Institutional traders are more and more risk-averse, shifting capital away from Bitcoin ETF merchandise. This shift in sentiment has led to a pointy spike in capital exit, with US-listed spot Bitcoin ETFs recording one other day of outflows on Tuesday.

This development indicators sustained bearish strain and a scarcity of conviction from institutional gamers who had beforehand fueled bullish momentum within the ETF market.

Bitcoin Sees Sharpest Fund Outflows Since March

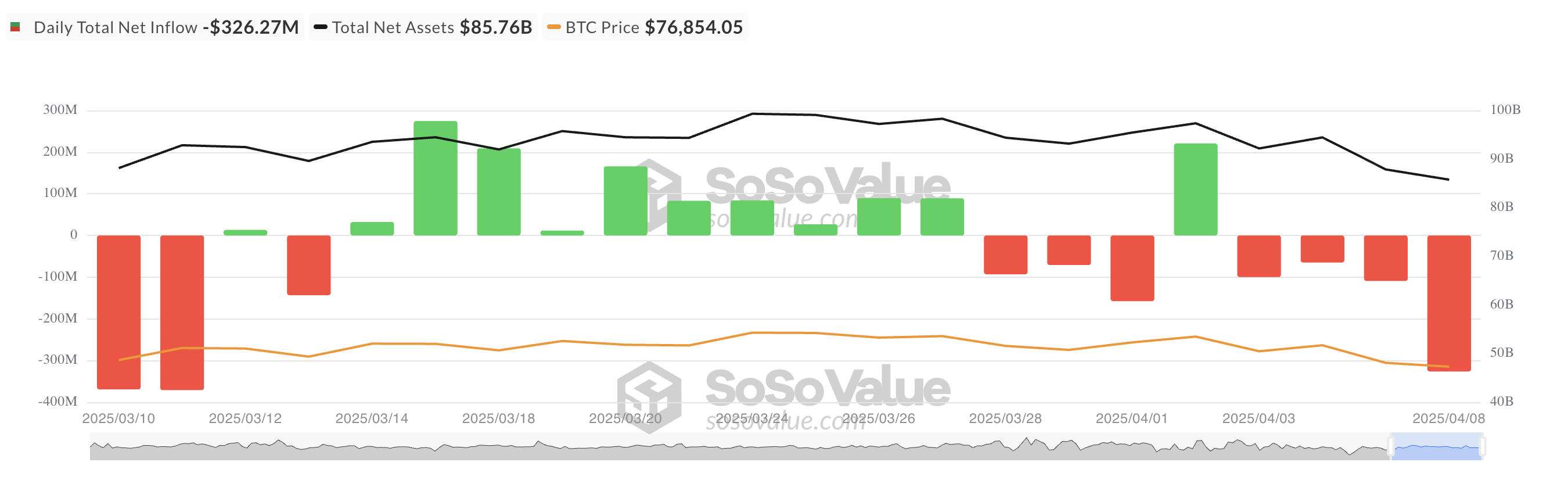

On Tuesday, fund outflows from spot BTC ETFs totaled $326.27 million, marking 4 consecutive days of constant outflows. Yesterday’s determine additionally represented the very best single-day outflow from spot BTC ETFs since March 10, signaling a notable shift in sentiment.

Complete Bitcoin Spot ETF Internet Influx. Supply: SosoValue

This sustained capital flight suggests that giant traders are de-risking their portfolios in response to macroeconomic pressures triggered by Donald Trump’s dealer wars. The development is important contemplating the position institutional flows have performed in driving BTC’s rally by way of ETF demand previously.

In keeping with SosoValue, BlackRock’s ETF IBIT noticed the very best internet outflow on Tuesday, totaling $252.29 million, bringing its whole historic internet influx to $39.66 billion.

Bitwise’s ETF BITB got here second with a every day internet outflow of $21.27 million. As of this writing, the ETF’s whole historic internet influx nonetheless stands at $1.97 billion.

For the second time this week, not one of the twelve US-listed spot Bitcoin ETFs recorded a single internet influx.

Bitcoin Futures Cool Off as Choices Merchants Guess on a Rebound

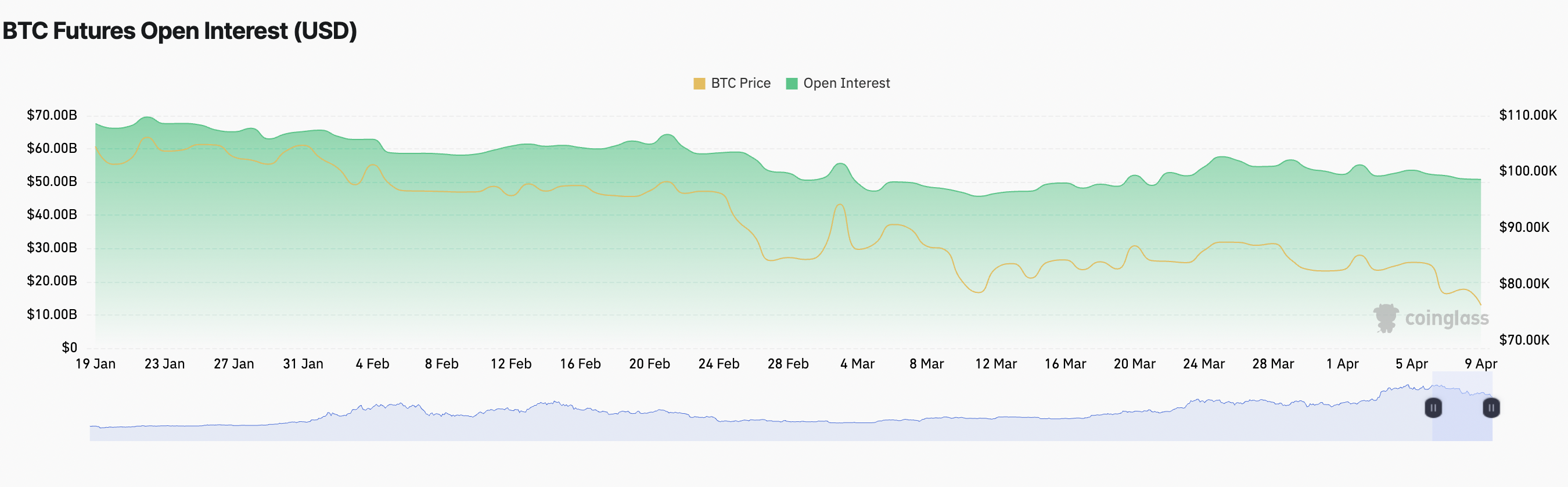

On the identical time, open curiosity (OI) in BTC futures stays suppressed, an indication that conviction amongst leveraged merchants has not returned. At press time, that is at $50.81 billion, falling by 0.27% over the previous day.

BTC Futures Open Curiosity. Supply: Coinglass

When BTC’s OI falls, present futures contracts are being closed out or liquidated sooner than new ones are being opened. This indicators lowered dealer participation or waning conviction within the present market development.

Regardless of this, many futures merchants stay optimistic, as mirrored by the coin’s constructive funding fee, which stands at 0.0090% at press time. BTC’s falling OI and constructive funding fee recommend that its merchants nonetheless pay a premium to carry lengthy positions, however total market participation is declining.

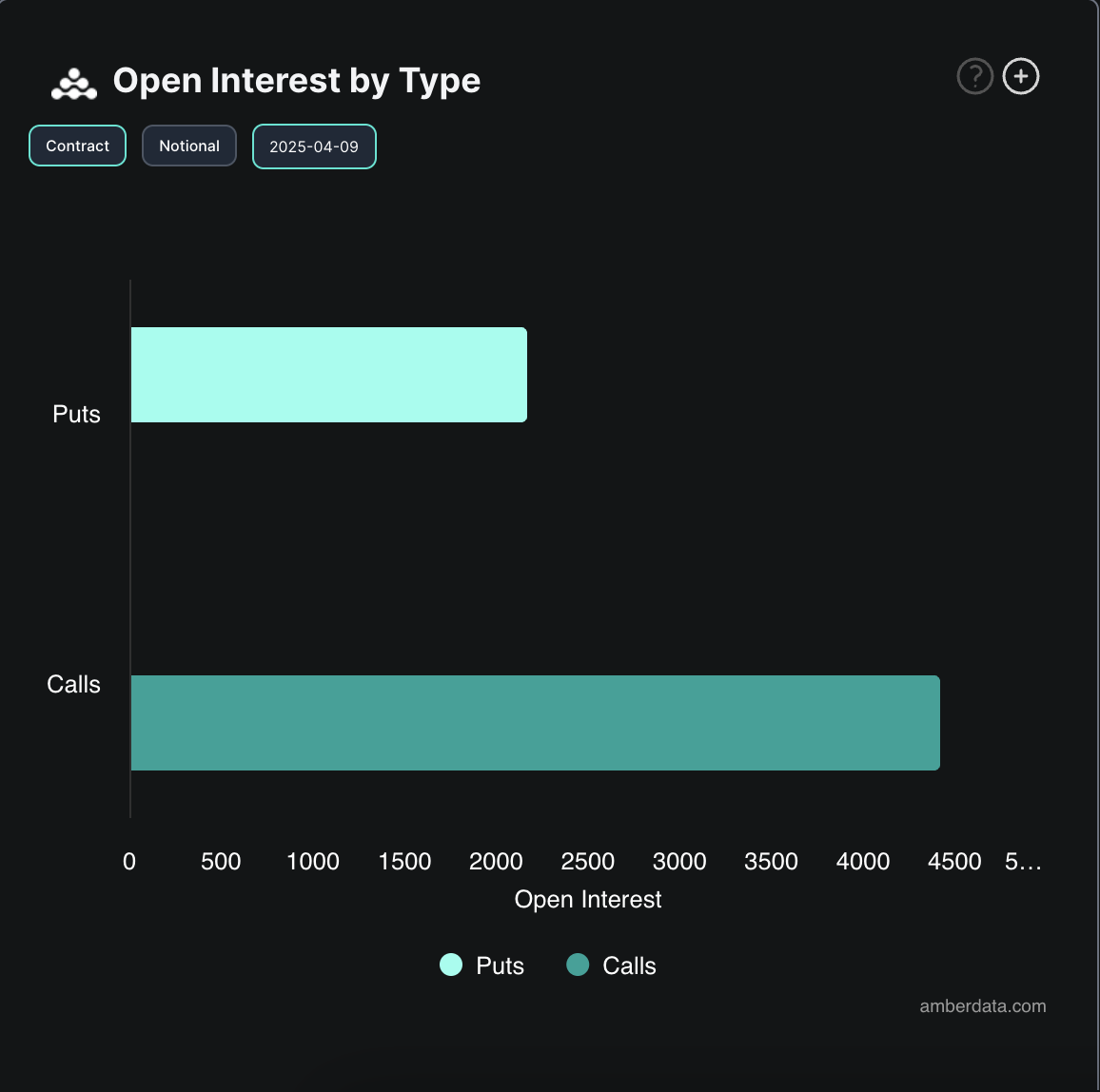

Notably, on the choices facet, the demand for name contracts has now exceeded places.

BTC Choices Open Curiosity. Supply: Deribit

Which means that extra merchants are betting on or hedging for value will increase. It signifies an elevated demand for upside publicity, suggesting confidence in a possible rally.