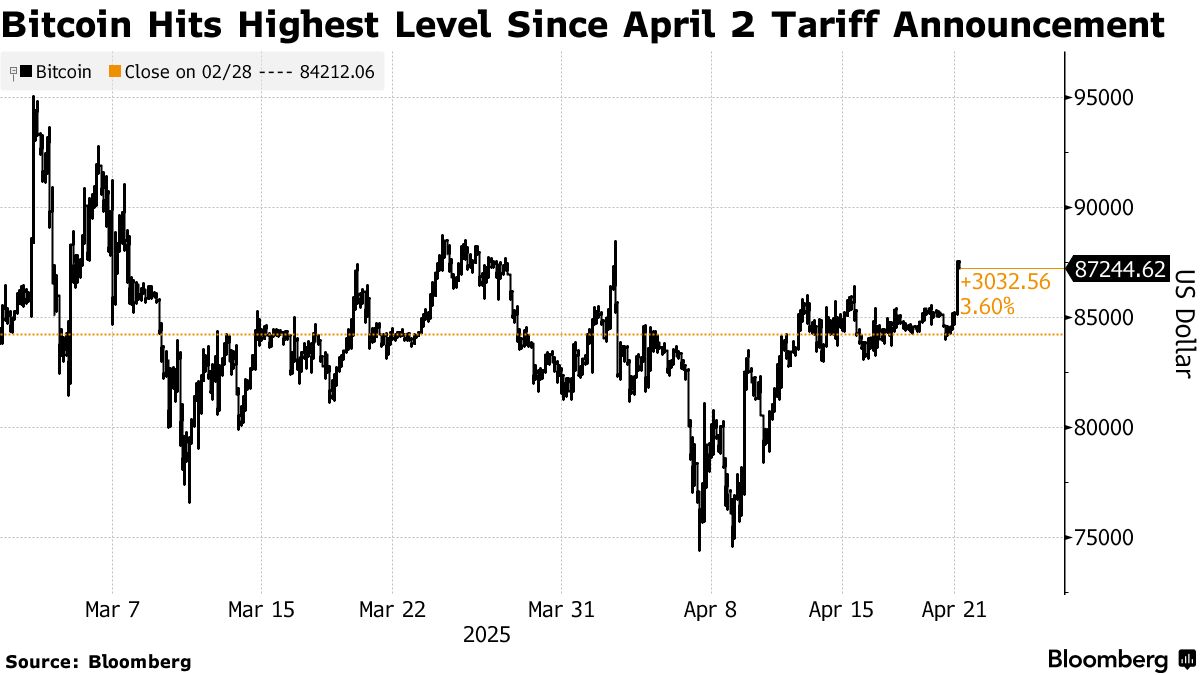

Bitcoin blasted by means of $87,600 on Monday morning in Singapore after president Donald Trump threatened to fireplace Federal Reserve Chair Jerome Powell, slamming the greenback and sending panic throughout world markets.

The three% rise in Bitcoin worn out almost all of the harm from April 2, the day Trump introduced his new spherical of retaliatory tariffs.

Supply: Bloomberg.

Bitcoin wasn’t the one factor flying. Gold additionally shot as much as a brand new all-time excessive as individuals began working towards safer locations to park their cash. With the greenback bleeding and belief in central coverage falling aside, crypto and metals have been the place the panic cash went.

Markets bleed as shares put up third loss in 4 weeks

The rally got here whereas U.S. inventory futures have been getting hammered and the greenback hit its lowest since January 2024. The stress began piling after Kevin Hassett, who runs the Nationwide Financial Council, stated Friday that Trump was “learning” whether or not he had the facility as well Powell from his put up.

That single remark drove the dollar into the bottom and put the independence of the Fed straight into query. Trump himself had stated on Reality Social:

“Too Late’ Jerome Powell of the Fed, who’s at all times TOO LATE AND WRONG, yesterday issued a report which was one other, and typical, full ‘mess!’ Oil costs are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS. Too Late ought to have lowered Curiosity Charges way back, however he ought to definitely decrease them now. Powell’s termination can’t come quick sufficient!”

On Monday morning, S&P 500 futures fell 0.79%. Nasdaq-100 futures dropped 0.82%. And the Dow Jones crashed 318 factors, down 0.81%. It adopted three straight shedding weeks, and this time the promoting hit onerous. Despite the fact that Thursday gave a tiny bump, the S&P 500 nonetheless closed the shortened vacation week down 1.5%.

The Dow and Nasdaq Composite each sank over 2% in the course of the four-day stretch. U.S. markets didn’t even open Friday due to Good Friday, however the selloff picked up pace the second buying and selling resumed.

Thursday’s buying and selling was brutal. UnitedHealth misplaced greater than 22% after slicing its full-year forecast and dropping weaker-than-expected earnings. That single inventory tanked the Dow.

Then Nvidia got here in with extra ache. The chip large noticed shares fall almost 3% after already shedding 7% earlier within the week. On Tuesday, Nvidia admitted it will take a $5.5 billion hit within the subsequent quarter on account of U.S. controls on delivery its H20 GPU chips to China and different international locations.