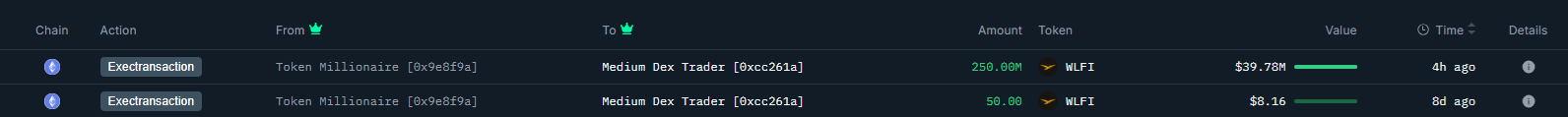

World Liberty Fi could also be making ready to spice up its WLFI token. On-chain knowledge confirmed the Trump household crypto fund despatched 250M tokens to Bounce Buying and selling.

World Liberty Fi moved $40M price of tokens into the wallets of Bounce Buying and selling, one of many main market makers within the crypto house.

The tokens have been moved on to one of many buying and selling wallets of Bounce Buying and selling, flagged for medium-level DEX exercise. Inside the first few hours, the WLFI inside the wallets remained untouched.

World Liberty Fi made its largest WLFI switch to a pockets recognized as Bounce Buying and selling. The pockets is used immediately for decentralized buying and selling exercise. | Supply: Nansen

Prior to now three months, Bounce Buying and selling obtained a number of transfers of WLFI, with the largest thus far for 45M tokens obtained on November 10. Bounce Buying and selling has additionally distributed WLFI to different wallets and counterparties.

WLFI is at the moment sitting at a crossroads, largely pressured by sellers. A breakout to a better vary could increase further demand. Bounce Buying and selling, as a market maker, would be capable to provide liquidity on the promote aspect within the case of a rally.

Will World Liberty Fi help WLFI?

Bounce Crypto isn’t just a custodial holder, however an energetic dealer by its Bounce Buying and selling department. The market maker could also be a part of the plan to spice up the place of WLFI. Lately, World Liberty Fi introduced buybacks to spice up the token, which is buying and selling at a multi-month low.

Bounce Buying and selling could use the holdings for a lot of duties, together with liquidity provision, market-making operations, strategic partnerships, or OTC offers.

Up to now, World Liberty Fi has not given any warnings in regards to the token switch or its intentions. WLFI tokens don’t see any particular hype or makes an attempt at deliberate pumps. Mindshare not too long ago fell by 7%, whereas the worth remained stagnant.

WLFI traded at $0.15, near the decrease vary for the previous three months. The token’s open curiosity on spinoff markets remained weak at $170M. The token traded with the bottom volumes for the previous three months.

World Liberty Fi focuses on USD1 adoption

Whereas WLFI tokens lagged, World Liberty Fi targeted on the adoption of its USD1 stablecoin.

The asset was added to Biannce spot as another choice for BTC buying and selling. The brand new BTC/USD1 buying and selling pair will open alongside the brand new BTC/USD and DYM/USDC pairs. The brand new markets may even be open to bots and algorithmic buying and selling.

Moreover, USD1 will proceed its zero-fee incentive interval on Binance till December 31. USD1 provide stays at over 2.7B tokens, barely down from the height of two.9B tokens as of October 30.

Of that offer, 1.86B tokens are on BNB Chain, the primary buying and selling venue, the place USD1 additionally trades in opposition to meme tokens. 651M USD1 is on Ethereum, and one other 143.6M on Solana.

The enlargement of USD1 can be linked to future plans so as to add real-world asset (RWA) tokenization. As Cryptopolitan reported, World Liberty Fi is making ready to supply some types of RWA from early 2026.