ZCash (ZEC) holders have began unshielding cash. The ZEC vaults are emptying out, probably signaling an exit from privateness property.

The earlier development of defending ZEC tokens in high-privacy vaults reversed previously weeks. Round 4.86M ZEC stay shielded, however among the property have been shortly withdrawn.

Shielded ZEC mirrored the withdrawal of 202M cash by a single whale, coming from the deposits on the Orchard privateness pool. | Supply: ZEC Dashboard

The worth of defending ZEC was purported to carry a brand new period of privateness in decentralized finance. The speedy rise in shielding coincided with final 12 months’s ZEC rally, which introduced the asset again to ranges not seen since 2018.

ZEC whale unshields over 1% of the availability

In early January, a earlier shielded holder eliminated over 200K ZEC, valued at over $100M, from the highest-security vault of ZCash.

The whale’s holdings are nonetheless sitting idle and are actually extra traceable. The whale used a brand-new pockets with no different on-chain interactions or historical past. The whale beforehand shielded 1 ZEC as a check.

The withdrawals from the high-privacy Orchard pool additionally observe a diminished provide within the Sprout and Sapling swimming pools. Total, the frenzy to protect extra ZEC and use it as a DeFi asset has diminished.

The whale’s ZEC can now be traded or used as a non-privacy asset, or shielded once more if wanted. The whale’s transfer additionally created considerations for potential promoting strain.

ZEC enlargement slows down

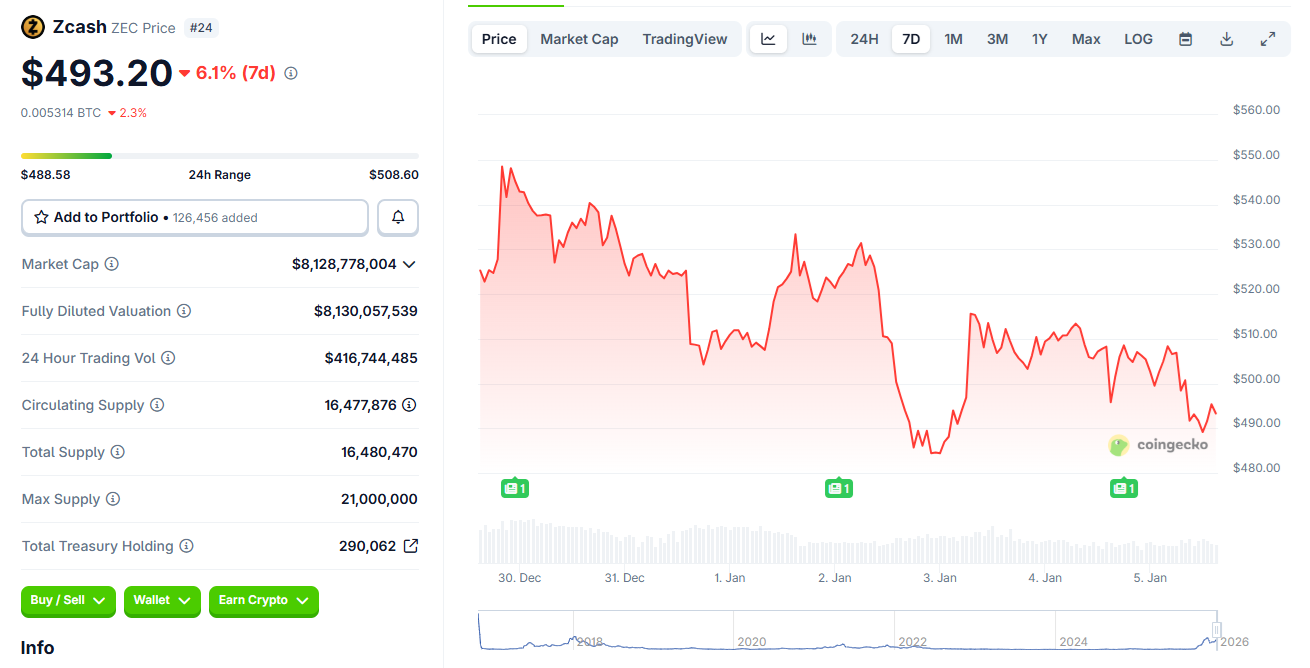

ZEC was among the many top-performing altcoins in 2025, briefly inflicting a rally for all privateness property. Prior to now week, ZEC slid to $492.51, down over 6.8%. Immediately following the large-scale unshilelding, the markets entered panic mode, pushing ZEC to an area low of $484.41.

ZEC had a turbulent week, reacting to the information of a whale unshielding 1.2% of the coin’s circulating provide. | Supply: Coingecko

ZEC open curiosity fell to $764M, down from its 2025 peak of practically $1B. ZEC can be not aggressively shorted, with a extra even cut up of open curiosity.

Even after the latest market slowdown, ZEC remained the main privateness coin by market capitalization. XMR consolidated across the $428 vary, whereas many of the legacy personal cash have been within the purple.

For others, ZEC remains to be making ready for a breakout as quickly as merchants return within the post-holiday interval. One Hyperliquid whale has already made the guess, with a big ZEC spot place and a promote restrict order at $509.

Based mostly on the latest liquidation heatmap, ZEC might dip decrease to focus on the collected lengthy positions. The asset might also meet resistance at round $520. The asset is buying and selling with diminished mindshare, just lately dropping by 67%, all the way down to 0.3%.

The ZCash group additionally relied on assist from Solana influencers, because the privateness coin was additionally utilized in its tokenized kind.

ZEC supporters and influencers nonetheless drive the narrative of displacing BTC. ZEC is anticipated to outperform the market, even when BTC fails. Regardless of the ZEC greenback value slide, the asset is up greater than 31% towards BTC for the previous month.