The crypto market continues to get better from the sharp downturn triggered by US President Donald Trump’s abrupt tariff announcement.

Whereas merchants are nonetheless processing the influence, a number of blockchain groups are taking proactive steps to stabilize sentiment and rebuild confidence throughout digital property.

WLFI Leads Token Buyback

Over the previous 24 hours, World Liberty Monetary (WLFI), Aster, and Sonic Labs every introduced large-scale token buyback applications. These initiatives purpose to ease promoting strain and show long-term dedication to their ecosystems.

On October 11, WLFI disclosed that it had allotted $10 million to repurchase its native WLFI tokens utilizing the USD1 stablecoin.

Whereas others panic, we stack. 🦅

Immediately we purchased $10 million price of $WLFI — and this received’t be the final time.

We all know how the sport is performed.https://t.co/do3wPuiuZc— WLFI (@worldlibertyfi) October 11, 2025

In line with the staff, the initiative kinds a part of a broader resilience plan designed to regular costs because the broader market stays risky.

Blockchain knowledge reveals the buyback was executed utilizing a Time-Weighted Common Worth (TWAP) mannequin. The algorithm spreads purchases evenly over time to stop sudden value swings.

By dividing orders into smaller intervals, WLFI averted distorting its personal market and achieved a median buy charge nearer to honest worth.

Notably, the challenge beforehand confirmed that every one repurchased tokens can be completely burned. This technique reduces circulating provide and strengthens value help over time.

Aster and Sonic Follows

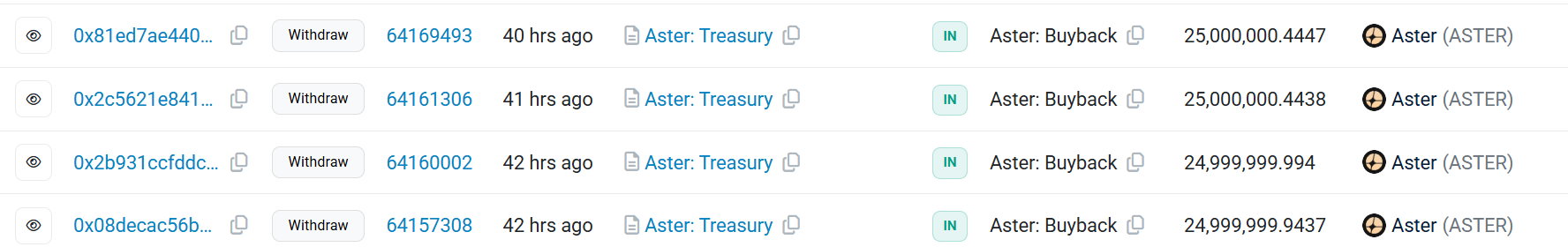

Alternatively, Aster, a decentralized trade backed by Binance founder Changpeng Zhao, adopted swimsuit with a 100 million ASTR token buyback.

Not like WLFI’s open-market technique, Aster transferred tokens from its treasury pockets however emphasised that the hassle displays its long-term confidence within the challenge.

Aster Token Buyback. Supply: BSC Scan

In the meantime, the timing coincides with the rollout of its Stage 2 Airdrop Checker, which has spurred greater consumer engagement as Aster continues to problem perpetuals chief Hyperliquid.

On the identical time, Sonic Labs additionally acted to defend its ecosystem from additional declines.

Whereas most networks have been struggling to remain on-line, Sonic operated flawlessly. Zero pending transactions, near-instant finality, and sub-cent charges throughout each DEX and app.

And whereas others pulled again, we stepped ahead by including $6 million in open-market shopping for, rising… https://t.co/56bYdob3rN pic.twitter.com/BjlyIkzm7D

— Sonic (@SonicLabs) October 11, 2025

On October 11, Sonic Chief Government Mitchell Demeter revealed that the agency bought 30 million $S tokens—roughly $6 million price—and added them to its treasury.

Certainly, Demeter argued that holding native property gives extra substantial long-term returns than stablecoins.

“By way of all of it, the Sonic community carried out precisely as designed. Zero pending transactions, lots of of TPS sustained for hours, near-instant finality, and sub-cent charges. No congestion throughout DEXs or infrastructure. Pure, constant efficiency,” he added.

These buyback applications underscore how blockchain groups use token repurchases and burns to soak up promoting strain and stabilize markets.

In consequence, DWF Labs Managing Accomplice Andrei Grachev mentioned his agency plans to help struggling initiatives recovering from the current market downturn. This would come with deploying a mix of capital injections, loans, and repurchase applications.

The submit These 3 Altcoins Turned the Market Crash Right into a Comeback With Large Buybacks appeared first on BeInCrypto.