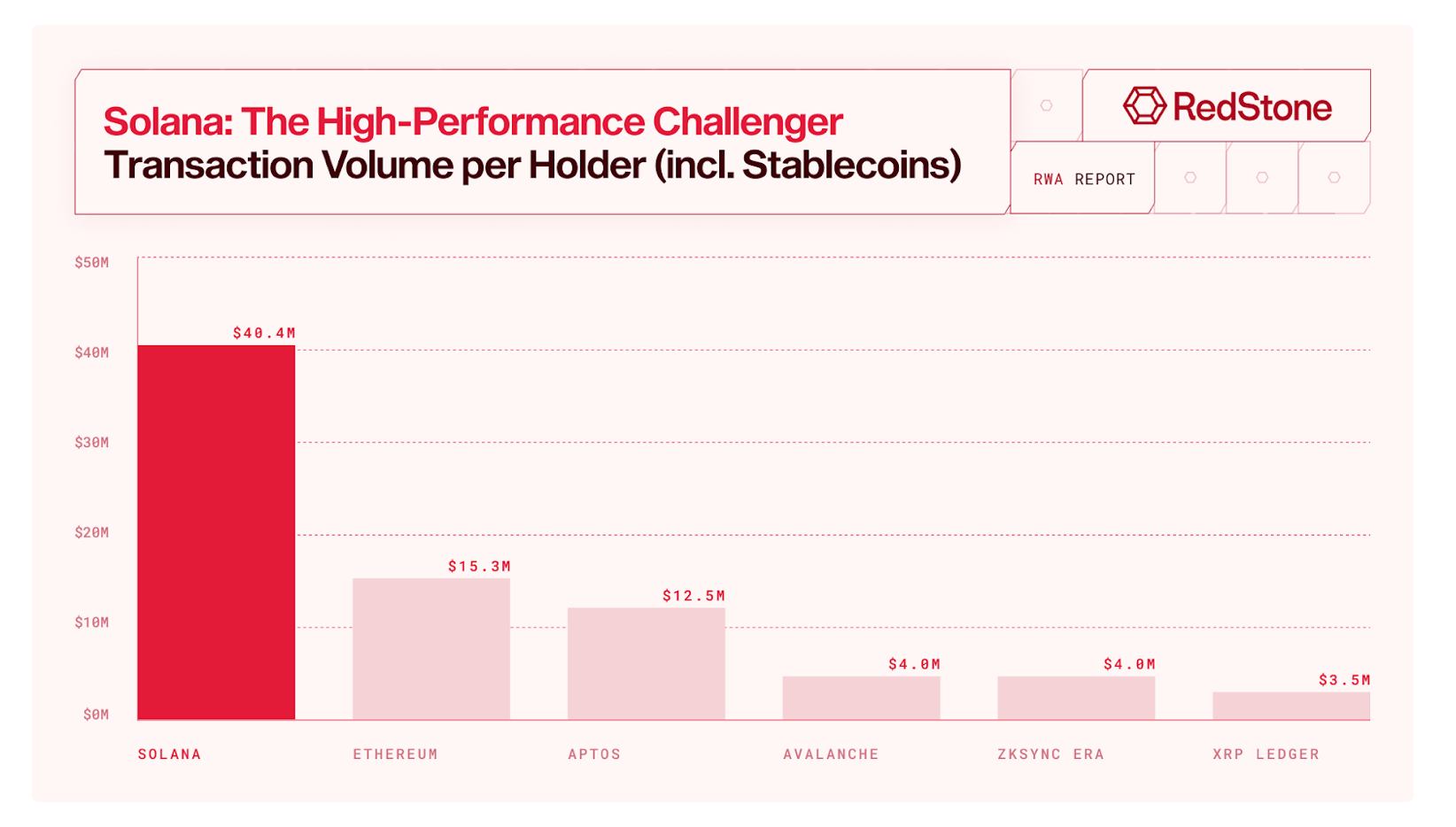

Solana planted a $13.5 billion flag in real-world property (RWAs), with stablecoins in combine, and Redstone’s newest report says that places the chain in pole place for Web Capital Markets.

Redstone Evaluation: Solana’s Tokenized Belongings Prime $13.5B, Constructing Web Capital Markets

The modular oracle protocol and decentralized finance (DeFi) agency Redstone explains that Solana’s RWA footprint isn’t a rounding error; it’s the headline, with almost 500% year-over-year development, median charges underneath a tenth of a cent, and sub-second finality backing declare.

Redstone’s new evaluation, revealed on Monday, frames the second clearly: tokenized finance jumped from $5 billion in 2022 to greater than $31 billion by September 2025, and Solana’s share now tops $13.5 billion, together with stablecoins.

Stablecoins dominate the stack on Solana, led by USDC above $8 billion, far outpacing USDT’s roughly $2 billion provide, whereas newer entrants like PYUSD, FDUSD, AUSD and EURC nibble for market share.

Supply: Redstone report.

Past {dollars}, non-stablecoin RWAs lean closely towards tokenized U.S. Treasuries, which account for greater than 90% of the class on Solana because of merchandise like Ondo’s USDY and OUSG and Blackrock’s BUIDL.

Establishments are delivery right here: Apollo’s ACRED and Hamilton Lane’s SCOPE arrive by way of Securitize, whereas Vaneck’s VBILL and Centrifuge-anchored funds prolong entry, turning Solana right into a busy onchain avenue.

The rails are constructed for compliance and velocity: Token-2022 extensions allow KYC gates, switch guidelines and company actions, whereas common 400-millisecond finality and 100% uptime over twelve months preserve throughput snappy.

Pricing and plumbing matter; Redstone oracles now safe RWA markets on Drift Institutional and Kamino, bringing NAV-aware feeds that allow DeFi methods plug into tokenized funds with out hand-waving mark-to-fantasy.

TradFi bridges are forming too: R3’s Corda is wiring regulated networks to Solana’s public chain, letting banks preserve privateness controls whereas settling into deeper liquidity swimming pools the place customers already transact.

The takeaway is easy: Solana’s mix of velocity, compliance tooling and institutional proof factors makes it a pure venue for tokenized property to graduate from pilots to manufacturing at web scale.