Charles Hoskinson has emphasised how undervalued Cardano’s DeFi ecosystem stays, urging market members to go lengthy on Cardano-based decentralized exchanges (DEXes).

Hoskinson, the founding father of Cardano, made this advice in response to a submit by Cardano stake pool operator (SPO) YODA, who highlighted the current efficiency of NIGHT, the native token of privacy-focused sidechain, Midnight.

NIGHT Spectacular Buying and selling Exercise

Within the submit, YODA pointed to NIGHT’s explosive momentum, noting that the token had reached a brand new all-time excessive whereas producing a powerful $4.2 billion in each day buying and selling quantity throughout centralized exchanges.

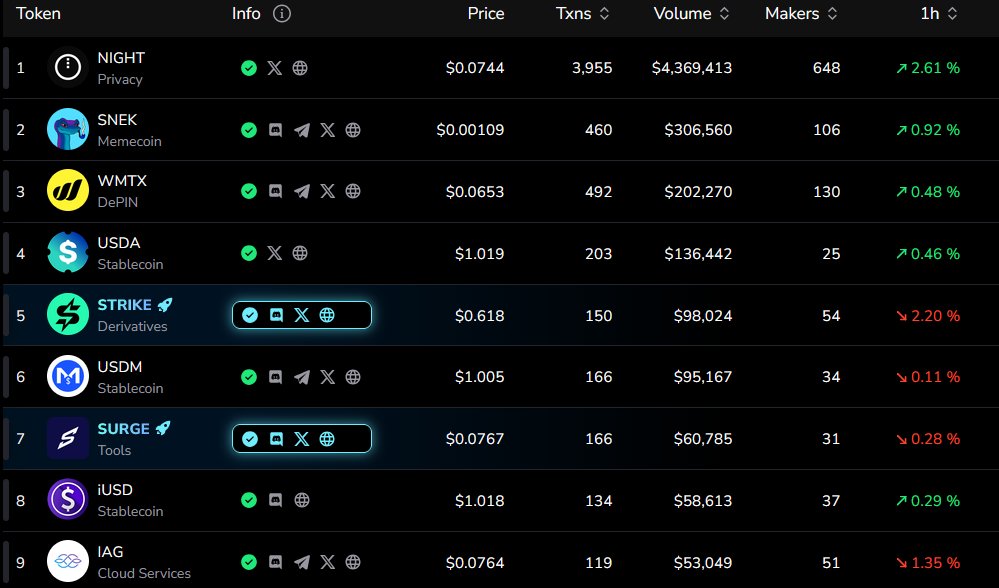

On the identical time, YODA highlighted NIGHT’s buying and selling exercise on Cardano’s decentralized platforms. Citing information from DEX Screener, the SPO revealed that Cardano DEXes collectively recorded simply $4.3 million in NIGHT buying and selling quantity.

Whereas the determine seems modest in comparison with centralized alternate volumes, YODA framed the efficiency as a relative success.

Notably, the connected screenshot reveals that NIGHT considerably outperformed the second-ranked token, SNEK, which posted solely $306,560 in DEX buying and selling quantity. Because of this, YODA expressed optimism that the rise in NIGHT’s exercise might function a contemporary catalyst for Cardano’s DeFi ecosystem.

NIGHT quantity on Cardano DEX

Hoskinson Highlights Infrastructure Required to Increase Cardano DEX Exercise

YODA’s replace underscored how far Cardano’s DeFi trails different ecosystems, regardless of the community’s robust technical foundations. In response, Hoskinson acknowledged the current surge in NIGHT’s DEX quantity however confused that Cardano’s DeFi ecosystem nonetheless requires sturdy stablecoins and cross-chain bridges to meaningfully speed up buying and selling exercise throughout its decentralized exchanges.

The Cardano founder has persistently highlighted the significance of those lacking infrastructure elements, significantly stablecoins, as catalysts for DeFi development.

Whereas Cardano already hosts a small variety of stablecoins, Hoskinson has repeatedly pushed for the launch of a tier-1 stablecoin on the community and has disclosed ongoing discussions with key entities to make this a actuality.

As beforehand reported, the shortage of a dependable stablecoin on Cardano led to a pricey incident by which a person working a five-year dormant account misplaced an estimated $6.05 million after swapping ADA for the low-liquidity stablecoin USDA.

This incident highlights a much bigger drawback: with out dependable stablecoins, merchants can not safely retailer funds, handle threat, or use extra superior buying and selling methods.

As well as, the shortage of robust cross-chain bridges limits capital coming in from main networks like Ethereum and Solana, holding Cardano’s DeFi ecosystem comparatively remoted.

Cardano DEX Quantity to Soar by 100x

Towards this backdrop, he recommended that after dependable stablecoins and efficient bridges are in place, the present low volumes on Cardano DEXes might increase dramatically, probably surging by as a lot as 100x.

Want some stables and bridges. Then they may 100x. Now is an effective time to go lengthy on Cardano DEXes.

— Charles Hoskinson (@IOHK_Charles) December 21, 2025

Within the meantime, he framed the present atmosphere as a lovely entry level, encouraging traders to “go lengthy” or accumulate low-cap tokens on Cardano’s decentralized exchanges in anticipation of this spike.

In Hoskinson’s view, Cardano DeFi is now in an accumulation section, the place exercise and valuations stay subdued at the same time as foundational upgrades progress.