XRP exchange-traded funds are quickly nearing the $1 billion milestone, attracting bullish commentary from Ripple’s CEO.

The momentum builds on sturdy institutional demand and a wave of recent listings from main traditional-finance gamers. In the meantime, Ripple CEO Brad Garlinghouse says that is solely the start, arguing that crypto’s share of the worldwide ETF market remains to be “terribly early.”

Ripple CEO: ETF Demand Is Simply Getting Began

Talking at Binance Blockchain Week in Dubai, Garlinghouse pushed again in opposition to claims that curiosity in XRP ETFs or broader crypto merchandise could also be cooling. He famous that XRP ETFs didn’t exist till not too long ago resulting from U.S. regulatory obstacles. However as soon as permitted, pent-up demand poured in.

In accordance with him, over the previous “two or three weeks,” greater than $700 million has flowed into XRP ETFs, representing traders looking for publicity with out the necessity for self-custody.

He famous that crypto ETFs at present make up simply 1–2% of the worldwide ETF trade, and that quantity will virtually actually develop.

Garlinghouse defined that establishments that beforehand sat on the sidelines resulting from regulation, threat issues, or inner insurance policies at the moment are cautiously getting into the market. Ripple’s personal prime-brokerage platform is seeing this shift firsthand, with shoppers “crawling, then strolling, then operating.”

In different phrases, institutional urge for food is strengthening, not weakening.

Vanguard’s Coverage Reversal Accelerates XRP Adoption

A serious catalyst behind the newest wave of inflows got here from Vanguard, the $11 trillion asset-management big. After years of rejecting crypto merchandise outright, Vanguard has now listed a full suite of XRP spot ETFs on its brokerage platform.

This marks one of the crucial important coverage reversals in conventional finance. Analysts imagine it may amplify mainstream entry to digital belongings in the identical means gold ETFs reworked precious-metals investing.

Certainly, this shift is regularly unfolding for XRP ETFs, which at the moment are approaching the $1 billion milestone.

XRP ETFs Close to $1B in Belongings With Zero Outflows

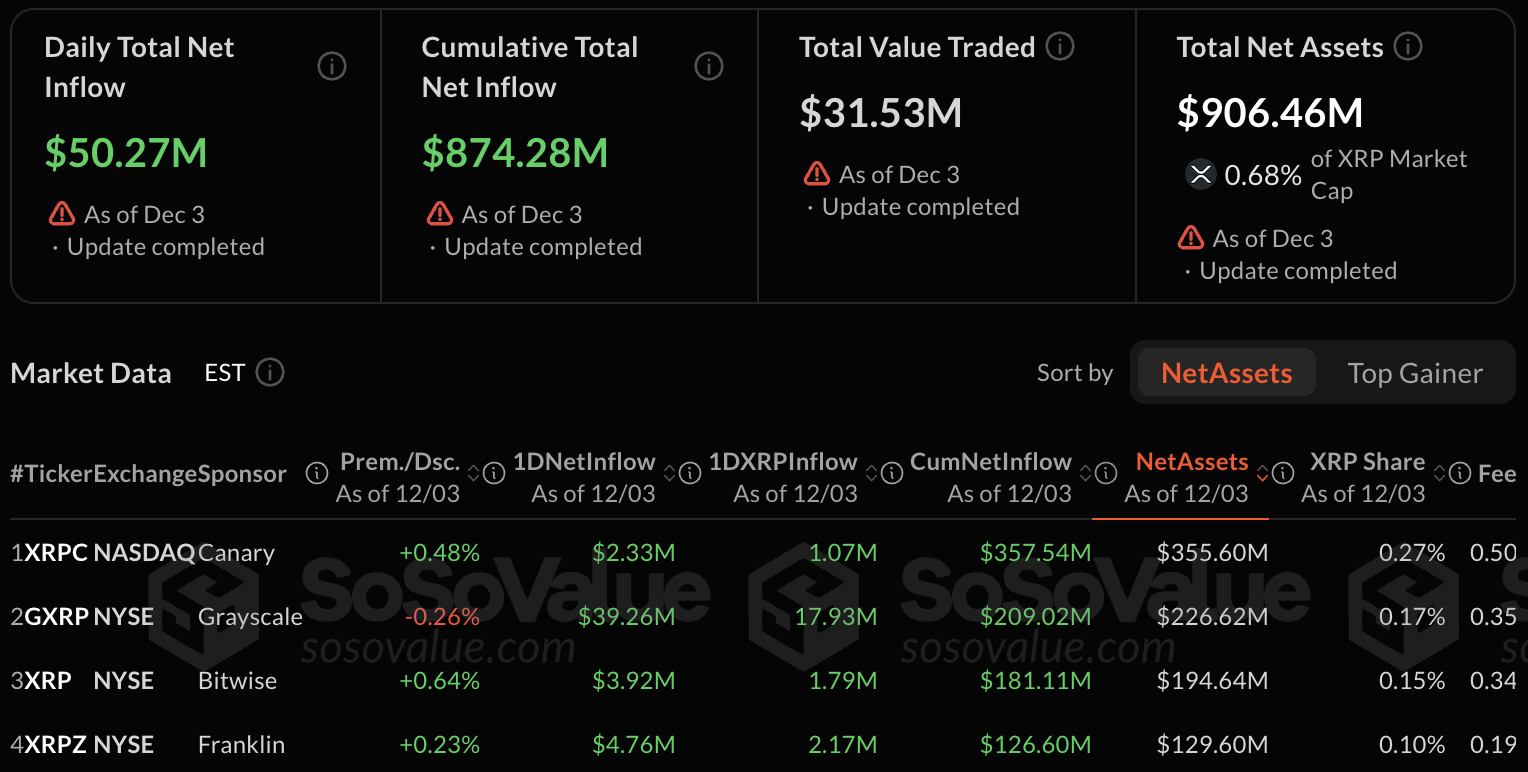

Up to date market knowledge reveals that XRP ETFs now maintain $906.46 million in complete belongings. This follows 14 buying and selling days that attracted $874.28 million in complete web inflows. Throughout this era, XRP ETFs recorded zero days of outflows since launch.

Yesterday, The Crypto Fundamental reported that XRP turned the second quickest crypto to succeed in $800 million in ETF inflows. Main spikes embody $243 million on November 14 throughout Canary Capital’s debut and $164 million on November 24 with new funds from Franklin Templeton and Grayscale.

Within the newest influx cycle on Wednesday, XRP ETFs logged $50.27 million in new investments from Canary Capital (AUM $355M), Grayscale ($209M), Bitwise ($194M), and Franklin ($129M).

XRP ETF information

In the meantime, 21Shares secured approval for its spot XRP ETF on Cboe BZX, with buying and selling set to start shortly.

With almost $1 billion now parked inside XRP ETFs and Vanguard’s adoption boosting confidence, sentiment throughout the ecosystem is popping more and more bullish. Garlinghouse believes the actual progress will unfold over the following few years as crypto strikes from 1% of the ETF market towards mainstream allocations.