Roughly $8.8 billion price of Bitcoin and Ethereum choices expire in the present day, January 30, 2026, marking the primary month-to-month choices expiry of the 12 months.

It locations renewed deal with Bitcoin’s wrestle to reclaim the $90,000 stage, because the pioneer crypto continues to float additional away from it.

Choices Market Alerts Warning as Bitcoin Drifts Additional Beneath $90,000

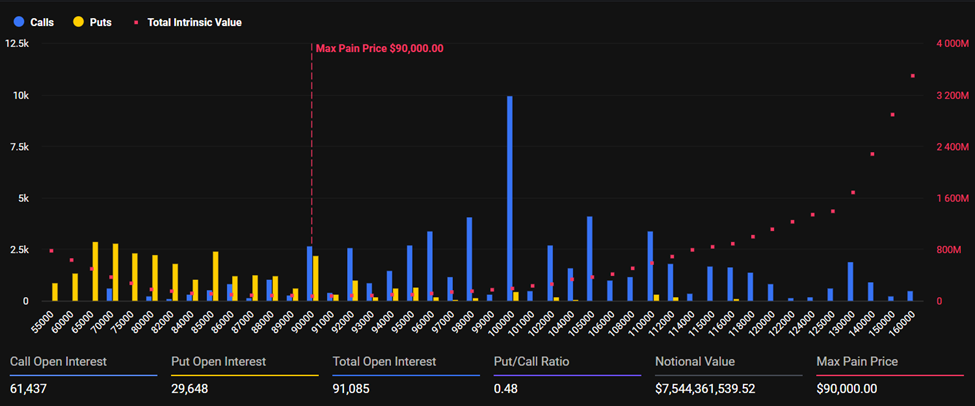

The majority of in the present day’s publicity sits in Bitcoin choices, which account for $7.54 billion in notional worth, whereas Ethereum choices make up an extra $1.2 billion.

Bitcoin is at present buying and selling at $82,761, nicely under its $90,000 max ache stage. Regardless of the pullback, positioning stays structurally bullish.

Name open curiosity stands at 61,437 contracts, in comparison with 29,648 places, pushing the put-to-call ratio (PCR) right down to 0.48. Whole open curiosity throughout Bitcoin choices stands at 91,085 contracts, highlighting the dimensions of leverage and positioning forward of expiry.

$BTC) Expiring Choices”>

$BTC) Expiring Choices”>Bitcoin ($BTC) Expiring Choices. Supply: Deribit

Nevertheless, beneath the floor, dealer conduct is changing into more and more defensive. Analysts at Deribit famous that whereas Bitcoin stays range-bound, demand for draw back safety has risen sharply heading into expiry.

“…demand for draw back safety has ramped up, exhibiting that merchants are cautious at the same time as positioning remains to be skewed bullish,” Deribit analysts mentioned.

They added that the choices expiry might amplify strikes round key ranges, particularly across the ache zones. This assumption holds as a result of costs are likely to gravitate towards the max ache ranges as choices close to expiry.

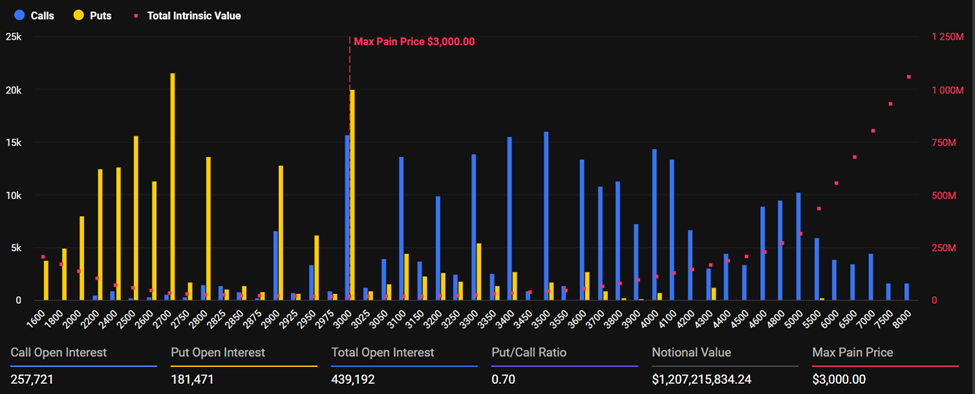

Ethereum displays an identical, although barely extra balanced, setup. $ETH is buying and selling at $2,751, under its $3,000 max ache stage. Whole open curiosity in Ethereum choices stands at 439,192 contracts, with name open curiosity at 257,721 and put open curiosity at 181,471. The ensuing put-to-call ratio of 0.70 suggests extra two-sided positioning in comparison with Bitcoin, however nonetheless factors to warning reasonably than outright bearishness.

Ethereum ($ETH) Expiring Choices. Supply: Deribit

Fading Volatility and Rising Liquidity Dangers Set the Stage for January Choices Expiry

On the macro stage, volatility expectations proceed to fade. In keeping with analysts at Greeks.stay, implied volatility (IV) has been grinding decrease, reinforcing a broader consolidation throughout crypto markets.

“[Today] marks the primary month-to-month expiration date of 2026, with over 25% of choices positions set to run out,” Greeks.stay mentioned.

As anticipated, the Federal Reserve didn’t reduce rates of interest, and with no main occasions on the horizon, the market stays remarkably steady, with implied volatility (IV) persevering with its downward development. Bitcoin’s value motion displays that stability.

Greeks.stay famous that Bitcoin has “retreated again into its consolidation vary within the latter half of the month,” with $90,000 performing as agency resistance.

“No decisive components seem imminent to interrupt this stalemate,” the analysts added, suggesting that the choices expiry itself could change into one of many few near-term catalysts for value motion.

Nonetheless, dangers are constructing beneath the calm floor. Greeks.stay highlighted current large-scale institutional outflows into exchanges, which have elevated liquidity pressures throughout the crypto market.

Crypto-related US equities have additionally weakened, contributing to a sentiment shift that’s steadily turning pessimistic. Amid broader geopolitical tensions and rising worry, uncertainty, and doubt, damaging sentiment has continued to accentuate.

Forward of the Federal Reserve’s price resolution, some merchants had already moved to hedge short-term volatility by buying draw back safety, a development that has continued even after the central financial institution opted to carry charges regular.

With no clear macro catalyst on the quick horizon, merchants now seem braced for potential short-term dislocations across the choices expiry, hedging in opposition to draw back threat whereas ready for a decisive break from Bitcoin’s $80,000 to $90,000 vary.

The submit $90,000 Loses Its Pull on Bitcoin as $8.8 Billion Choices Expiry Approaches appeared first on BeInCrypto.