Bitcoin (BTC) fell sharply after U.S. President Donald Trump signed an government order establishing a Strategic Bitcoin Reserve.

As a substitute of triggering a bullish response, nonetheless, the announcement become a basic ‘promote the information’ occasion, with Bitcoin crashing from $92,000 to beneath $85,000 earlier than stabilizing round $88,000 at press time.

The cryptocurrency had rebounded from $83,000 to $92,000 earlier within the week forward of the White Home Crypto Summit on March 7. Nevertheless, investor sentiment soured after the order failed to stipulate a shopping for technique, as an alternative counting on seized Bitcoin belongings with no speedy influence available on the market.

On the identical time, some analysts see this as a transfer that would encourage different nations to comply with go well with, additional legitimizing Bitcoin.

Including to the combination, recent U.S. job information added to market hypothesis, with nonfarm payrolls growing by a seasonally adjusted 151,000 for the month, in keeping with expectations, whereas unemployment edged as much as 4.1%, fueling optimism over potential fee cuts by the Federal Reserve.

Finbold AI predicts Bitcoin value goal for March 31

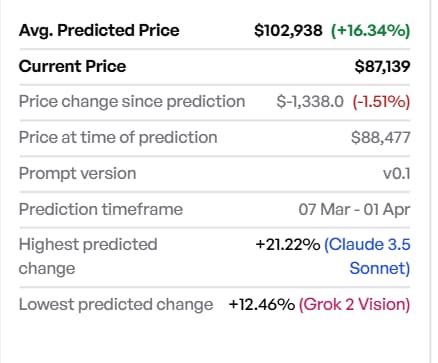

As Bitcoin hovers round its present degree, Finbold’s AI-powered prediction device has offered an up to date outlook for its trajectory main as much as March 31, 2025. Based mostly on technical indicators and market developments, the mannequin forecasts a mean BTC value of $102,938, reflecting a 16.34% acquire from its value on the time of prediction of $87,139.

Regardless of the general bullish projection, AI fashions present a spread of potential outcomes. Probably the most optimistic forecast, generated by Claude 3.5 Sonnet, anticipates a 21.22% surge, which might place BTC round $107,217 by early March.

In the meantime, Grok 2 Imaginative and prescient presents a extra cautious outlook, forecasting a 12.46% enhance, translating to a value of $99,484.

Analyst tackle BTC

Regardless of lingering blended sentiment, the broader pattern stays bullish. In response to an evaluation by TradingShot, Bitcoin is anticipated to consolidate sideways all through March, making an attempt to determine a agency backside earlier than making a decisive transfer. Historic value developments counsel {that a} potential breakout may unfold inside a month.

On the identical time, CryptoQuant analysts be aware that Bitcoin is at present in a pullback section, with liquidity constraints stopping a breakout. Quick-term rallies could face resistance, and a sustained uptrend is unlikely till Bitcoin enters a brand new accumulation section.

Till long-term holder accumulation resumes, analysts warn that Bitcoin could battle to maintain upward momentum, delaying a decisive breakout.

Featured picture by way of Shutterstock