Analyst Joao Wedson warns that an October “judgment day” might set Bitcoin up for a crash to $50,000 subsequent yr.

Abstract

- Bitcoin could also be approaching a bear market that would ship its value right down to $50,000

- An extended-term chart means that Bitcoin is nearing its prime, presumably at $140,000

- Wall Road is prone to information Bitcoin’s actions within the close to future

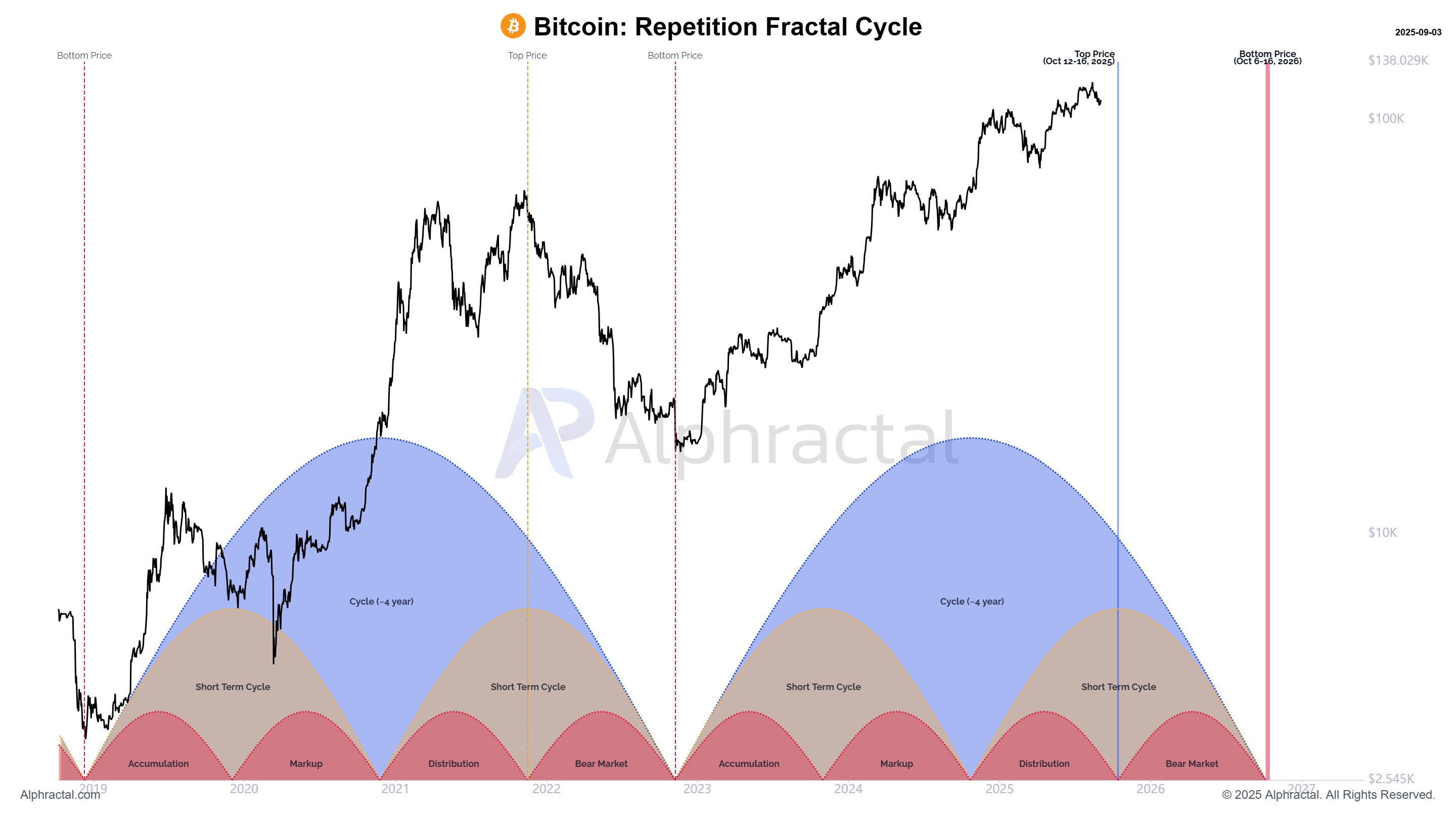

Bitcoin (BTC) could also be heading towards a “judgment day” in October 2025, based on a studying from a long-term sample. On Wednesday, September 3, analyst Joao Wedson warned that the market is closing on its four-year cycle and approaching a bear market that would see it crash to $50,000.

Bitcoin fractal repetition cycle in comparison with its value | Supply: X

Whereas Wedson cautions towards drawing a conclusion based mostly on solely that chart, which places the market prime one month forward, he states that this can be attainable. On this case, Bitcoin might dip to $100,000 earlier than surging previous $140,000 in weeks. After that, merchants can anticipate a crash to $50,000 within the 2026 bear market.

You may also like: Bitcoin could be hacked, quantum’s greatest breakthrough proves it’s not if however when

Will Bitcoin crash to $50K in 2026?

Nonetheless, the true query is that if the fractal stays dependable, Wedson asks, given the rising institutional demand and ETFs which can be driving its value up. Nonetheless, there are potential headwinds that function a counter-narrative. Notably, macroeconomic pressures are nonetheless creating fears within the inventory market.

You may also like: Inflation knowledge sinks Bitcoin, making Trump’s huge price cuts much less probably

Most of Wall Road is fearful concerning the results of tariffs on the inventory market, whereas the Federal Reserve is worried about their results on inflation. Even Trump’s former ally, Elon Musk, as Wedson factors out, warned that Trump’s tariffs would trigger a recession within the second half of 2025, in a since-deleted publish.

If shares go right into a bear market, Bitcoin will probably comply with, particularly as a result of important institutional publicity to the asset. If establishments begin fleeing into safer investments, Bitcoin faces a big liquidity disaster.

You may also like: Bitcoin value prediction: Can BTC break $112K or fall again to $108K?