US spot Bitcoin exchange-traded funds simply posted their busiest buying and selling session ever, even because the current slide within the cryptocurrency’s worth has left the typical ETF investor holding losses.

The surge in exercise marks a brand new part available in the market’s adjustment to this month’s selloff within the sector.

BlackRock’s IBIT on High as $238 Million Inflows Return Amid Market Stress

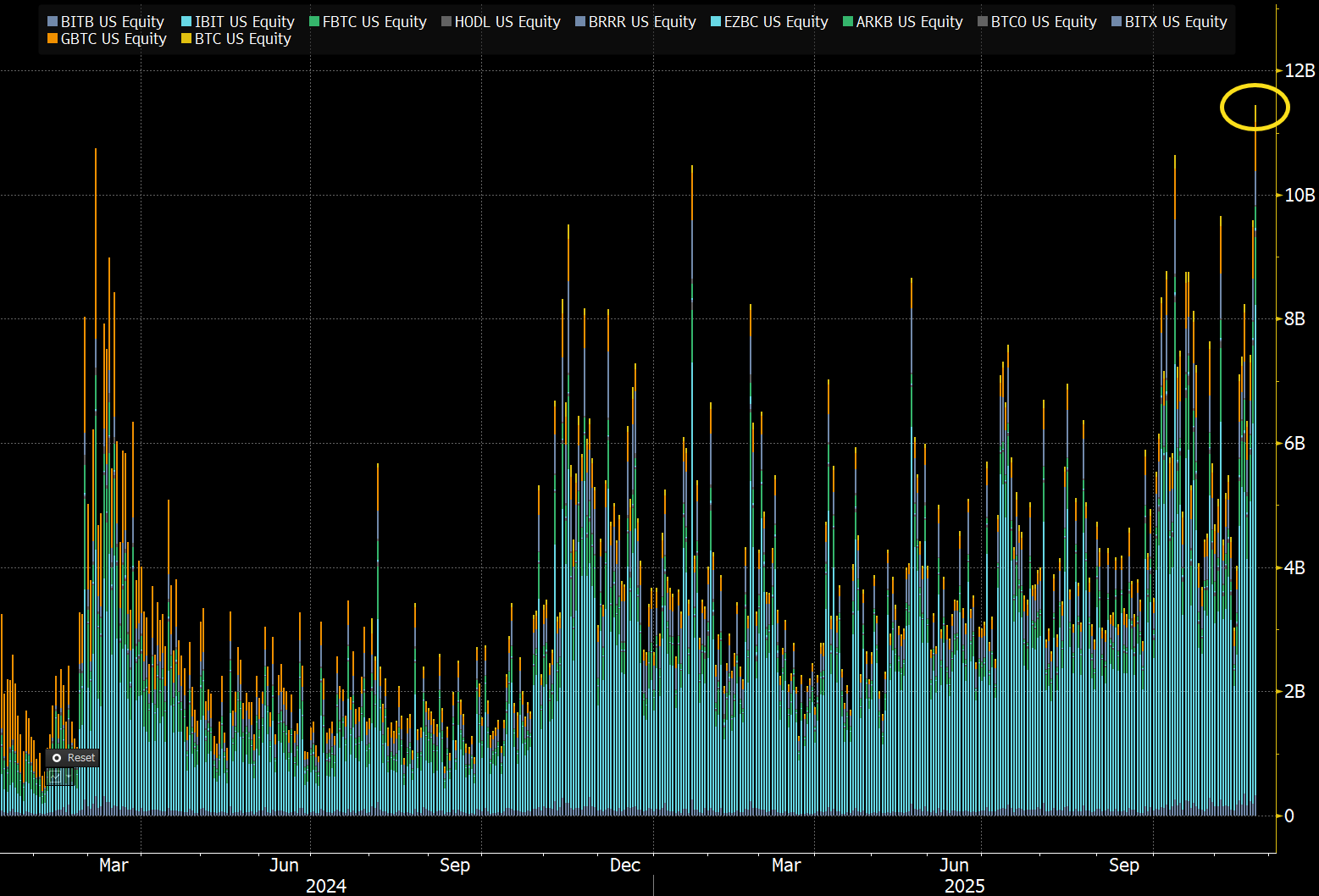

On November 21, Bloomberg Senior ETF Analyst Eric Balchunas reported that the 12 spot Bitcoin ETFs recorded $11.5 billion in mixed buying and selling quantity.

US Bitcoin ETFs File Buying and selling Quantity. Supply: Eric Balchunas

Balchunas described the spike in quantity as “wild however regular,” noting that ETFs and different asset lessons are inclined to report elevated turnover in periods of market stress.

He mentioned such bursts of exercise usually sign the discharge of liquidity as traders reshuffle positions.

The elevated turnover mirrored brisk two-way participation, with some traders slicing publicity whereas others took benefit of decrease costs so as to add to positions.

BlackRock’s IBIT led the surge, producing $8 billion in turnover and accounting for greater than 69% of all spot Bitcoin ETF buying and selling that day. This was IBIT’s highest-volume session since launch, although the fund nonetheless ended the day with $122 million in outflows.

“Additionally, no shock report week for Put quantity in IBIT.. that is one factor that will assist folks keep the course, they’ll all the time purchase some places as a hedge whereas they keep lengthy,” Balchunas added.

In the meantime, different Bitcoin ETFs, led by Constancy’s FBTC, posted internet inflows of greater than $238 million.

Regardless of this influx, the 12 Bitcoin funding automobiles are on the right track for his or her worst buying and selling month, with internet outflows of greater than $3.5 billion.

US Bitcoin ETFs Month-to-month Flows. Supply: SoSoValue

This substantial outflow and report session come as the typical spot Bitcoin ETF holder has slipped into the pink.

Knowledge from Bianco Analysis reveals the weighted common buy worth for spot Bitcoin ETF inflows stood at $91,725 as of November 20.

The typical Spot BTC ETF holder is now within the pink. pic.twitter.com/fMb5ln2we7

— Jim Bianco (@biancoresearch) November 20, 2025

Bitcoin’s drop beneath that degree this week pushed most holders, together with those that entered the market in January 2024, into unrealized losses.

Bitcoin fell roughly 12% this week to as little as $80,000 earlier than recovering to $84,431 as of press time. This worth efficiency extends a month-long slide and reinforces the risk-off sentiment throughout digital property.

The publish Bitcoin ETFs Hit File $11.5 Billion Quantity as Most Traders Slip Into Losses appeared first on BeInCrypto.