Paolo Ardoino, chief government of Tether, has seized on final week’s crypto market crash to tout the resilience of USDT, the world’s largest stablecoin, as rivals struggled to keep up parity.

His remarks got here after Ethena Labs’ artificial greenback, USDe, briefly depegged amid essentially the most extreme liquidation cascade within the digital asset market’s historical past, which was triggered by President Donald Trump’s announcement of recent tariffs on Chinese language imports on October 10.

In a put up on X, Ardoino declared that “USDT is the perfect collateral for derivatives and margin buying and selling. Liquid, examined by hearth.” He added, in attribute aptitude, that these utilizing “low liquidity tokens, some bananas, a horse, 3 olives and a chewed bubblegum” as collateral ought to “brace your self when the market strikes.”

USDe’s flash depeg exposes structural fragility

Ethena Labs’ USDe, a $14 billion “artificial” stablecoin ranked third by market capitalization, was among the many hardest hit within the midst of the disaster. USDe maintains its greenback peg by way of a derivatives-based hedging construction that mixes spot crypto holdings with offsetting brief futures positions, which may be very completely different from Tether’s USDT or Circle’s USDC, each fiat-backed by money and Treasury reserves.

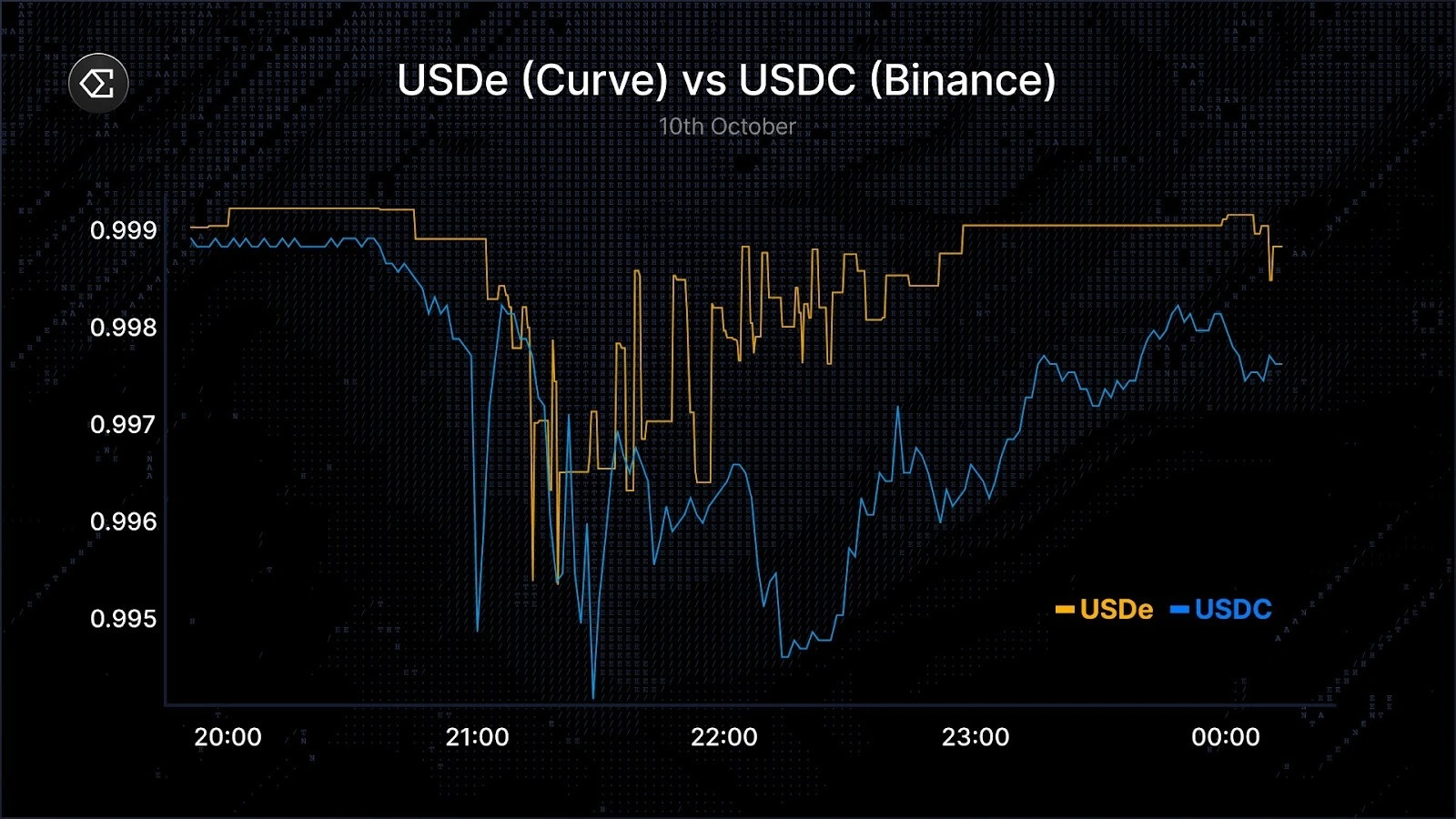

Comparability of USDe’s greenback peg on Curve and Binance. Supply: Man Younger (@gdog97_) on X

Throughout the turmoil, USDe’s worth on Binance plunged as little as $0.65 following what Ethena described as an inside pricing discrepancy within the change’s spot market.

On-chain liquidity swimming pools comparable to Curve, Fluid, and Uniswap, against this, confirmed solely minor deviations, which weren’t as much as 30 foundation factors, much like spreads between USDC and USDT.

Binance’s degraded efficiency exacerbated the dislocation. It affected BNSOL, the Binance-issued Solana liquid staking token, and WBETH, the wrapped Beacon liquid staking token.

In line with Man Younger, Ethena Labs founder, Ethena’s mint and redeem perform processed “greater than $1b in a couple of hours and $2b in a 24-hour interval with zero points.”

Younger put up on X implied that the depeg was a Binance-specific glitch fairly than a structural failure of USDe itself. He proposed improved oracle designs to forestall compelled liquidations throughout short-lived worth distortions and urged that pegging to USDT fairly than USD in periods of stress may have mitigated the incident.

Binance’s chief government officer, Richard Teng, later apologized for the efficiency of the platform and its influence on customers through the warmth of Friday’s market capitulation and promised to compensate affected customers, acknowledging that “there are not any excuses” for its efficiency through the occasion.

Tether touts sturdiness as rivals stumble

For Ardoino, the incident supplied a chance to distinction USDT with different gamers available in the market. USDT, now with greater than $179 billion in circulation, weathered the rout with out deviation, a reality Ardoino was fast to focus on. His put up suits inside an effort to place Tether as crypto’s foundational layer of liquidity and reliability, following years of scrutiny over its reserves and transparency.

Ardoino has made some extent of emphasizing Tether’s conservative asset administration and swift redemption document, describing the token as battle-tested.

His touch upon the opposite low-liquidity tokens is sort of sardonic; nonetheless, the market seems to have validated his declare.

After the crash: classes in collateral and design

The October 10 occasion has already entered crypto lore because the “Tariff Crash,” each for its geopolitical set off and for the staggering $19 billion in compelled liquidations it produced, the most important in digital asset historical past.

Analysts say the sell-off uncovered how closely the market nonetheless depends upon leverage and centralized pricing feeds.

Ethena’s measured dealing with of redemptions earned it cautious reward from some traders, however the episode highlighted how even refined hedging programs stay susceptible to exchange-specific distortions.

Calls are rising for decentralized oracles that derive costs from deep-liquidity swimming pools fairly than particular person venues and for real-time proof-of-collateral monitoring to determine early indicators of stress.