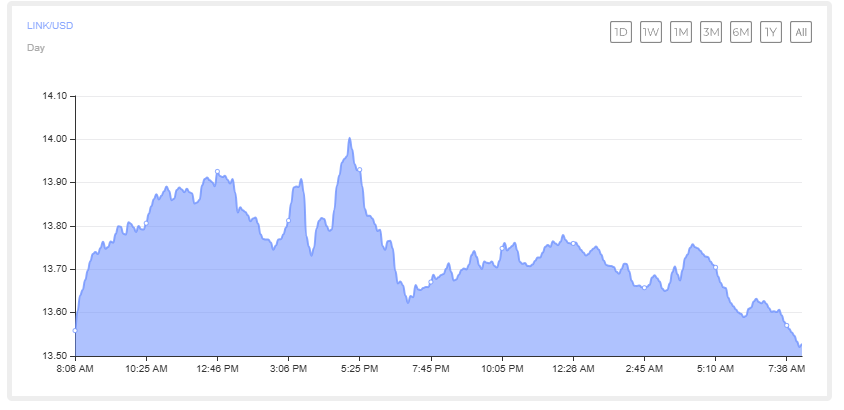

Chainlink has been on a powerful run too, gaining 3.79% over the past week and one other 6% surge prior to now 24 hours because it holds regular at $13.88. Buying and selling exercise for LINK has additionally picked up, with quantity rising 67.6% in a single day to succeed in $479 million.

- With CCIP dwell on Solana, it opens up a complete new world of prospects for each customers and builders by providing safe and seamless cross-chain connections.

- It additionally signifies that DeFi communities and token tasks constructed on EVM chains lastly have a method to lengthen their attain into Solana.

On Could 19, Chainlink (LINK )introduced that its Cross‑Chain Interoperability Protocol (CCIP) is formally dwell on Solana’s mainnet. Solana (SOL), being a non-EVM chain, beforehand lacked seamless connectivity with Ethereum-based ecosystems. So, that is the primary time CCIP has been deployed on a non‑EVM chain, because of its upgraded v1.6 structure.

In keeping with our earlier replace, the Chainlink v1.6 replace introduces assist for VM-agnostic networks like Solana, which runs on Sealevel as a substitute of the Ethereum Digital Machine (EVM). This brings huge enhancements: transaction prices for cross-chain messaging are minimize by 90%, and message batching means decrease latency and charges.

Chainlink Co-founder Sergey Nazarov highlighted how this integration supercharges Solana’s sensible contracts, making them extra highly effective by means of cross-chain messaging and programmable token transfers.

What Chainlink’s CCIP Means for Web3

For Solana builders, it’s a game-changer, lastly making quick, low-cost, and safe cross-chain performance potential with out counting on dangerous, complicated bridging options. Not like conventional bridges that depend on wrapped tokens or custodial options, CCIP permits direct and decentralized transfers of each messages and tokens, even to non-EVM chains like Solana.

It leverages superior options like Threshold Signature Schemes (TSS), decentralized oracle networks (DONs), and built-in price limits and circuit breakers for additional safety.

This implies builders can now work together extra seamlessly with ecosystems like Ethereum (ETH), HashKey Chain, HyperEVM, Arbitrum (ARB), Optimism, BNB Chain, and Base. This then unlocks new use circumstances and liquidity flows. On high of that, CCIP helps the Cross-Chain Token (CCT) commonplace, permitting actual, native belongings to maneuver throughout blockchains with out shedding safety or management, which is a large step ahead in making Web3 really interconnected.

Belongings like stablecoins, tokenized real-world belongings (RWAs), and DeFi tokens can transfer into the Solana ecosystem natively with out the necessity for wrapped tokens or dangerous third-party bridges. This implies over $19 billion in worth from companions like Circle, Maple Finance, and The Graph can now be deployed on Solana extra securely and effectively.

For enterprises, CCIP brings the form of instruments they want: standardized APIs for transferring tokens and knowledge, built-in automation, auditability, and gas-efficient batching. Conventional finance (TradFi) gamers in search of compliant, safe infrastructure now have a dependable path into Solana.

On the similar time, the businesses working with RWAs, central financial institution digital currencies (CBDCs), or tokenized securities, Solana turns into a sensible, enterprise-ready choice for cross-chain exercise.

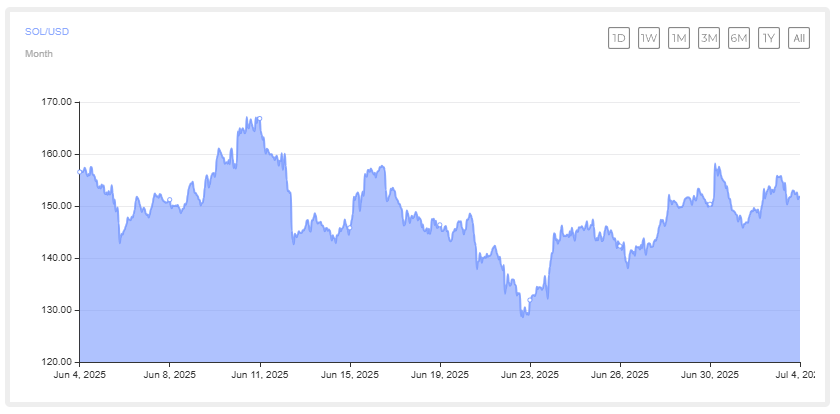

Solana noticed a fast 4.34 % enhance, constructing on a strong 7% acquire over the previous week. It’s at present hovering round $155, with its buying and selling quantity spiking by 24.61% in simply 24 hours, now sitting at a hefty $4.12 billion. In keeping with our evaluation, the subsequent main degree to observe is $187, which marks the excessive Solana hit again in Could.

Chainlink has been on a powerful run too, gaining 3.79% over the past week and one other 6% surge prior to now 24 hours because it holds regular at $13.88. Buying and selling exercise for LINK has additionally picked up, with quantity rising 67.6% in a single day to succeed in $479 million.