Bitcoin worth is sitting at a choice level after a quiet pullback. Since peaking on January 5, BTC has slipped however averted any main breakdown. 12 months-over-year, Bitcoin stays down roughly 4.5%, sustaining a barely unfavorable annual efficiency.

That small purple quantity issues greater than it seems to be. A slim worth window now separates Bitcoin from a uncommon historic sign that final appeared in 2020. Whether or not Bitcoin flips or fails might determine the following development.

A 4.5% Bitcoin Value Transfer May Echo a Uncommon 2020 Sample

A latest historic evaluation highlighted a uncommon setup. When Bitcoin’s 1-year worth change turns unfavorable after which flips again constructive, it has typically marked main development shifts. This uncommon transfer surfaced in July 2020, which was adopted by a powerful bull part.

One thing uncommon is going on with Bitcoin!

The 1-year proportion change, when unfavorable, has traditionally been related to bear markets, excluding July 2020, when it briefly turned unfavorable and was quickly adopted by a powerful bull market.

Now, the present setup… pic.twitter.com/3YdmKj0C7L

— Alphractal (@Alphractal) January 10, 2026

Proper now, Bitcoin is hovering just under that flip level. A transfer of roughly 4.5% would flip the yearly change inexperienced and repeat that historic situation.

The chart construction helps why this issues. Bitcoin is buying and selling contained in the deal with of a cup and deal with sample, a bullish formation the place worth pauses after a rounded restoration earlier than trying a breakout.

Breakout Sample Holds: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

It will be attention-grabbing to see if the measured breakout distance of this sample (above the neckline) intently aligns with that very same 4–5% zone?

EMA Help and a 95% Drop in Promoting Strain Strengthen the Setup

Quick-term development conduct is reinforcing the bullish case.

An exponential transferring common (EMA) offers extra weight to latest costs and helps monitor short-term development path. Bitcoin has lately reclaimed its 20-day EMA and is holding above it. The final time BTC reclaimed this stage in early January, the worth rallied practically 7% inside days.

Shedding the 20-day EMA in mid-December led to a 6.6% drop, exhibiting how reactive the worth has been round this stage. For now, holding above it retains upside momentum intact.

EMAs Maintain The Line For BTC: TradingView

The subsequent hurdle is the 50-day EMA. Bitcoin misplaced this stage on January 12 and corrected shortly after. A clear reclaim would sign a stronger development restoration and align with the cup and deal with breakout construction.

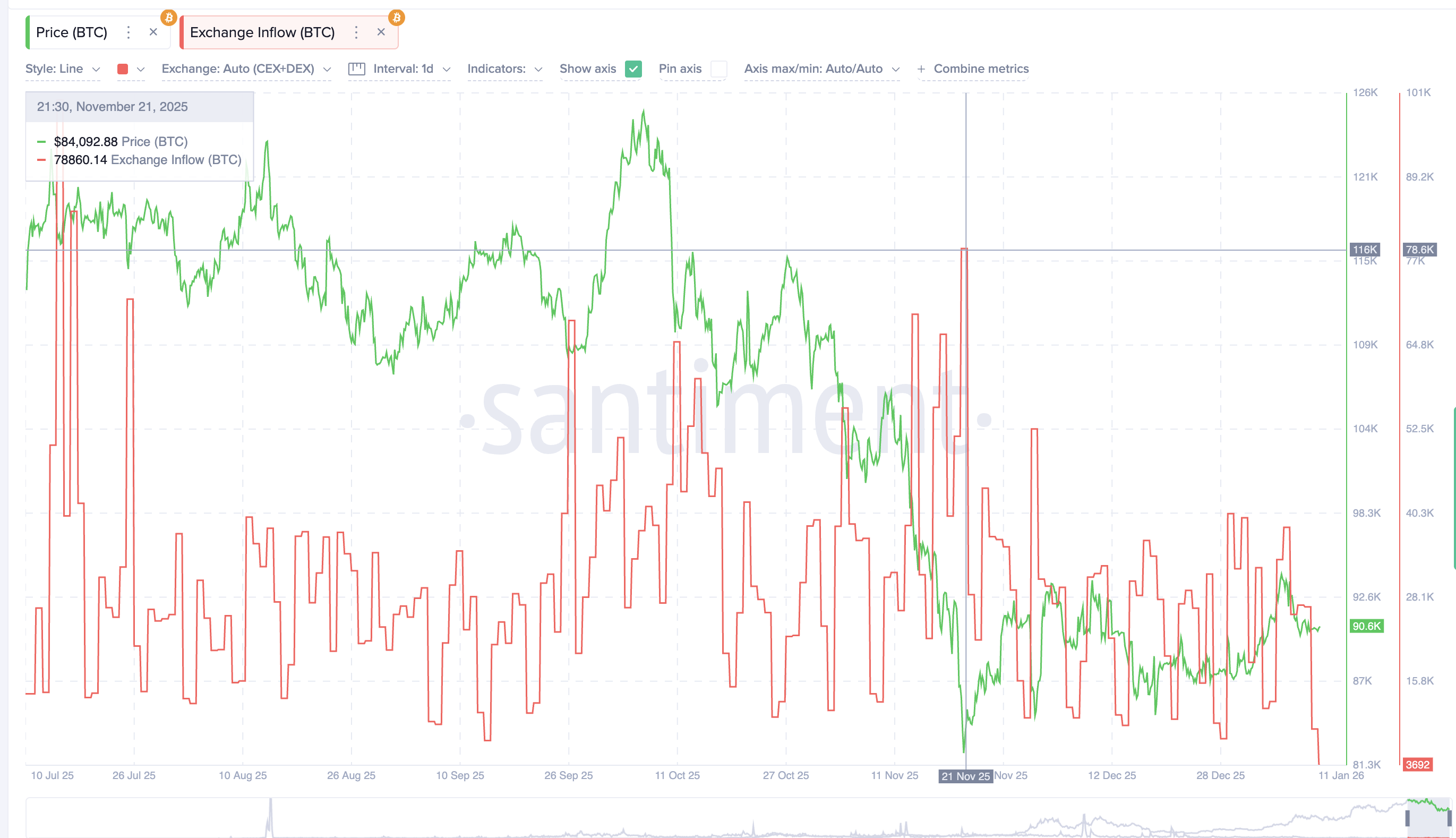

On-chain information provides weight. Alternate influx, which tracks cash transferring to exchanges and sometimes indicators promoting intent, has collapsed to a six-month low. Each day inflows have dropped from roughly 78,600 BTC on November 21 to about 3,700 BTC now, a decline of greater than 95%.

Drop Is Doable Promoting Strain: Santiment

This sharp fall suggests promoting strain has dried up. Fewer cash are being despatched to exchanges, decreasing the availability obtainable to promote into rallies.

Derivatives Strain and Key Bitcoin Value Ranges Resolve The Subsequent Leg

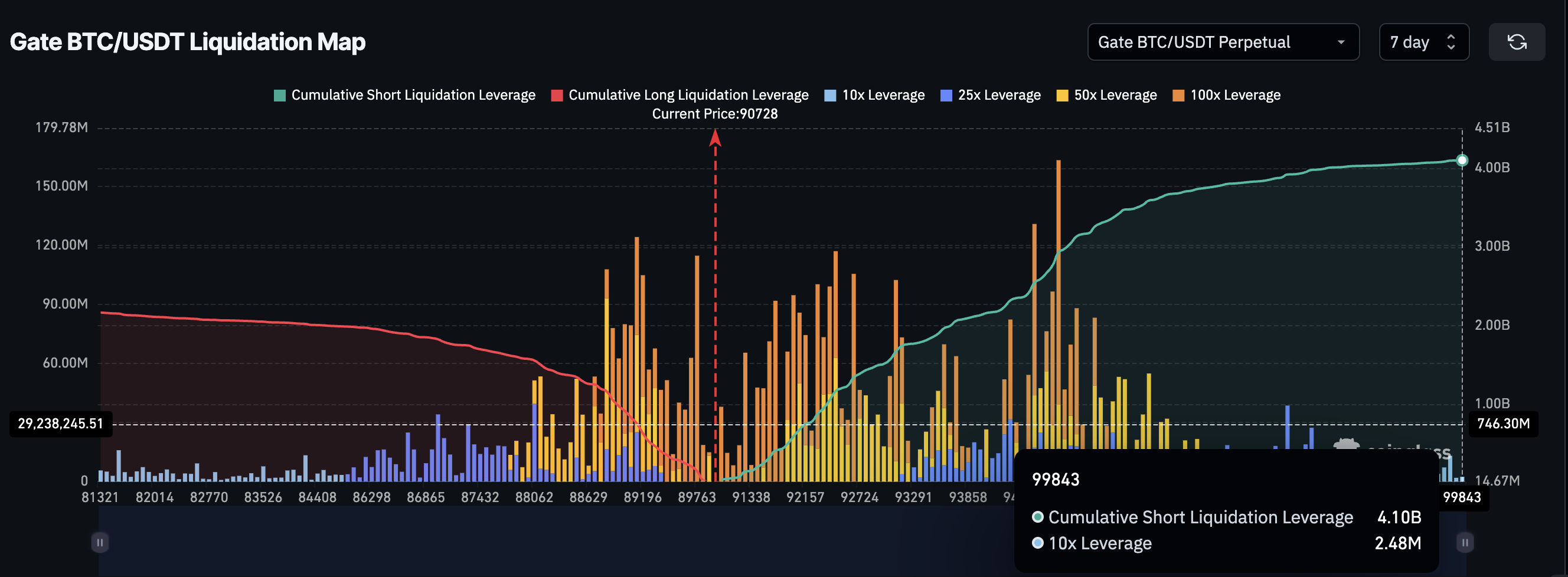

Leverage positioning provides one other layer.

Over the following seven days, cumulative quick liquidation leverage sits close to $4.10 billion, whereas lengthy liquidation publicity is round $2.17 billion. That places quick publicity roughly 89% increased than longs.

Liquidation Map: Coinglass

Crowded quick positioning creates gasoline. If the BTC worth begins transferring increased, pressured quick protecting can add computerized shopping for strain. Bitcoin has repeatedly moved in opposition to leverage bias over the previous 12 months, making this imbalance notable relatively than bearish.

All of this converges at clear worth ranges.

A day by day shut above $94,880 would full the cup and deal with breakout and align with the 4.5% yearly flip. From there, upside targets sit close to $99,810, adopted by $106,340 based mostly on Fibonacci extensions and the cup’s breakout projection.

Bitcoin Value Evaluation: TradingView

On the draw back, $89,230 is the primary key assist. A lack of that stage would expose $86,650 and invalidate the bullish construction.

For now, the Bitcoin worth sits in a slim hall.

Promoting strain is at a six-month low, short-term development assist is holding, and a uncommon historic sign is simply 4.5% away. Whether or not Bitcoin reaches it might outline what comes subsequent.

The publish Bitcoin Bull Market Begins With a 4.5% Transfer? Historical past and Charts Lastly Align appeared first on BeInCrypto.