In current weeks, a lot has been mentioned concerning the wealth erased from varied cryptocurrencies’ valuation. For instance, within the seven days main as much as December 24 – and regardless of the rally on the day – Bitcoin’s (BTC) valuation collapsed by practically $200 billion.

Nonetheless, for all of the frustration rising from the obvious cancellation of the ‘Santa Claus’ rally, 2024 stays an exceptionally robust 12 months throughout the board, with the numerous cash and tokens being overwhelming winners within the final 12 months.

Bitcoin up greater than $1 trillion in 2024

Bitcoin itself, regardless of erasing roughly $200 billion within the final ten or so days, stays greater than $1 trillion extra beneficial as an asset at press time on December 27 than it was on January 1.

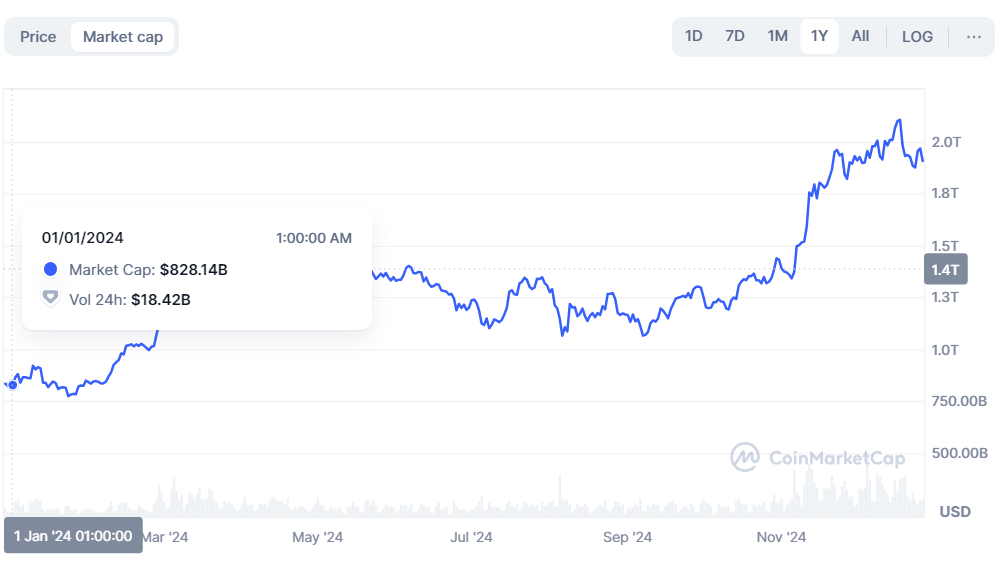

Particularly, information retrieved by Finbold from CoinMarketCap reveals that initially of the now-outgoing 12 months, BTC’s market cap stood at $828 billion, whereas at press time, it’s as excessive as $1.91 trillion.

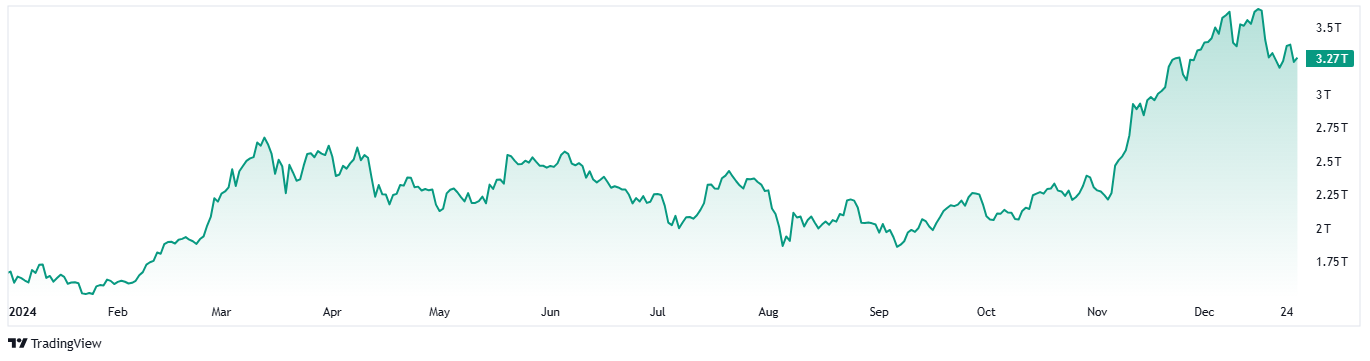

The state of affairs may be very comparable for digital property as a complete. TradingView information reveals the entire cryptocurrency valuation on January 1 as $1.67 trillion and divulges that, on December 27, it’s at $3.27 trillion – a $1.6 trillion distinction.

Nonetheless, the marginally much less encouraging side of the chart is that it concurrently signifies that Bitcoin’s dominance amongst cash and tokens stays important, as BTC accounts for roughly two-thirds of the expansion.

On the flip aspect, this truth may bolster the ‘alt season’ narrative for 2025 because it may trace that different cryptocurrencies are considerably undervalued.

Might 2025 be as robust for cryptocurrencies as 2024?

Lastly, it’s value declaring that for the successes of 2024 – and stagnation within the 12 months’s ultimate month – predictions for the brand new 12 months stay exceedingly bullish.

Although Bitcoin has once more taken heart stage with 12-month value targets operating as excessive as $800,000, albeit with a rising consensus that the following transfer for BTC could possibly be a plunge towards $70,000 and even $60,000, it’s removed from the one digital asset traders are bullish about.

XRP, for instance, is seen as boating a very grand progress safety because it seems poised to totally clear the regulatory roadblocks with some on-chain analysts – with Ali Martinez on X being, maybe, essentially the most distinguished – seeing a possible rally to as excessive as $48: 2,100% above the press time costs at $2.18.