Macroeconomic tremors from China and the US have put Bitcoin (BTC) within the highlight, providing fertile floor for its narrative as a hedge towards conventional finance (TradFi) instability.

The affect of macroeconomic components and forces on Bitcoin has escalated from 2024 to 2025, after a interval when it dissipated in 2023.

Bitcoin Features from China’s Price Reduce and US Credit score Downgrade

On Tuesday, the Individuals’s Financial institution of China (PBOC) lower its benchmark lending charges for the primary time in seven months. Particularly, it lowered the 1-year Mortgage Prime Price (LPR) from 3.10% to three.00% and the 5-year LPR from 3.60% to three.50%.

The transfer injects recent liquidity into world markets. It goals to stimulate a sluggish economic system weighed down by weak home demand and bolster a shaky property sector, all amid latest commerce tensions with the US.

“The PBOC lower… to assist the economic system amid slowing development and US commerce pressures. Basically, this injects extra momentum into danger property by offering cheaper liquidity and fostering a risk-on sentiment,” famous Axel Adler Jr., an on-chain and macro researcher.

Whereas China’s easing measures purpose to spice up native borrowing and spending, they could additionally spill over into world asset markets, together with crypto.

Typically seen as a high-beta asset, Bitcoin sometimes advantages from such liquidity tailwinds. That is very true when coupled with fiat weakening or broader financial instability.

Concurrently, the US faces its personal credibility disaster. Moody’s downgraded the US sovereign credit standing from AAA to AA1. It cited persistent fiscal deficits, ballooning curiosity bills, and a projected federal debt burden of 134% of GDP by 2035.

This marks solely the third main downgrade in US historical past, following related strikes by Fitch in 2023 and S&P in 2011. Nick Drendel, a knowledge integrity analyst, highlighted the sample of unstable market reactions following earlier downgrades.

“[The Fitch downgrade in 2023] led to a 74 buying and selling day (-10.6%) correction for the Nasdaq earlier than closing above the shut from earlier than the downgrade,” Drendel famous.

This downgrade mirrors these issues amid huge debt, political gridlock, and rising default danger.

Moody’s Downgrade, US Fiscal Woes Enhance Bitcoin’s Secure-Haven Attraction

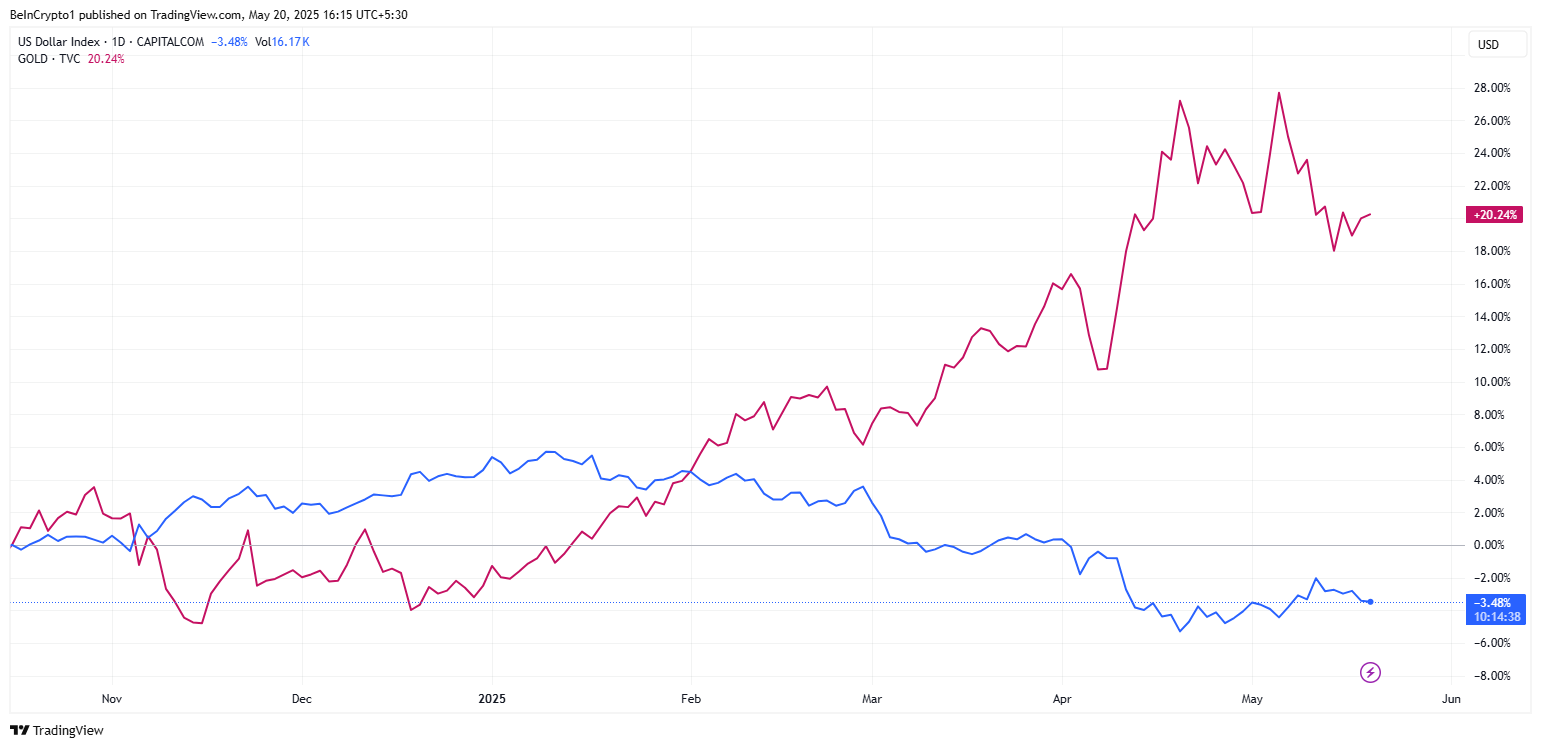

On-chain analyst Adler factors out that the market’s response was swift. The US Greenback Index (DXY) weakened to 100.85, whereas gold rose 0.4%, signaling a basic flight to security.

DXY weakens whereas Gold rises. Supply: TradingView

Bitcoin, ceaselessly dubbed digital gold, noticed renewed curiosity as a non-sovereign retailer of worth.

“…regardless of the prevailing ‘risk-off’ sentiment… Bitcoin could discover itself in a comparatively stronger place within the present setting as a consequence of its “digital gold” narrative and the supportive impact of a weaker greenback,” Adler famous.

Ray Dalio, founding father of Bridgewater Associates, criticized credit score scores for underplaying the broader financial dangers.

“…they solely price the danger of the federal government not paying its debt. They don’t embrace the larger danger that nations in debt will print cash to pay their money owed, thus inflicting holders of the bonds to undergo losses from the decreased worth of the cash they’re getting (somewhat than from the decreased amount of cash they’re getting),” Dalio warned.

Towards this backdrop, Dalio concludes that the dangers for US authorities debt are larger than the score businesses are conveying.

Echoing that sentiment, economist Peter Schiff argued that inflation danger needs to be entrance and middle when score sovereign debt. In his opinion, that is very true when overseas traders who lack political leverage maintain a lot of it.

“…when a nation owes lots of debt to foreigners, who can’t vote, the percentages of a default on foreign-owned debt needs to be factored in,” he famous.

The twin macro shifts, China injecting liquidity and the US exhibiting fiscal cracks, current Bitcoin with a novel tailwind. Traditionally, BTC has thrived below related circumstances – rising inflation fears, weakened fiat credibility, and world capital on the lookout for resilient alternate options.

Although markets stay unstable, the confluence of dovish Chinese language coverage and renewed doubts about US fiscal self-discipline may drive institutional and retail traders towards decentralized property like Bitcoin.

If the greenback continues to lose enchantment and central banks undertake simpler insurance policies, Bitcoin’s worth proposition as a politically impartial, non-inflationary asset will develop into more durable to disregard.

Bitcoin (BTC) Value Efficiency. Supply: BeInCrypto

BeInCrypto information reveals BTC was buying and selling for $105,156 as of this writing. This represents a modest 2.11% surge within the final 24 hours.