Bitcoin (BTC) has slipped 2% as we speak, because the broader crypto market continues to face downward strain. The decline comes amid weakening buying and selling volumes, indicating cautious sentiment amongst traders.

Nevertheless, on-chain knowledge means that this pullback could also be short-term.

BTC Bulls Maintain the Line

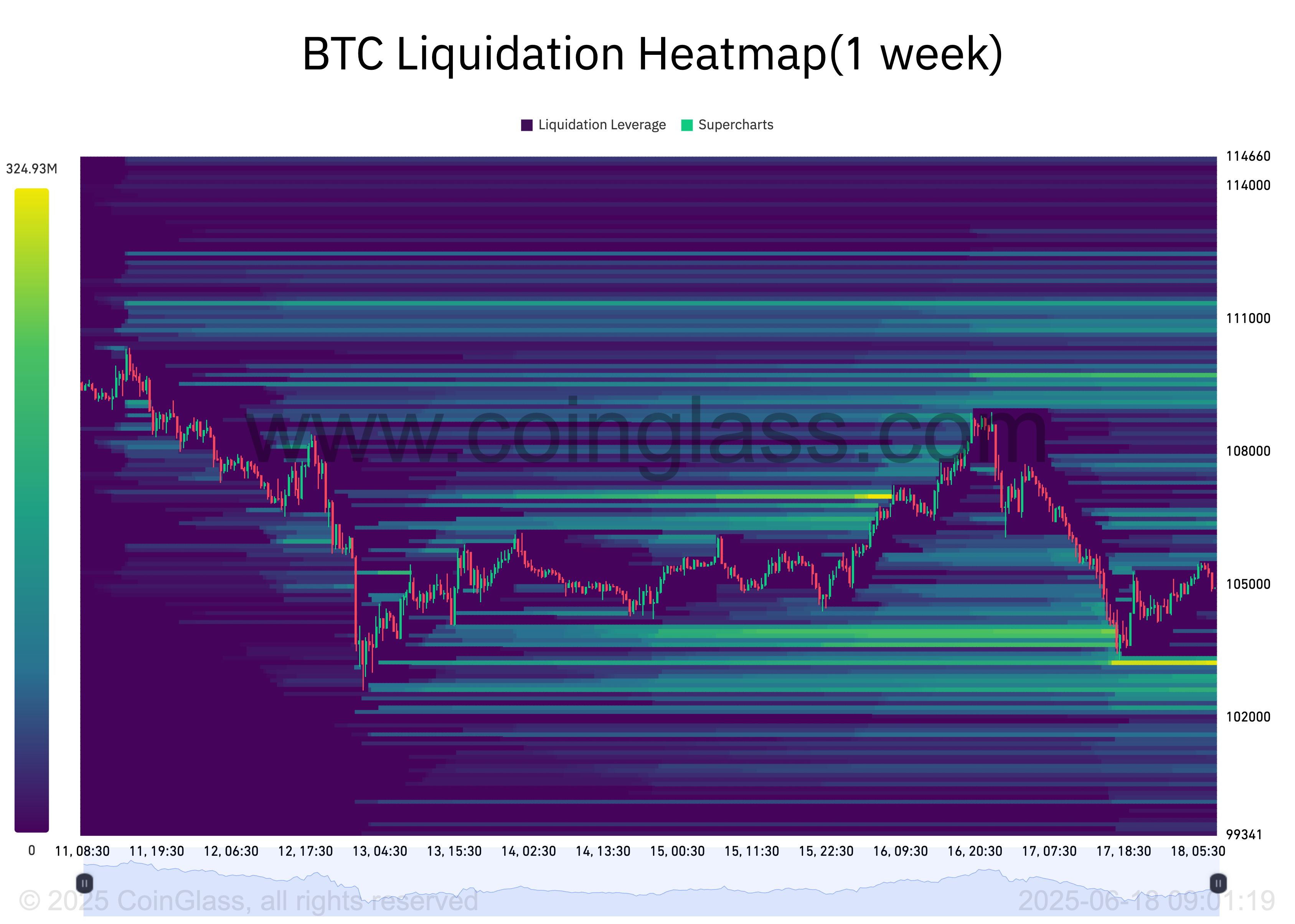

One of many extra notable alerts comes from a concentrated liquidity cluster forming across the $103,000 zone. Readings from BTC’s liquidation heatmap present a focus of liquidity under its worth on the $103,221 zone.

BTC Liquidation Heatmap. Supply: Coinglass

This means important market help ready to be activated if the value dumps towards this stage. Liquidation heatmaps are used to determine worth ranges the place massive clusters of leveraged positions are prone to be liquidated. These maps spotlight areas of excessive liquidity, usually color-coded to indicate depth.

BTC’s liquidation heatmap means that sturdy help is ready to soak up promoting strain if the coin witnesses a correction towards the cluster zone. Merchants have positioned many purchase orders on the $103,221 space, indicating confidence that BTC is unlikely to interrupt under this threshold.

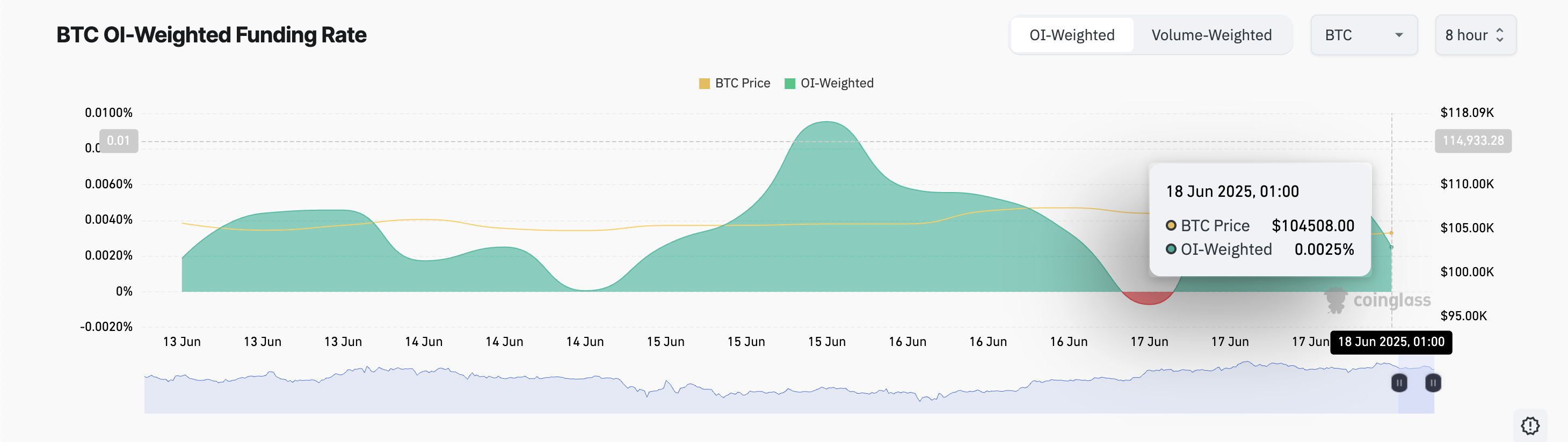

Moreover, BTC’s constructive funding price, at 0.0025% at press time, provides to the cautiously optimistic outlook. It displays merchants’ willingness to pay a premium for lengthy positions.

BTC Funding Price. Supply: Coinglass

The funding price is a recurring cost exchanged between lengthy and quick merchants in perpetual futures markets to maintain costs aligned with the spot market. When its worth is constructive, it signifies bullish market sentiment, as extra merchants predict the asset’s worth to rise.

$106,000 or Bust? Bitcoin’s Subsequent Transfer Hinges on World Tensions

Regardless of the bullish on-chain alerts, BTC stays closely influenced by broader market sentiment, which has been weakening amid escalating tensions between Israel and Iran.

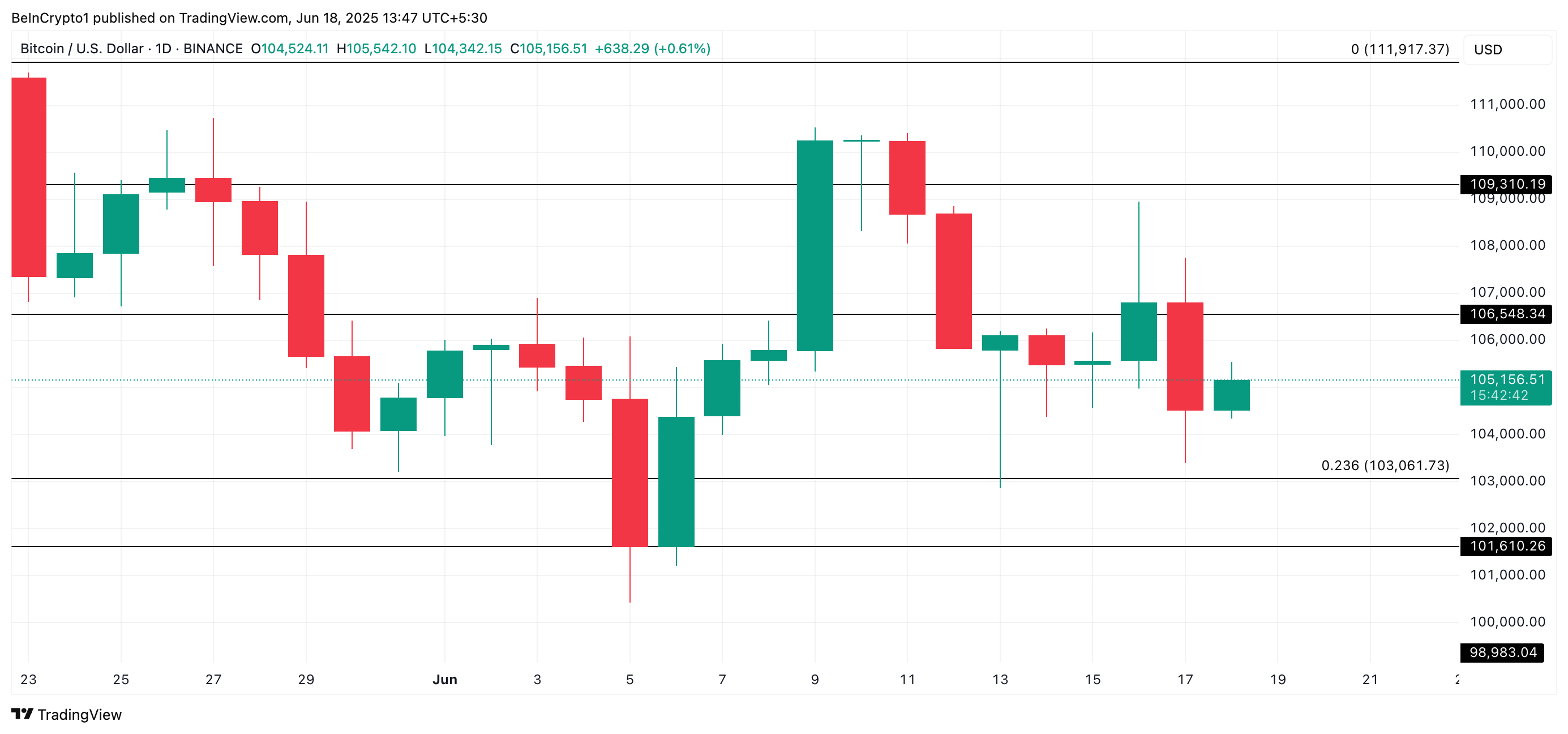

Bitcoin’s worth rally may stall if the geopolitical state of affairs deteriorates additional, doubtlessly sliding towards $103,061. Ought to the liquidity cluster close to $103,000 fail to supply help, a deeper drop to $101,610 may comply with.

BTC Worth Evaluation. Supply: TradingView

Conversely, if bullish momentum returns and market sentiment improves, the coin may rebound from current lows and transfer towards the $106,548 stage.