As the ultimate quarter of 2025 will get underway, buyers are coming into a traditionally favorable interval for crypto markets — notably for bitcoin BTC$111,589.19, which has delivered a mean This fall return of 79% since 2013.

In keeping with a brand new report from CoinDesk Indices, a number of components could assist that development repeat, together with financial easing, surging institutional adoption and recent regulatory momentum within the U.S.

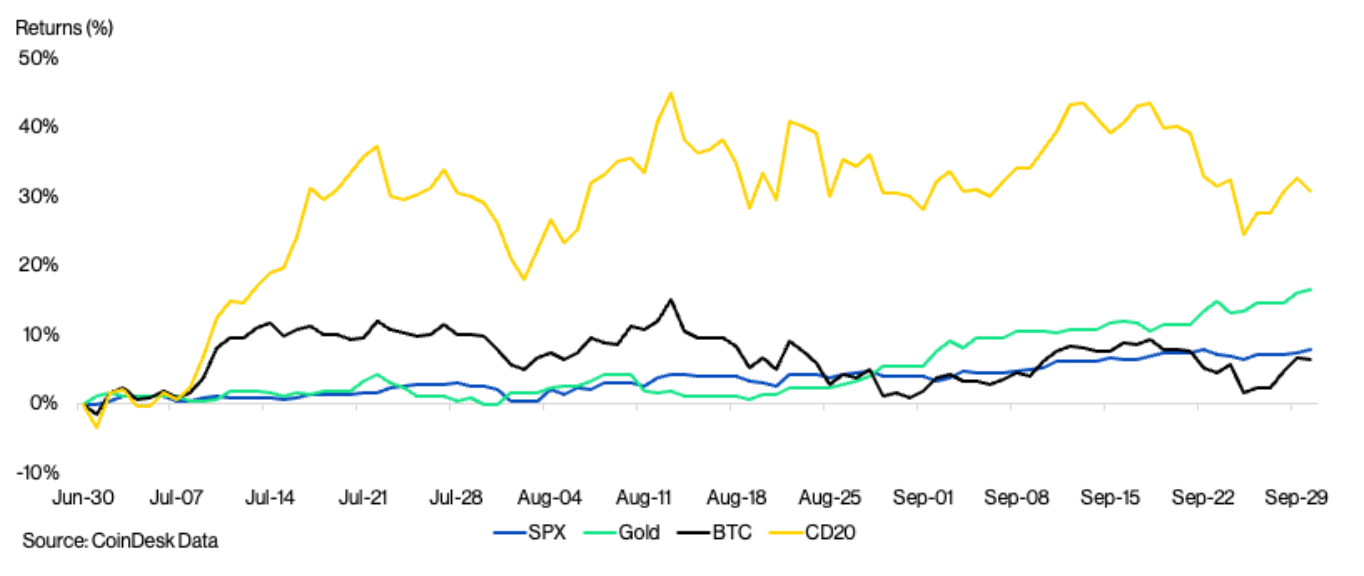

BTC vs Gold vs SPX vs the CoinDesk 20 Index (CD20), Q3 2025 (CoinDesk Indices)

The backdrop is shifting quick. The Federal Reserve’s newest price reduce introduced rates of interest to their lowest stage in almost three years, setting the stage for broader risk-on sentiment. Establishments responded aggressively in Q3: U.S. spot bitcoin and ether ETH$3,834.97 ETFs noticed mixed inflows of over $18 billion, whereas public corporations now maintain greater than 5% of bitcoin’s whole provide.

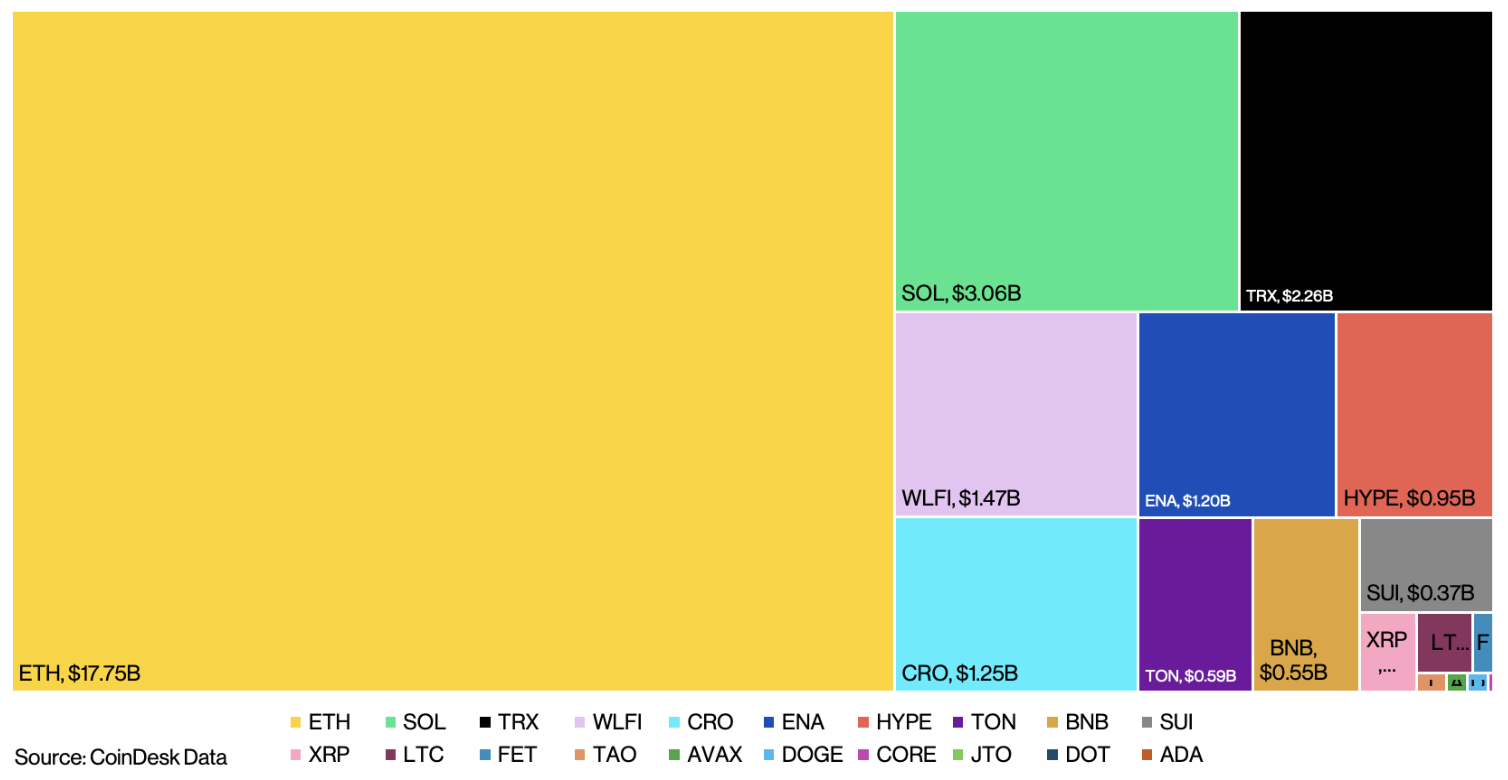

Altcoins, too, have made inroads, with over 50 listed corporations now holding non-BTC tokens on their steadiness sheets, 40 of which joined simply final quarter.

Altcoin holdings by public corporations (CoinDesk Indices)

Bitcoin ended Q3 up 8%, closing at $114,000, pushed largely by treasury adoption amongst public corporations. With expectations for additional price cuts and rising curiosity in bitcoin as a hedge towards foreign money debasement, CoinDesk Indices expects the asset’s momentum to proceed into year-end.

However this time round, bitcoin is sharing the highlight. Ethereum surged 66.7% in Q3, hitting a brand new all-time excessive close to $5,000. That transfer was led by treasury accumulation and ETF flows, however future beneficial properties could hinge on November’s Fusaka improve which is aimed toward bettering scalability and community effectivity. If profitable, it might reinforce Ethereum’s function as the muse for on-chain monetary exercise, particularly in “low-risk” DeFi.

Solana SOL$180.48 noticed a 35% quarterly achieve, backed by large-scale company purchases and report ecosystem income. With new exchange-traded merchandise launching and the Alpenglow improve within the pipeline, Solana is positioning itself because the high-performance layer for decentralized functions, a story that resonates with establishments searching for throughput and value effectivity.

XRP, in the meantime, delivered a year-to-date achieve of almost 37%, fueled by authorized readability after the Securities and Change Fee (SEC) and Ripple withdrew appeals of their long-running case. Traders are watching intently as Ripple’s stablecoin RLUSD expands globally. The stablecoin’s fast progress might draw extra DeFi protocols to the XRP Ledger, deepening XRP’s utility.

ADA$0.6433 rose 41.1% in Q3, outperforming a number of of its friends. Whereas exercise on the chain stays comparatively modest, constant progress in stablecoin use, derivatives quantity and DEX exercise has created a extra secure base for potential enlargement. A pending resolution on a spot ADA ETF might mark a turning level for institutional adoption.

The broader development can also be evident in index efficiency. The CoinDesk 20 Index, which tracks the 20 most liquid and tradable digital belongings, gained over 30% in Q3, outpacing bitcoin. The CoinDesk 80 and CoinDesk 100, which seize mid- and small-cap belongings, additionally posted robust returns, reflecting rising curiosity throughout the market cap spectrum.

Trying forward, the approval of generic itemizing requirements for crypto ETFs and the emergence of multi-asset and staking-based ETPs might additional speed up inflows. For merchants, This fall presents a novel combine: a good macro atmosphere, deepening institutional engagement and renewed curiosity in altcoins.