The true-world asset (RWA) market worth may greater than triple its present worth by 2026, because it expands past crypto-native use circumstances and utility, in response to Chris Yin, co-founder and CEO of RWA-focused layer-2 blockchain Plume.

Talking to Cointelegraph, Yin stated the RWA worth took off final yr and roughly doubled, and he expects it to extend by three to 5 occasions in 2026 as a base case.

“At present, we’re monitoring to over 10x the RWA holders quantity for the reason that begin of the yr and so we anticipate us to maintain inflecting and we predict it’s not loopy to think about one other banner yr with 25x+ in consumer progress numbers,” he stated.

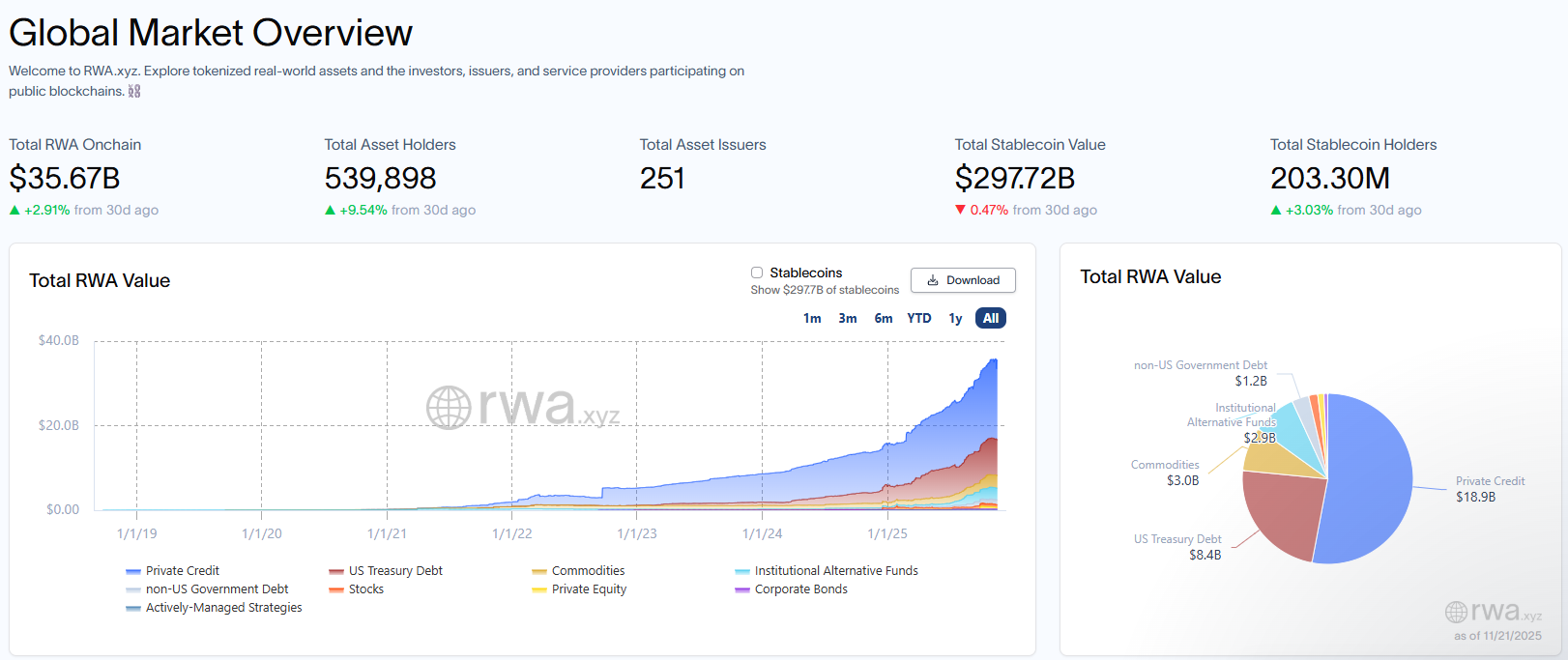

Over $35 billion in RWA is estimated to be onchain, in response to RWA.xyz, throughout greater than 539,000 holders.

Chris Yin thinks the real-world asset market worth may surge previous its present worth of $35 billion. Supply: RWA.xyz

RWA market will develop exponentially

Yin stated the market of tokenized RWAs is solely serving crypto natives however predicts it would develop exponentially throughout whole worth, customers, asset courses and utility.

“Whereas right now the overwhelming majority of RWA worth is in US treasury payments, the market maturing and the mixture of price cuts is pushing onchain customers to hunt larger yields in new locations,” he stated.

“We’re already seeing a pickup in non-public credit score in addition to different various property reminiscent of mineral rights, oil, GPUs, vitality, and extra.”

Rules may additionally play an element. Many international locations are engaged on laws governing stablecoins and different tokenized property. Yin stated it will assist transfer them out of the sandbox and into real-life utilization quickly.

“Outdoors of pure issuance on the availability aspect, we anticipate to start to see the demand aspect lastly come onchain,” Yin added.

Plume inks cope with Securitize

Plume introduced on Wednesday that Securitize, a tokenization platform backed by BlackRock and Morgan Stanley, plans to deploy institutional-grade property on Plume’s Nest staking protocol.

Associated: Plume Community good points SEC switch agent standing to deliver TradFi onchain

The Nest staking protocol permits buyers to commerce and earn yield on tokenized property. The partnership will join Securitize’s tokenized funds to Plume’s community of over 280,000 RWA holders, in response to Plume.

Hamilton Lane funds would be the first, after which different issuers and asset courses from Securitize’s platform will comply with in 2026.

Supply: Plume

Plume has 279,692 holders, which makes up round 50% of the whole variety of holders throughout all RWA networks. Plume, nonetheless, isn’t within the high ten in response to RWA.xyz, with the most important community for RWAs being Ethereum and BNB Chain.

Nevertheless, Yin explains that Plume has an enormous share of customers, however every holder might maintain fewer RWA property than on different networks.

“Plume has 280k customers holding an combination $200 million of RWAs, which is a a lot more healthy measure of utilization on a community,” he added.

Journal: Crypto carnage — Is Bitcoin’s 4-year cycle over? Commerce Secrets and techniques