- Hedera cofounder Mance Harmon says the venture is constructing invisible tech that powers the plumbing of the decentralized future.

- He says that hashgraph is fixing all of the challenges blockchain solves, however “in a much more safe, environment friendly, and performant means.”

Hedera is constructing know-how that powers the way forward for Web3, however the customers by no means should know concerning the plumbing, says co-founder Mance Harmon. In an interview with CNBC, he described the venture’s objective as “invisible ubiquity.”

Harmon was talking on the sidelines of the World Financial Discussion board in Davos, the place, as we reported, crypto was nicely represented. The Web Laptop unveiled its first nationwide subnet on the occasion, whereas Ripple showcased its institutional-grade XRPL infrastructure.

“Invisible ubiquity” @ManceHarmon spoke with @CNBC about what “success” seems like for Hedera.

“If we take into consideration the web, it runs on applied sciences that nobody has ever heard of… Hedera would be the identical.”

Full article: https://t.co/AgHadubRA9 pic.twitter.com/O2SHtDA19x

— Hedera (@hedera) January 30, 2026

Harmon drew parallels between what his venture is constructing and the plumbing of the web. Whereas billions of individuals use the web on daily basis, few are conscious of the know-how underpinning it. Nevertheless, not realizing what powers the web has doesn’t inhibit the customers’ means to benefit from the expertise. He instructed CNBC:

“Hedera would be the identical. It’s offering a set of companies for the Web3 economic system, but it surely’s like plumbing: it’s going to be on the backside of this new know-how stack that allows Web3, which everybody will use.”

Hedera: Like Blockchain, However Higher

Not like different networks, Hedera depends on hashgraph, a special kind of decentralized know-how the place knowledge is saved in directed acyclic graphs (DAGs), with nodes consistently sharing details about transactions and consensus reached mathematically, as our detailed information breaks down. Hashgraph is quicker as information are added in parallel, and its prices are a lot decrease.

Harmon summed it up:

“Hashgraph solves the identical class issues as blockchain, but it surely does it in a much more safe and environment friendly and performant means.”

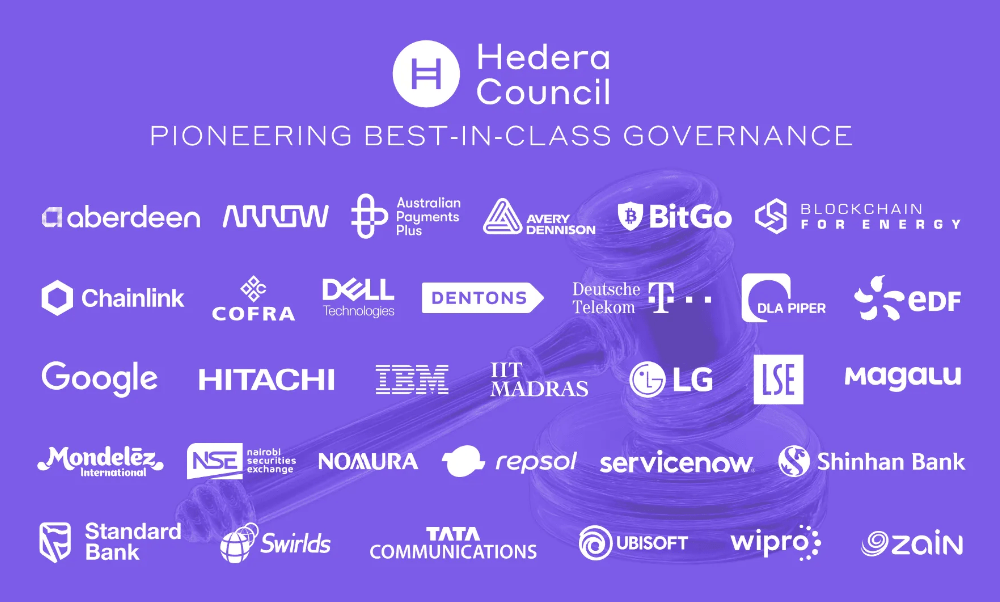

One other means Hedera units itself aside is its node validators. On networks like Bitcoin, any person can run a node. Nevertheless, Hedera introduced collectively over 30 of the world’s largest firms with international reputation to run the nodes, with membership to this group rotating among the many members. This contains Google, Aberdeen, IBM, Dell, LG, Hitachi, Dentons, and Ubisoft.

Picture courtesy of CNBC.

This council ensures that the community doesn’t depend on one celebration. This strategy additionally ensures that it’s impenetrable, as attackers would want to breach the safety guardrails of a number of the world’s most essential firms.

Hedera’s strategy has attracted thousands and thousands of customers, each retail and enterprise, Harmon says. One of many sectors the place it has made nice headway is tokenization. “We will instantaneously skip settlement and clearing and go straight to atomic swaps—supply versus cost—in a single fell swoop. One transaction in a fraction of a second,” he famous.

Like most different networks, Hedera can be focusing on the AI sector, Harmon added. One of many methods Harmon believes would be the most impactful is agentic funds, the place the AI brokers can interact in autonomous commerce amongst themselves. The funds that may move between these brokers will “dwarf what we’ve seen right this moment in our current economic system.”

He acknowledged:

“Regular cost techniques don’t work nicely for those who’re speaking about transferring worth that’s a fraction of a U.S. penny. With the efficiencies and the know-how that we’ve got, we are able to switch fractions of a cent effectively.”

HBAR trades at $0.0959, dropping 3% within the early hours right this moment for a $4.12 billion market cap. Its buying and selling quantity has been hit by the cyclic weekend dip to settle at $159 million, a 21% drop.