Jobless claims surged on the finish of April in keeping with contemporary knowledge from the Division of Labor, however each conventional and crypto markets nonetheless rallied Thursday morning.

Markets Rally: Bitcoin Hits $97K At the same time as Jobs Information Disappoints

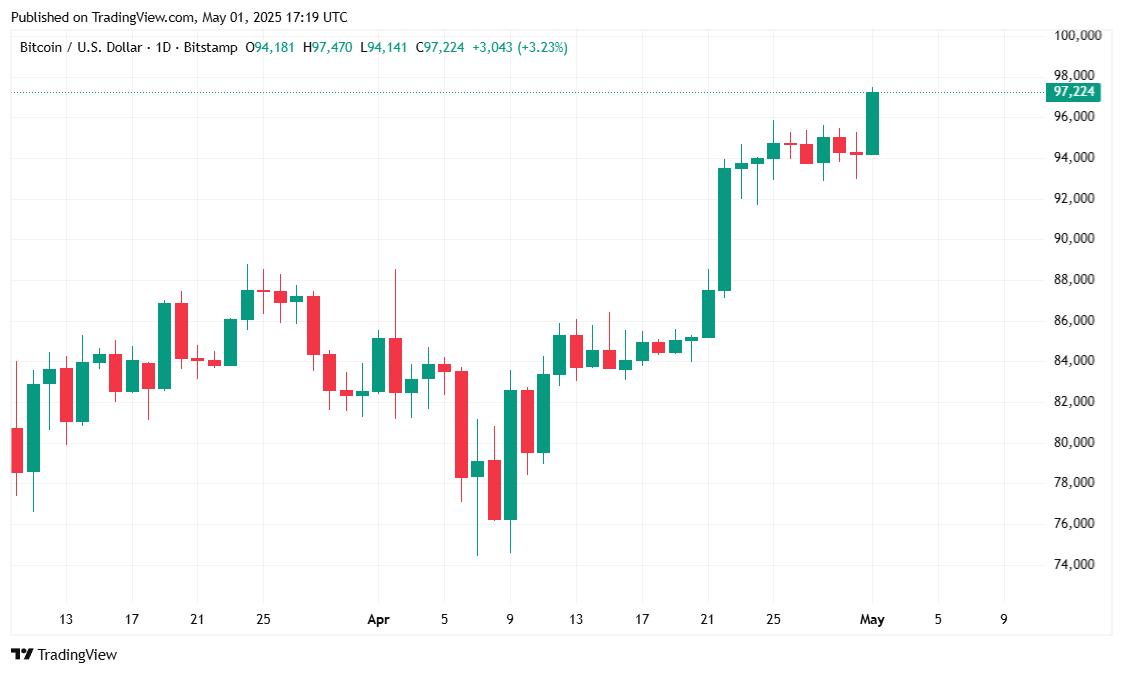

The variety of unemployed People submitting for jobless advantages swelled to a seasonally adjusted 241,000 for the week ending April 26, a rise of 18,000 from the prior week, in keeping with knowledge from the U.S. Division of Labor launched on Thursday morning. Nonetheless, markets appeared unaffected, with bitcoin (BTC) rallying previous $97K and conventional market indices trending upward.

Reporting from Reuters signifies that traders weren’t spoofed as a result of the disappointing numbers have been triggered by spring break within the state of New York and don’t replicate a basic weakening of the employment panorama.

Curiously, bitcoin’s surge stood in stark distinction to gold, which edged decrease, buying and selling at $3,216.00, down 2.17% on the time of reporting. “I’ll repeat my rationale,” stated Geoffrey Kendrick, head of digital belongings analysis at London-based Customary Chartered Financial institution in a Thursday word to shoppers. “I believe bitcoin is a greater hedge than gold in opposition to strategic asset reallocation out of the U.S.”

Overview of Market Metrics

Bitcoin climbed 3.37% up to now 24 hours, reaching $97,178.85 on the time of reporting, in keeping with Coinmarketcap. The cryptocurrency traded between $93,762.50 and $97,437.96 over the identical interval, marking one among its strongest intraday performances this week, which noticed a 7-day value appreciation of roughly 4.05%.

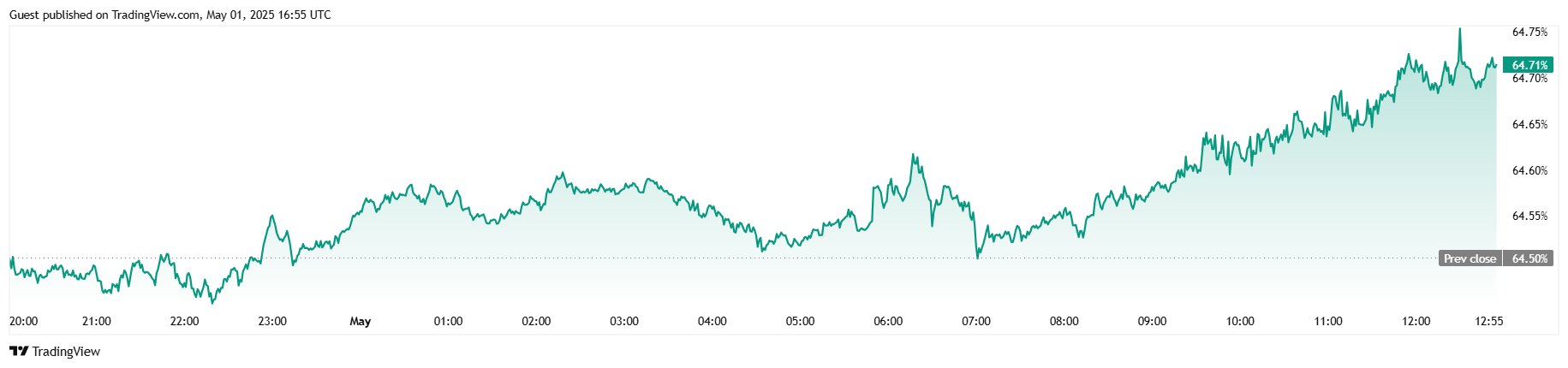

Buying and selling exercise intensified alongside the value rally, with 24-hour quantity rising 7.45% to $31.20 billion. Market capitalization additionally mirrored the value surge, climbing to $1.92 trillion, a rise of three.40% since yesterday. Bitcoin’s dominance within the broader crypto market now stands at 64.72%, up barely by 0.085 share factors.

The derivatives market additionally echoed the bullish sentiment. Coinglass knowledge reveals BTC futures open curiosity jumped by 8.96% to $67.93 billion during the last 24 hours, indicating elevated dealer confidence. Liquidations totaled $892,840, however brief sellers bore the brunt of it, with $860,900 in losses in comparison with simply $31,940 from lengthy positions. The imbalance in liquidations hints at a attainable shift in short-term market sentiment towards additional features.