin slipped beneath the $110,000 mark.

Evaluation of weekly worth charts exhibits that Bitcoin has been testing the essential 50-week shifting common (MA), a traditionally decisive degree in cycle shifts. A sustained shut beneath this indicator has beforehand triggered deeper corrections.

The analyst famous that in 2021, Bitcoin peaked roughly seven weeks earlier than U.S. equities, and the same divergence seems to be unfolding once more, with the S&P 500 setting new file highs whereas BTC retreats.

In keeping with the evaluation, Bitcoin topped earlier this yr close to $120,000 and has since shaped decrease highs and declining RSI peaks, mirroring the setup seen forward of the 2022 breakdown.

TradingShot’s cycle mapping additional highlighted a repeating market rotation sample: the final bull cycle ended with capital flowing out of crypto and into equities, with shares peaking shortly after Bitcoin. The present setup exhibits the same lag, suggesting equities might high out towards late November if the timeline holds.

Bitcoin’s subsequent goal

If Bitcoin decisively loses the 1-week 50-MA, technical projections level to a doable retest of the 1-week 100-MA close to the mid-$80,000 zone and a chronic consolidation vary between these two development strains.

Within the earlier cycle, that section preceded an eventual capitulation transfer towards the 1-month 100-MA, presently far decrease, signaling potential draw back danger if the sample repeats.

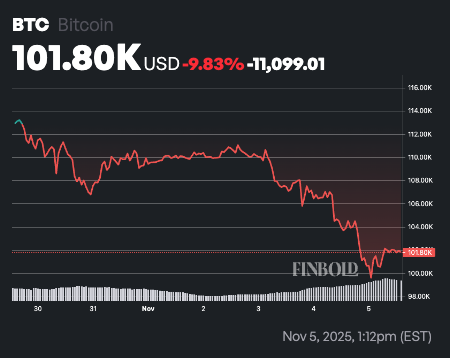

This bearish outlook comes as Bitcoin briefly fell beneath the $100,000 degree, hitting its lowest worth since late June amid a broad crypto-market correction.

The sell-off follows the Federal Reserve’s unexpectedly hawkish stance final week, which dampened hopes for an interest-rate minimize in December. Bitcoin’s weak spot has pissed off traders, particularly because it coincides with file highs in equities and, till just lately, gold.

Bitcoin worth evaluation

By press time, Bitcoin was buying and selling at $101,850, down nearly 2% up to now 24 hours and 10% decrease on the week.

Because it stands, Bitcoin’s fundamental problem is to outlive and keep a worth above $100,000 to reduce the danger of renewed declines.

Featured picture by way of Shutterstock