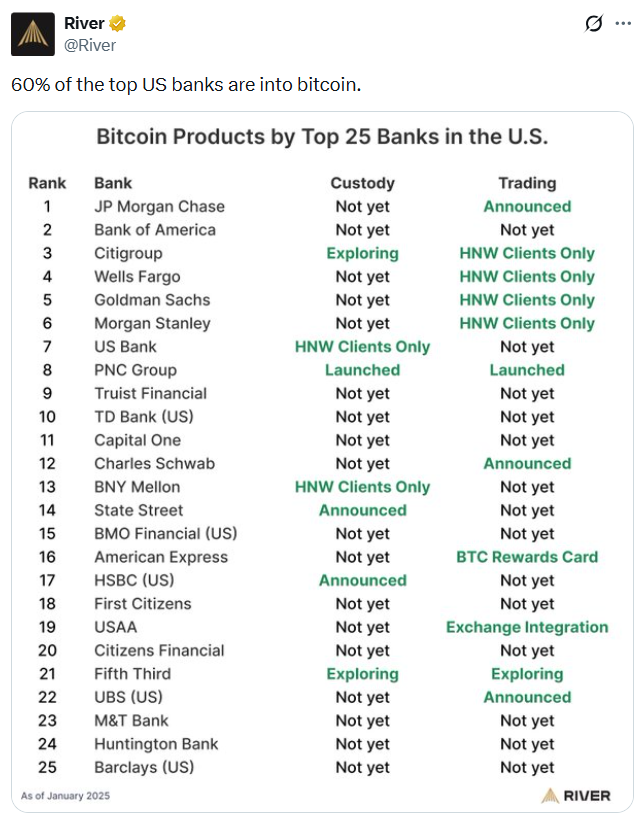

Greater than half of the highest US banks have both began providing or introduced plans to supply Bitcoin-related companies resembling buying and selling or custody, says Bitcoin monetary companies agency River.

In an X put up on Monday, River shared a listing of the highest 25 establishments working within the US, saying, “60% of the highest US banks are into Bitcoin.”

On Saturday, crypto trade Coinbase CEO Brian Armstrong stated {that a} key takeaway from his time on the Davos World Financial Discussion board in Switzerland, which was held from Jan. 19 till Jan. 23, was that banking CEOs have gotten friendlier towards crypto.

Out of the unnamed banking CEOs he met, Armstrong stated, “most of them are literally very professional crypto and are leaning into it as a possibility, some aren’t fairly there but. One CEO of a high 10 international financial institution instructed me crypto is their primary precedence, and so they view it as existential.”

Supply: River

Some US banks had been beforehand accused of being anti-crypto and allegedly complicit in actions such because the so-called Operation Chokepoint 2.0, a authorities effort to debank crypto corporations.

Three out of the Massive 4 are on the checklist

The most recent addition to River’s checklist, Swiss banking big UBS, which additionally operates within the US, is reportedly exploring opening up Bitcoin (BTC) and Ether (ETH) buying and selling to its wealthiest shoppers, Bloomberg reported on Friday.

Among the many “Massive 4” US banks, JPMorgan Chase has introduced it’s contemplating including crypto buying and selling, Wells Fargo affords companies like Bitcoin-backed loans to institutional shoppers, and Citigroup is exploring institutional crypto custody companies.

Mixed, these three banks maintain over $7.3 trillion in belongings, in keeping with Forbes.

Nonetheless, banks are nonetheless not totally on board with all features of crypto. They’ve been a few of the loudest critics of yield-bearing stablecoins, fearing they might pose important dangers to the monetary system.

Associated: Saylor pitches Bitcoin-backed banking system to nation-states

Ten massive banks nonetheless on the sidelines

Financial institution of America, the opposite member of the Massive 4 group of US monetary establishments, and the second-largest US financial institution total, has but to announce any plans for Bitcoin companies, in keeping with River.

Forbes estimates its belongings are over $2.67 trillion. Whereas the following two largest banks on the Forbes checklist have but to disclose any curiosity in Bitcoin companies, Capital One has $694 billion in belongings, and Truist Financial institution holds $536 billion.

Journal: 6 causes Jack Dorsey is unquestionably Satoshi… and 5 causes he’s not