Bitcoin has shifted right into a corrective leg following its latest pullback, however from a market-structure perspective, the broader development stays constructive.

Worth motion is behaving extra like a managed retracement than a breakdown, becoming neatly inside a higher-timeframe setup that traditionally precedes continuation.

Bitcoin Earnings Have Declined

From a dealer’s lens, the latest drawdown appears much less like panic promoting and extra like weak fingers being flushed out. Quick-term sellers seem like stepping apart, whereas bigger and extra affected person contributors are quietly repositioning.

This rotation typically marks the transition from late-cycle distribution into early accumulation, creating the circumstances for a volatility enlargement to the upside as soon as liquidity rebuilds.

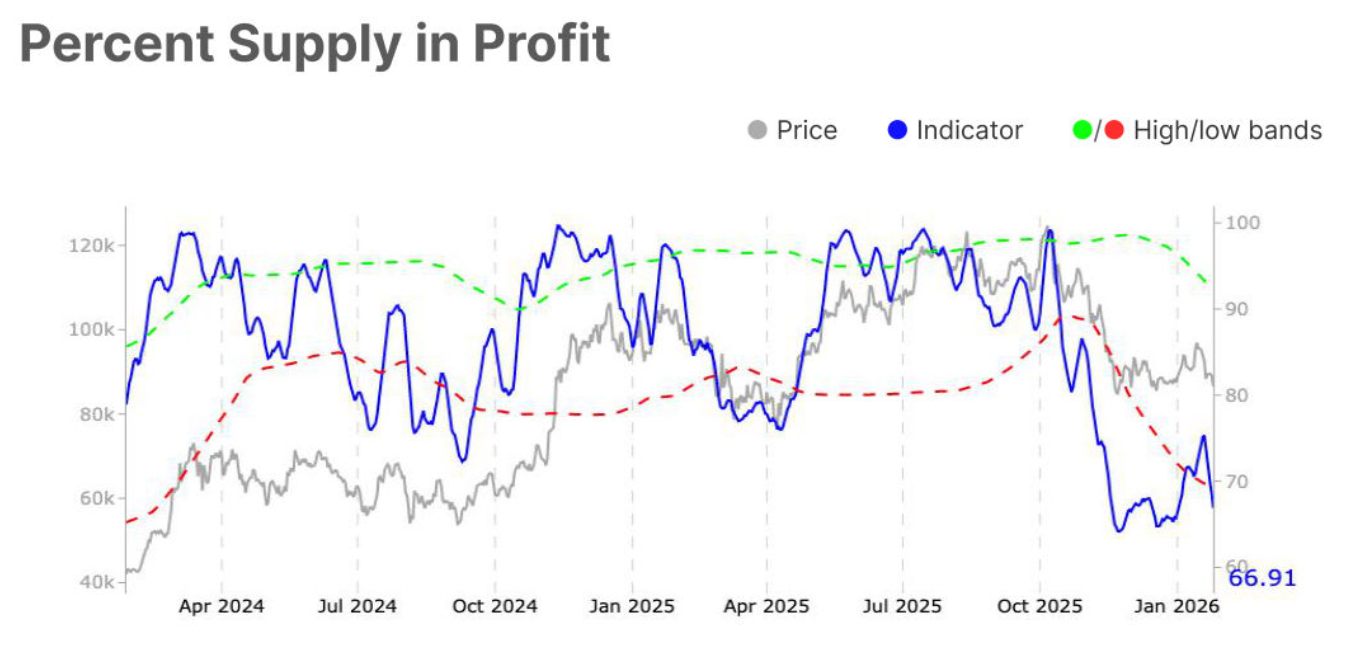

On-chain information reinforces this narrative. Community-wide profitability has compressed meaningfully, with the share of Bitcoin provide in revenue dropping from 75.3% to 66.9%. This transfer pushed profitability beneath the decrease historic threshold round 69.1%, a zone that has repeatedly coincided with native worth stabilization.

When a rising share of holders sit underwater, promote stress sometimes dries up, as the inducement to exit at unfavorable costs diminishes.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Bitcoin Provide In Revenue. Supply: Glassnode

Traditionally, dips beneath this decrease revenue band have acted as a reset mechanism, permitting worth to type a base earlier than the subsequent impulsive leg increased. Though a short, short-term bearish section lately disrupted this sample, present worth ranges are considerably decrease than prior peaks.

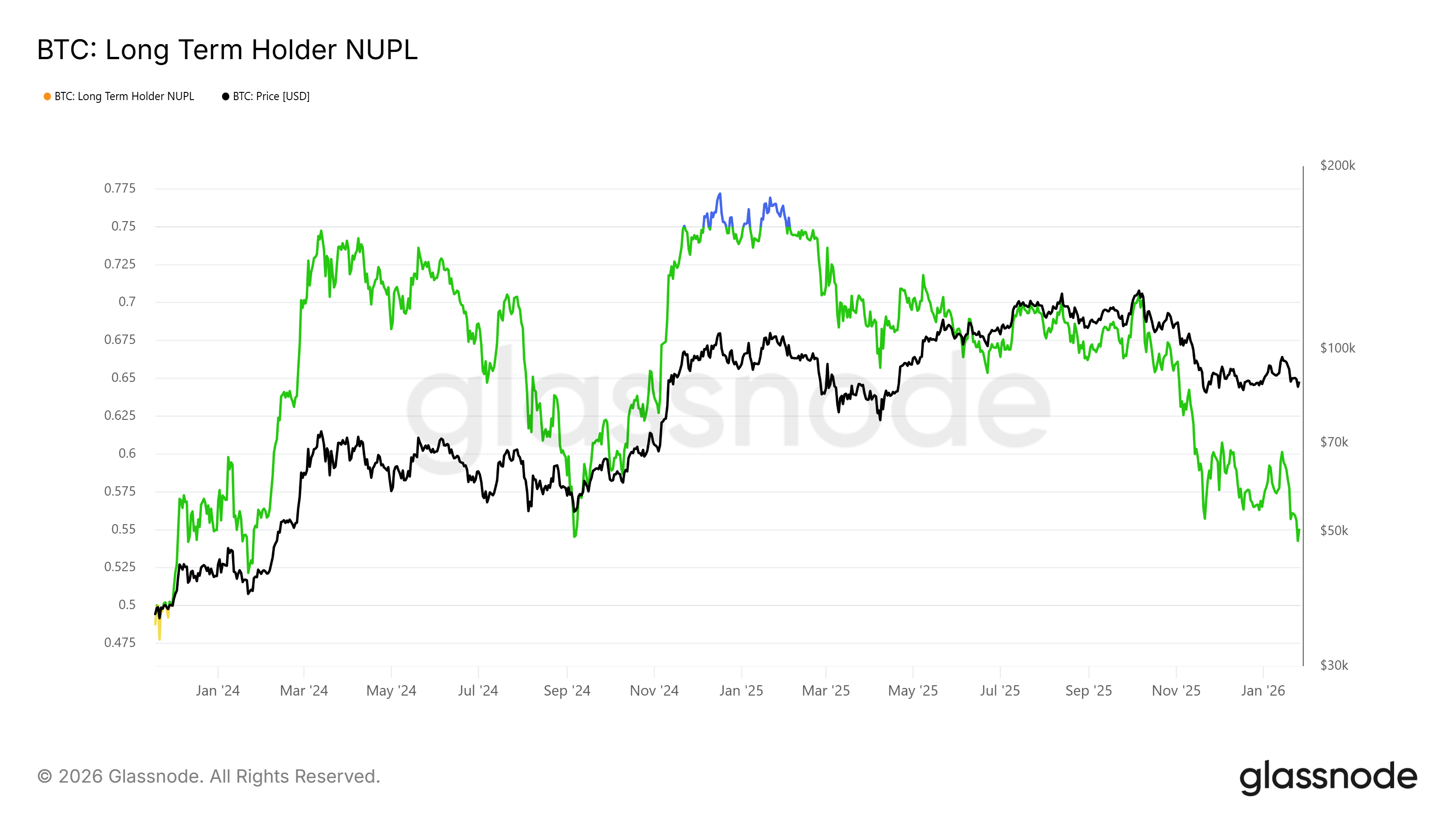

Lengthy-term holder habits additional strengthens the bullish case. The Lengthy-Time period Holder Web Unrealized Revenue/Loss (LTH NUPL) metric exhibits earnings compressing towards ranges which have traditionally altered holder habits.

Bitcoin LTH NUPL. Supply: Glassnode

When LTH NUPL drops beneath 0.60, long-term contributors sometimes gradual or halt distribution, selecting as a substitute to attend for improved circumstances. In earlier cycles, this shift has marked the early levels of renewed accumulation and decreased sell-side stress, permitting worth to get well methodically.

BTC Worth Is Bold

From a technical standpoint, Bitcoin worth stays inside an ascending broadening wedge. Worth lately bounced from the decrease boundary of this construction and is now buying and selling close to $88,475. The fast process for bulls is to clear $89,241 and reclaim the psychological $90,000 stage. Acceptance above $90,000 would sign bettering short-term momentum and ensure energy inside the sample.

A confirmed breakout from the wedge opens the door for increased targets. A transfer towards $98,000 is probably going the primary main milestone, adopted by a wholesome consolidation pullback towards $95,000 to determine assist. This base can be crucial earlier than any sustained push towards the $100,000 mark.

Bitcoin Worth Evaluation. Supply: TradingView

Nevertheless, draw back threat can’t be ignored. If promoting stress resurfaces or macro circumstances worsen, a failure to carry present ranges may ship Bitcoin beneath $87,210. In that situation, a deeper retrace towards $84,698 turns into doubtless, invalidating the bullish setup and suspending the breakout thesis.

The submit Bitcoin Worth’s Rise To $100,000 Will Warrant A Pit-Cease At This Degree appeared first on BeInCrypto.