The response from Bitcoin builders on the chance of quantum computing to the cryptocurrency is weighing down its worth and affecting capital circulate, crypto trade executives have argued.

Adam Again, a cypherpunk the and co-founder of Bitcoin infrastructure firm Blockstream argued in a collection of X posts on Thursday that it’s good for Bitcoin (BTC) to be “quantum prepared,” but it surely gained’t be a risk for the following few a long time, because the know-how continues to be “ridiculously early,” and has analysis and growth points.

He predicts there might be no dangers within the subsequent ten years and even when some elements of Bitcoin’s encryption had been damaged, it doesn’t depend on encryption for its core safety mannequin and “it’s not going to lead to Bitcoin being stolen on the community.”

Supply: Adam Again

Quantum computing continues to be debated as a possible risk to the crypto trade, as extra superior computer systems that might break encryption have been theorized as having the potential to disclose consumer keys and expose delicate knowledge.

Traders involved about quantum threat

Nic Carter, a companion at enterprise capital agency Citadel Island Ventures, stated in response to Again, that it’s “extraordinarily bearish” that many influential builders “flatly deny that there’s any quantum threat.”

“The discrepancy between capital and builders on this problem is very large. Capital is worried and searching for an answer. Devs are primarily in full denial. Incapacity to even acknowledge quantum threat is already weighing on the worth.”

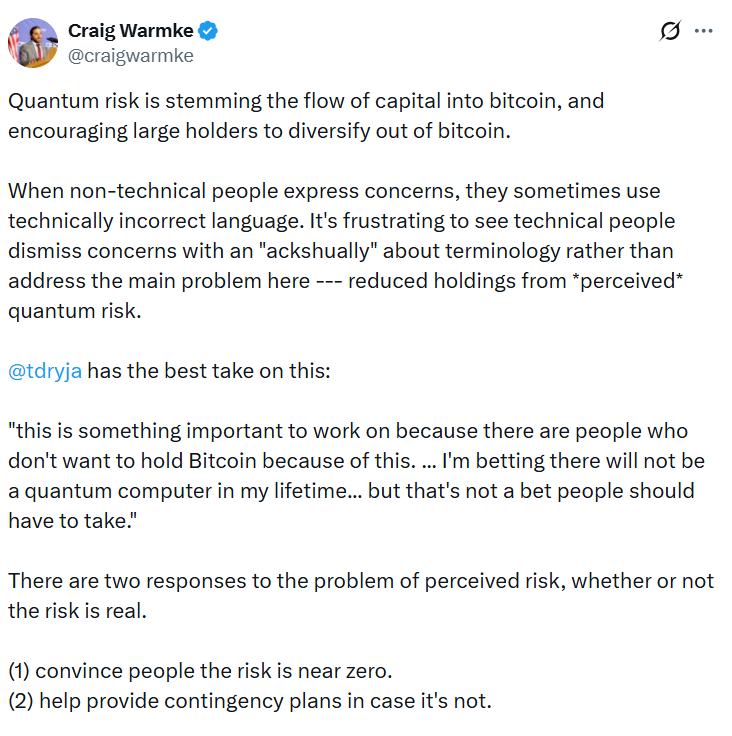

Craig Warmke, a fellow on the suppose tank, the Bitcoin Coverage Institute, agreed, including that quantum threat is slowing the circulate of capital into Bitcoin and pushing bigger holders to diversify.

“When non-technical folks categorical issues, they often use technically incorrect language,” he stated, including it was “irritating to see technical folks dismiss issues” fairly than handle the subject of “decreased holdings from perceived quantum threat.”

Supply: Craig Warmke

Contingency plans needs to be in place

Together with the know-how being years away from being a risk, critics additionally argue that banking giants and different conventional targets might be cracked lengthy earlier than Bitcoin.

Carter maintains that corporations and even nations are elevating vital funds to construct quantum computer systems, and synthetic intelligence helps speed up the event.

In the meantime, Warmke stated the easiest way ahead, whether or not or not the chance is actual, is to persuade folks the chance is close to zero and assist present contingency plans in case it’s not.

“The one approach ahead is to develop and converge on contingency plans, simply in case, so that individuals really feel extra snug holding Bitcoin,” he added.