From its 2025 peak, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of many main crypto funding funds — has notably managed its XLM holdings throughout this downturn.

Excessive market worry on the finish of the 12 months continues to gas adverse expectations. What does Stellar (XLM) must face these headwinds?

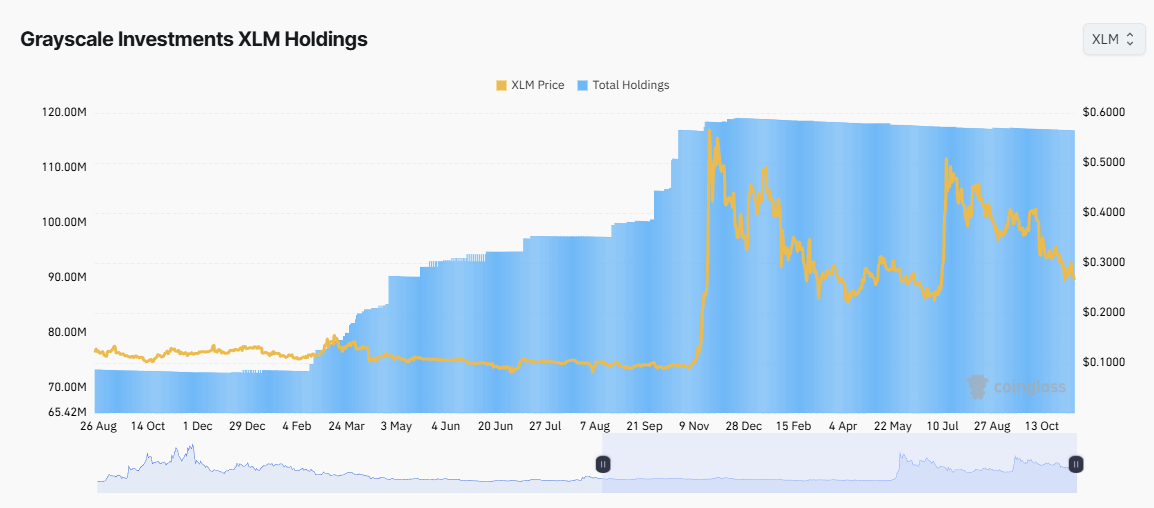

Grayscale Holds Extra Than 116 Million XLM

Based on the newest knowledge from Coinglass, Grayscale’s XLM holdings elevated from final 12 months, earlier than XLM printed a “god candle” in November 2024 with practically 600% progress.

Grayscale efficiently collected XLM from 70 million to 119 million forward of the rally. This transfer highlights the fund’s effectiveness as a smart-money participant that positioned itself earlier than main market swings.

Grayscale Investments XLM Holdings. Supply: Coinglass

Nevertheless, since early 2025, the fund has stopped accumulating. XLM’s value has stopped setting new highs and entered a downward pattern. In comparison with the 2025 peak, Grayscale’s XLM holdings barely decreased to 116.8 million.

The fund’s refusal to promote aggressively displays its traders’ long-term perspective. They seem to view XLM as a useful asset within the cross-border funds sector.

Extra notably, shares of Grayscale Stellar Lumens Belief (GXLM) commerce at a premium over its precise Internet Asset Worth (NAV).

Grayscale Stellar Lumens Belief Efficiency. Supply: Grayscale

GXLM’s market worth sits at $24.85, whereas its NAV per share is $22.29.

The market value is about 10–15% increased than NAV. This premium signifies that traders are prepared to pay above the underlying asset worth. This situation has dominated many of the buying and selling classes in 2025.

Nevertheless, when evaluating Grayscale’s XLM holdings to the greater than 32 billion XLM circulating provide, the fund solely controls about 0.36% of the provision. This share stays too small to create any decisive influence available on the market.

What Does Stellar (XLM) Should Counter Promoting Strain?

November 2025 marked a pivotal second when seven main crypto gamers — Fireblocks, Solana Basis, TON Basis, Polygon Labs, Stellar Improvement Basis, Mysten Labs, and Monad Basis — formally launched the Blockchain Funds Consortium (BPC).

This alliance goals to advertise blockchain-based fee requirements. BPC focuses on cross-chain integration, enabling XLM to achieve thousands and thousands of customers throughout different ecosystems. These developments may enhance demand in 2026.

“Throughout Q3, the Stellar community noticed 37% progress in full-time builders, 8 instances sooner than the business progress charge,” Stellar said.

In parallel, the Stellar ecosystem continues to see explosive progress in Actual-World Belongings (RWA). Complete RWA worth on the community reached a report $654 million in November 2025, up from $300 million initially of the 12 months.

Tokenized Asset Worth on Stellar. Supply: RWA

Charts from RWA.xyz present important contributions from tokenized funds, together with Franklin OnChain US Authorities Fund and WisdomTree Prime.

Nevertheless, actual adoption tales don’t all the time align with market sentiment. Current evaluation signifies that XLM has traditionally carried out poorly in November. With altcoins drowning in excessive worry, XLM could wrestle to flee the broader adverse pattern.

The put up How Grayscale Holds XLM because the Value Drops Extra Than 50% appeared first on BeInCrypto.