The bitcoin worth has been chopping sideways for months, however liquidity knowledge that has tracked this cycle virtually completely is hinting that would quickly change. International M2, stablecoin provide, and Gold correlations all counsel BTC is constructing stress for its subsequent breakout.

International M2 and the Bitcoin Worth

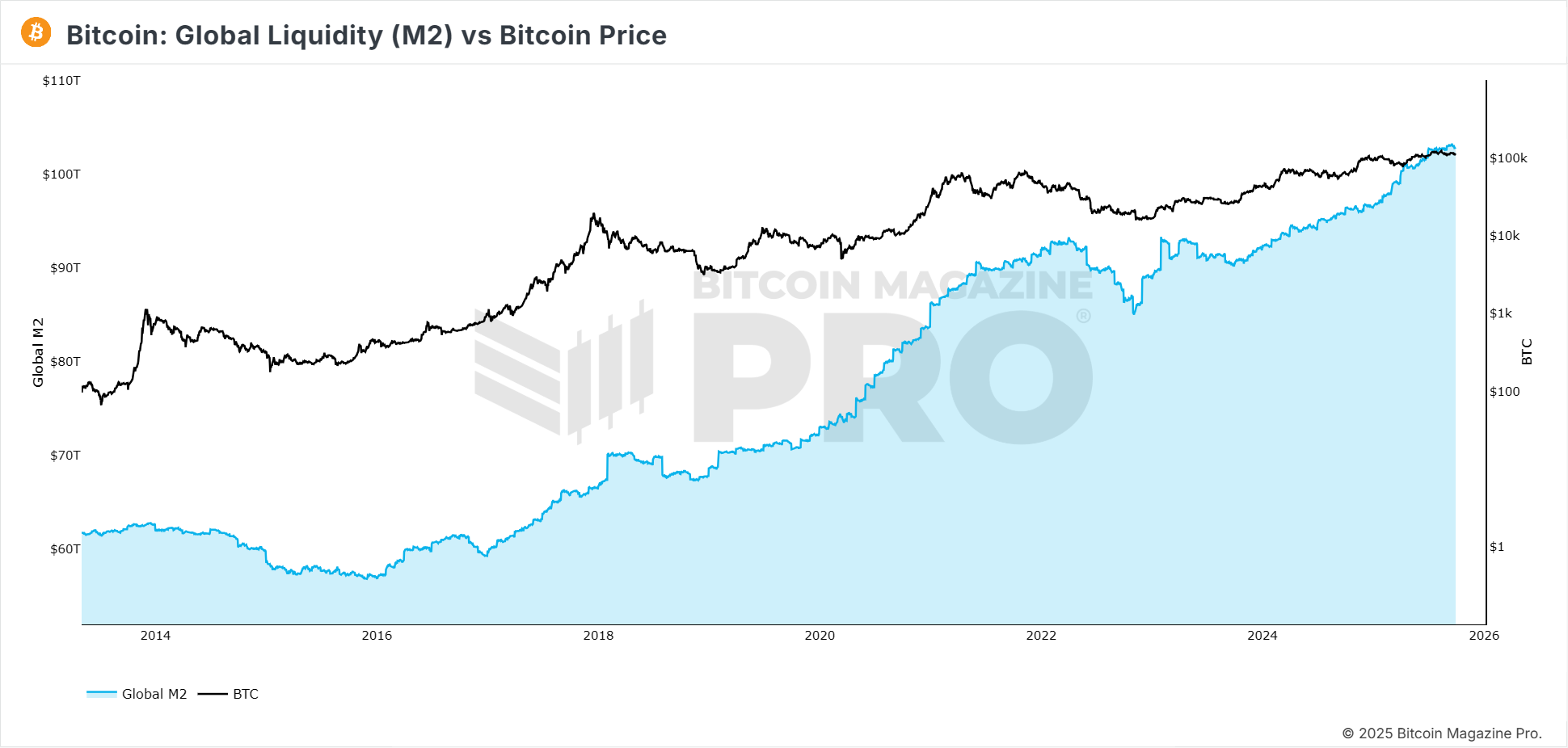

The worldwide M2 cash provide has traditionally proven a robust hyperlink with Bitcoin cycles. Growth tends to coincide with bull markets, whereas contraction or stagnation has lined up with intervals of chop and draw back. Over the previous few months, International M2 development has slowed, and BTC has mirrored that with stagnant worth motion after hitting an all-time excessive close to $124,000. When International M2 accelerates once more, it has constantly flowed into speculative property, with Bitcoin one of many largest beneficiaries.

Determine 1: International Liquidity (M2) vs Bitcoin Worth. View Dwell Chart

Stablecoin Provide and Bitcoin Worth Developments

Stablecoin provide throughout the crypto ecosystem has confirmed to be a fair stronger indicator than International M2. Correlations with BTC have reached above 95%, and on a year-on-year foundation the alignment stays close to good. When the speed of change in stablecoin provide crosses above its 90-day shifting common, it has traditionally signaled a super interval to build up bitcoin forward of robust rallies. The alternative has held true as effectively, with contractions lining up with intervals of weak spot.

Gold Correlations and the Bitcoin Worth

All through 2025, Bitcoin has most intently tracked Gold with a few 40-day lag, exhibiting a correlation of over 92%. Gold’s relentless push to new all-time highs this 12 months has supplied a tailwind for BTC, which frequently follows as buyers rotate into more durable and extra speculative property. If this relationship holds, BTC may see a breakout towards $150,000 in early November.

US Greenback Energy vs. Bitcoin Worth

Whereas liquidity and Gold correlations have leaned bullish, the US Greenback Energy Index has been exhibiting the other. Bitcoin usually trades inversely to the greenback, and the DXY has bounced in current weeks. On a year-on-year foundation, the inverse correlation stands round minus 40%. This implies some near-term chop or draw back stress may stay, even when the bigger pattern favors increased costs.

The confluence of International M2, stablecoin provide, and Gold correlations all level towards BTC being on the verge of a significant breakout, with This fall seasonality including additional weight to the bullish case. Nonetheless, conflicting alerts from the greenback remind us that sideways buying and selling and false begins are a part of each cycle. The bitcoin worth has a historical past of lengthy consolidations earlier than explosive strikes, and present knowledge suggests we could also be proper on the sting of 1 now.

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here:

Bitcoin Is PERFECTLY Following THIS Knowledge Level

For deeper knowledge, charts, {and professional} insights into bitcoin worth tendencies, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding selections.

This put up Bitcoin Worth Poised for Breakout as Liquidity Expands first appeared on Bitcoin Journal and is written by Matt Crosby.