- Tether, the world’s largest stablecoin issuer, mints one other $1 billion value of USDT on the Tron blockchain on Friday.

- Massive stablecoin inflows throughout a market rally usually point out recent shopping for strain.

- As traders brace for US and China inflation studies, tokens like BNB, BGB and TRX may benefit from the risky market swings.

Recent $1B USDT Issuance alerts liquidity surge on Tron community

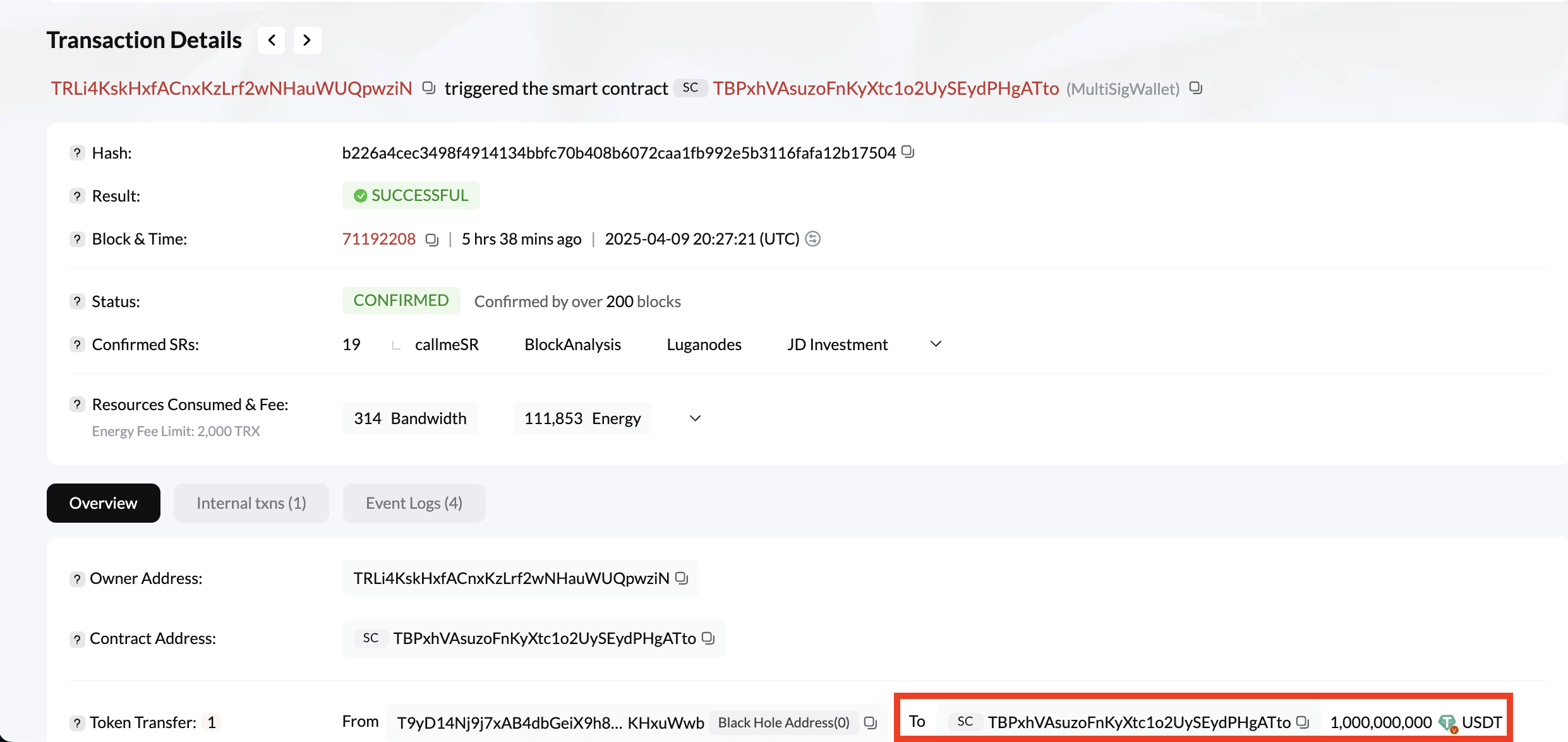

Tether, the world’s largest stablecoin issuer, has minted one other $1 billion value of USDT on the Tron blockchain, in accordance with Whale Alert information revealed Friday.

This issuance pushes Tether’s complete USDT provide on Tron previous $50 billion, reinforcing its dominance throughout the stablecoin sector.

Nonetheless, timing of Tether’s newest mints—simply forward of essential macroeconomic studies from each the U.S. and China—counsel it might be linked to merchants seeking to enter crypto positions to capitalize on potential short-term beneficial properties.

On the flip aspect, the $1 billion influx might additionally present firepower to scoop the dip if hawkish inflation indicators emerge from any or each of the world’s two largest economies on Thursday.

Notably the inflows coincided with Bitcoin worth which briefly surpassed $83,600 after former U.S. President Donald Trump introduced a rollback of the worldwide tariffs. With CPI and PPI information looming, Tether’s $1 billion liquidity injection might present directional momentum, relying on the result of every.

Tron On-chain metrics warmth up as Tether mints one other $1B in USDT

Tron’s blockchain fundamentals are flashing bullish alerts, supported by a raft of intense on-chain exercise amid the market turbulence.

On Wednesday, on-chain information from Tronscan exhibits that Tether’s the world’s largest stablecoin issuer executed one other $1 billion USDT issuance on the community.

This aligns with the dominant narrative that traders start to re-allocate capital in the direction of crypto threat property.

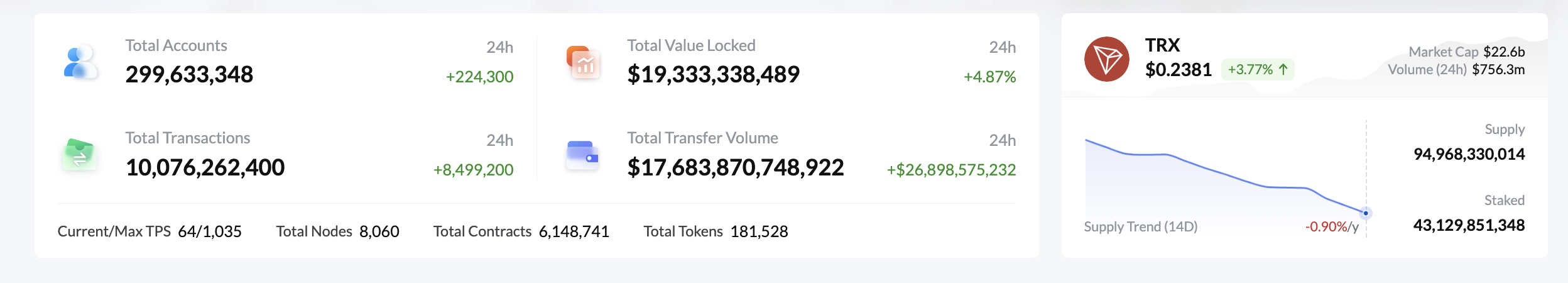

Validating this stance, Justin Solar’s Tron community growth has accelerated considerably. In keeping with real-time information from Tronscan, new TRX accounts surged by 224,300 in simply 24 hours, bringing the cumulative depend to 299.63 million. This uptick emphasizes rising consumer adoption and elevated stablecoin exercise as market turbulence heightens.

Extra importantly, Tron’s each day transaction depend elevated by 8.5 million, pushing the full variety of all-time transactions previous 10.07 billion. Concurrently, the Complete Worth Locked (TVL) climbed 4.8% to $19.33 billion, reflecting a significant injection of latest capital into the Tron DeFi ecosystem.

These headline metrics are additional supported by deeper liquidity indicators. Over a 24-hour interval, Tron’s switch quantity surged by $26.89 billion, lifting cumulative switch quantity to a formidable $17.68 trillion. This means capital is actively shifting throughout the ecosystem—not simply parked—which generally precedes demand strain for TRX.

In essence, TRX supply-side dynamics paint an image of tightening provide and enhanced investor sentiment after Trump’s choice to pause tariffs imposed on all US’ commerce companions, besides China.

TRX worth primed for breakout amid liquidity wave

Traditionally, recent stablecoin issuance—particularly on Tron—has preceded surges in TRX and different associated tokens. A lot of the newly minted USDT fuels cross-border transfers, OTC desk settlements, and DeFi lending, all of which incur TRX fuel charges.

Therefore, durations of intense market volatility with merchants rotating out and in of stablecoins usually generate important traction for the TRX token holder incentives, leading to persistent purchase strain.

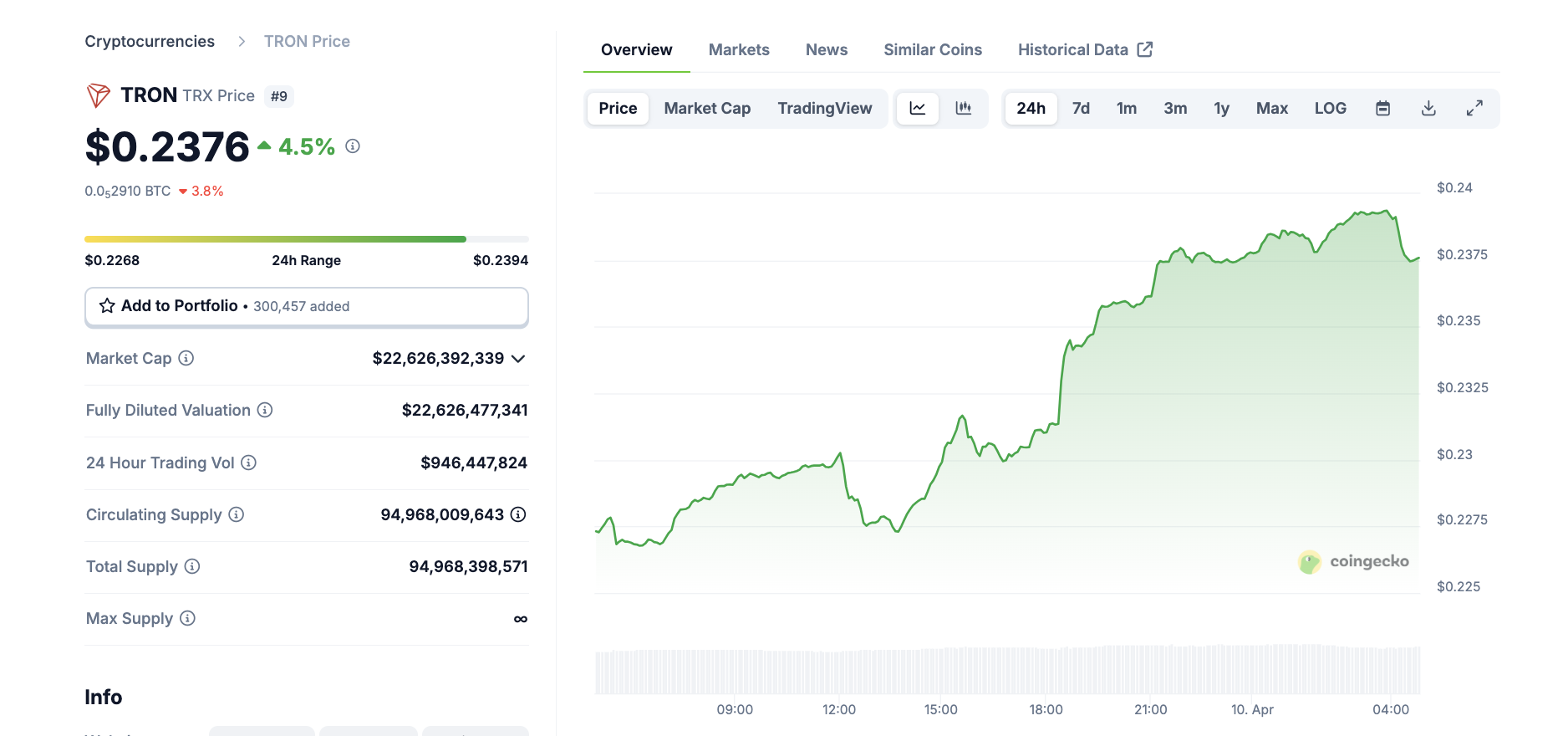

Tron (TRX) Value Motion, April 10 | Supply: Coingecko

With TRX worth up 4.5% at press time on Thursday, buying and selling at $0.2831 and 24-hour buying and selling quantity reaching $946 million, market sentiment is starting to align with the on-chain energy.

Furthermore, trade balances for TRX have declined sharply up to now 48 hours, as traders migrate tokens to non-public wallets or stake them—one other sign of diminished sell-side strain and lengthy positioning.

If upcoming macroeconomic information confirms dovish inflation tendencies, TRX could break by means of short-term resistance close to $0.135, a stage not seen in 30 days. This might see present TRX holders earn one other 4.7% revenue within the close to time period.

Share: Cryptos feed