Bitcoin (BTC) has seen a notable drop in shopping for stress over the previous few days because the cryptocurrency’s worth continues to swing between $98,000 and $10,000. This drop in bullish momentum means that BTC won’t be prepared for its subsequent leg up.

As an alternative, it signifies that the value may proceed to commerce sideways except one thing adjustments.

Bitcoin Accumulation Lowers

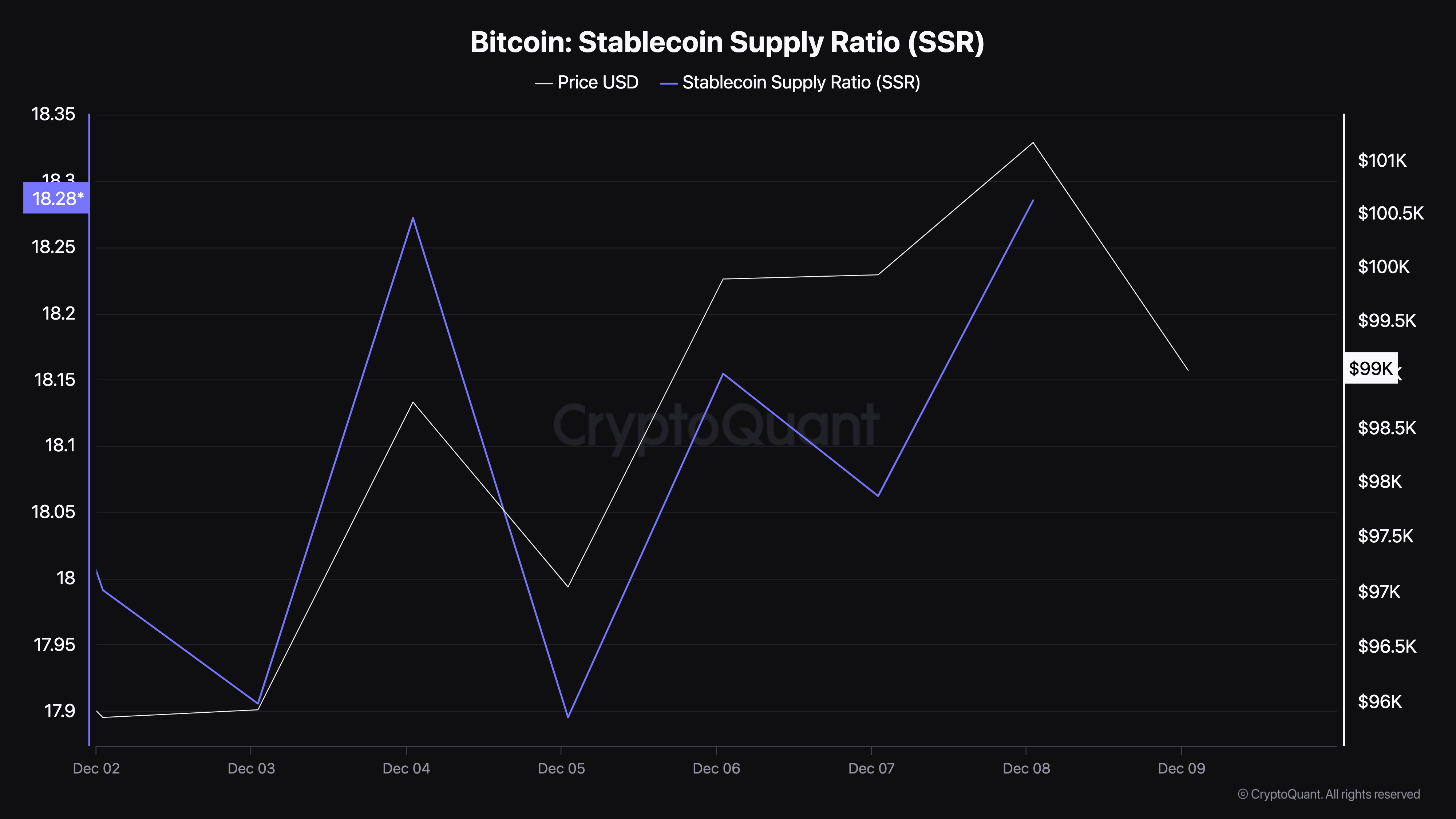

One indicator displaying a decline in Bitcoin shopping for stress is the Stablecoin Provide Ratio (SSR). The SSR measures the ratio of a cryptocurrency’s market capitalization to the aggregated market capitalization of all stablecoins in circulation.

Low SSR signifies increased shopping for energy from stablecoins. It suggests that there’s a great amount of stablecoin liquidity out there, which might drive upward worth momentum if transformed into cryptocurrency.Excessive SSR, alternatively, displays decrease stablecoin liquidity relative to the cryptocurrency’s market cap, probably indicating weaker BTC shopping for energy or restricted demand.

In keeping with CryptoQuant, the Bitcoin SSR has spiked to 18.29. The circumstances said above point out that purchasing energy is not robust. As such, Bitcoin’s worth may proceed to commerce beneath its all-time excessive of $103,900.

Bitcoin Stablecoin Provide Ratio. Supply: CryptoQuant

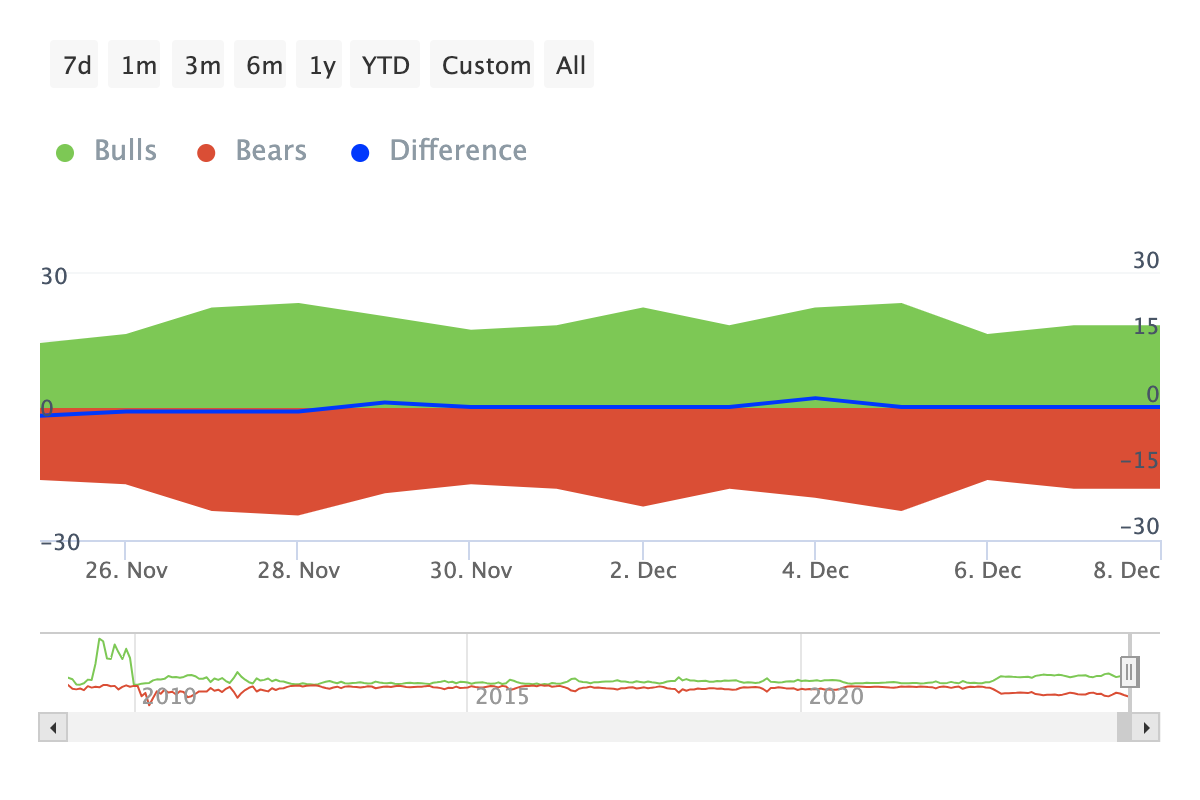

One other metric suggesting the identical is the Bulls and Bears indicator. For context, bulls are addresses that purchased no less than 1% of the overall buying and selling quantity inside a particular interval. Bears, on the flip aspect, are those that offered an analogous quantity.

When there are extra bulls than bears, the BTC worth is more likely to improve. Nonetheless, if bears have the higher hand, the other happens. In keeping with IntoTheBlock knowledge, the variety of bulls and bears over the past seven days has remained the identical.

This means that Bitcoin bulls have kept away from shopping for extra cash to boost the value. If this development continues, then the BTC worth may proceed consolidating.

Bitcoin Bulls and Bears Indicator. Supply: IntoTheBlock

BTC Value Prediction: Additional Decline Looms

On the day by day chart, the Transferring Common Convergence Divergence (MACD) has dropped to the destructive area. The MACD measures the momentum round a cryptocurrency.

When the MACD is constructive, momentum is bullish. Nonetheless, on this case, the momentum is bearish, suggesting that BTC’s worth won’t expertise a major uptrend within the quick time period. The indicator’s place additionally signifies a drop in Bitcoin shopping for stress.

Bitcoin Every day Evaluation. Supply: TradingView

If this stays the identical, Bitcoin’s worth is more likely to drop to $90,623. Nonetheless, if shopping for stress will increase and bulls purchase in massive volumes, the coin worth may leap to $103,581.