Bitcoin has spent the vast majority of the week buying and selling inside a decent consolidation vary. However not like earlier consolidations, this one carries a bullish undertone. With worth motion holding above main help ranges and forming potential structural shifts, merchants are on alert for a breakout transfer.

Bitcoin’s (BTC) latest worth motion has been marked by low volatility and declining quantity, however this might not be an indication of weak spot. As an alternative, the technical construction and help dynamics counsel that the market is coiling earlier than its subsequent transfer. Worth stays above vital help zones, and quantity conduct is attribute of accumulation, probably setting the stage for a breakout.

Key technical factors

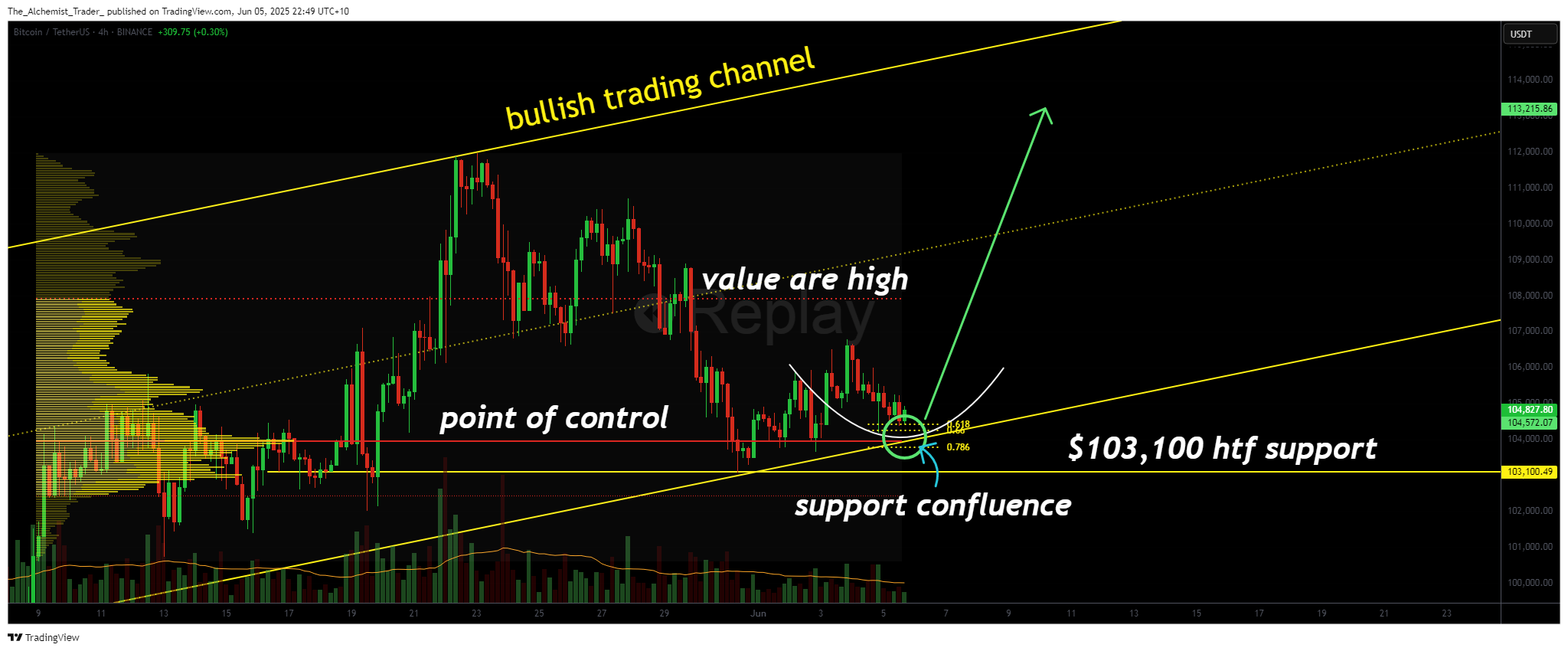

- Level of Management Assist: Bitcoin is holding above the POC, which aligns with each the bullish channel low and the 0.618 Fibonacci retracement.

- Rounded Backside Formation: Worth construction on the 4-hour chart is morphing right into a rounded backside sample, typically a precursor to upward momentum.

- Quantity Decline Signifies Accumulation: Quantity has been declining as worth compresses above help — a standard sign of accumulation earlier than growth.

BTCUSDT (4H) Chart, Supply: TradingView

Bitcoin has been consolidating inside a slender vary, however the location of this vary is what makes it important. As an alternative of compressing beneath resistance or inside a impartial zone, worth is resting on a technically robust help cluster. The Level Of Management, the worth degree with the very best traded quantity, coincides with the channel low help and the 0.618 Fibonacci retracement, creating a sturdy zone that has held by way of a number of retests.

You may also like: Lightchain AI grabs watchlist spots whereas Litecoin waits for a market shift that by no means comes

On the 4-hour timeframe, candles have been persistently closing above this degree, signaling that patrons are defending the zone. The worth construction is steadily forming what seems to be a rounded backside, suggesting a potential reversal sample and power constructing at help.

Quantity has been truly fizzling out throughout this era, a standard function in accumulation phases. Sometimes, such low-volume compressions resolve in sharp, directional breakouts as soon as quantity re-enters the market. In Bitcoin’s case, a reclaim of the worth space excessive would be the first sign of power. This degree has acted as a ceiling in latest weeks and marks the higher boundary of the present quantity profile.

What to anticipate within the coming worth motion

If Bitcoin continues to carry above the POC and confirms a breakout with quantity, a push towards a brand new all-time excessive is probably going. Till then, merchants ought to monitor quantity intently, a spike might sign the top of this accumulation part and the start of a significant transfer.

Learn extra: Punisher Coin forecast: How this new memecoin plans to outpace DOGE, PEPE