Bitcoin has stepped into its traditionally most important month for beneficial properties — November — with a median improve of 42.51% since 2013 — that means Bitcoin may surpass $160,000 this month if historical past rhymes.

Nevertheless, a crypto analyst famous that a number of macroeconomic elements are additionally at play.

“I do assume seasonal charts matter quite a bit, nevertheless it must be mixed with plenty of different elements,” stated crypto analyst Markus Thielen from 10x Analysis.

Wanting forward, there’s an expectation that the US Fed will additional decrease rates of interest, and the US and China are engaged on a commerce deal; each developments might be favorable for Bitcoin. Nevertheless, the federal government shutdown and US tariffs proceed so as to add to financial uncertainty.

Right here’s a breakdown of some key developments to maintain your eye on within the weeks forward.

US / China easing commerce tensions

A gathering between US President Donald Trump and Chinese language President Xi Jinping on Thursday was seen as a constructive step towards ending commerce tensions between the US and China.

Trump described the talks with the Chinese language president in South Korea as “wonderful.” A part of the talks included an settlement from Trump to trim tariffs on China in alternate for Beijing cracking down on fentanyl commerce, resuming US soybean shopping for and an finish to restrictions on uncommon earth exports for a yr.

Bitcoin month-to-month returns since 2013. Supply: CoinGlass

Trump instructed reporters he expects a commerce take care of China “fairly quickly.”

Trump’s menace of tariffs towards China was blamed for the current crypto crash, which noticed $19 billion liquidated over simply 24 hours on Oct. 11. The crypto market has struggled to get better since then.

Nevertheless, Dennis Wilder, a professor at Georgetown College and a senior fellow in its China Initiative, instructed CBC Information that the assembly was extra of a “pause” within the commerce warfare, nevertheless it was removed from over.

US Fed to chop charges, finish quantitative tightening

It was solely days in the past that Fed officers voted for an additional quarter-point fee minimize, decreasing the important thing lending fee to its lowest degree in three years.

The subsequent Fed assembly date is about for Dec. 10, 2025. Knowledge from CME’s FedWatch — a instrument used to measure expectations for a Federal Reserve fee change — reveals merchants are pricing in a 63% likelihood of a fee minimize.

Fed Chair Jerome Powell stunned markets on Wednesday by saying the transfer was “not a foregone conclusion.”

Fed cuts are seen as bullish for Bitcoin, because the decrease value of borrowing cash has traditionally incentivized traders to commerce riskier property, similar to cryptocurrencies.

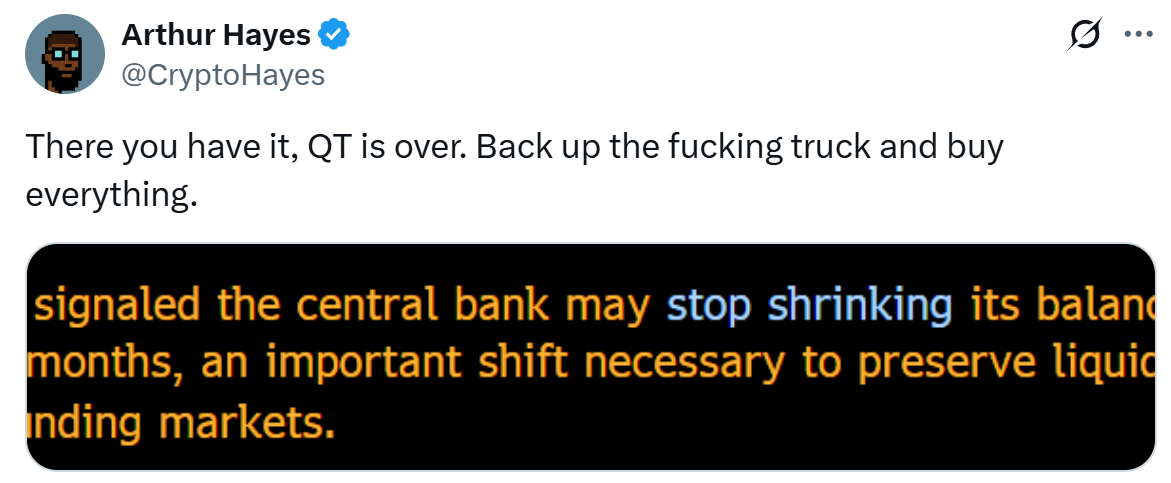

Including to that is the Federal Reserve’s current resolution to halt its quantitative tightening (QT) program on Dec. 1. QT is the method of contracting the central financial institution’s stability sheet. The aim of QT is to chill down an overheating economic system and stop inflation from rising too rapidly.

Supply: Arthur Hayes

The other of this, quantitative easing, includes central banks injecting more money into the economic system, and is seen pretty much as good for crypto, as a few of that cash flows into various property.

US authorities shutdown stretches on

The US authorities shutdown is quickly to enter its fifth week, approaching the longest in US historical past, as US Republicans and Democrats stay deadlocked over the federal government spending plan.

Associated: Bitcoin’s 4-year cycle is not lifeless, count on a 70% drop subsequent downturn: VC

On Thursday, Trump known as on Republicans to abolish the “Senate filibuster” rule, which permits a small group of senators to dam motion by the bulk, which he blames for the federal government shutdown.

“THE CHOICE IS CLEAR – INITIATE THE ‘NUCLEAR OPTION,’ GET RID OF THE FILIBUSTER AND MAKE AMERICA GREAT AGAIN!” Trump wrote on Fact Social.

An finish to the shutdown has been seen as a obligatory step for the SEC to provide the ultimate inexperienced gentle to a number of crypto ETFs, together with essential developments of the crypto markets construction invoice, often known as the CLARITY Act.

Journal: Bitcoin flashing ‘uncommon’ prime sign, Hayes ideas $1M BTC: Hodler’s Digest, Oct. 19 – 25