Filecoin (FIL), a number one cryptocurrency within the decentralized storage sector, is exhibiting robust indicators of restoration in November 2025. Though the value stays far beneath the height of its earlier cycle, market sentiment has clearly shifted. Traders are actually focusing extra on tasks with real-world purposes.

What’s driving traders’ optimism about FIL’s future? Listed here are some notable factors.

Filecoin Buying and selling Demand Surges in November

Filecoin (FIL) is a decentralized blockchain undertaking designed to create an open knowledge storage market. It permits customers to lease or lease storage capability globally, eliminating the necessity for centralized suppliers like Google Drive, Amazon S3, or Dropbox.

In keeping with BeInCrypto knowledge, Filecoin’s value surged almost 60% throughout the first week of November, with 24-hour buying and selling quantity exceeding $1.4 billion.

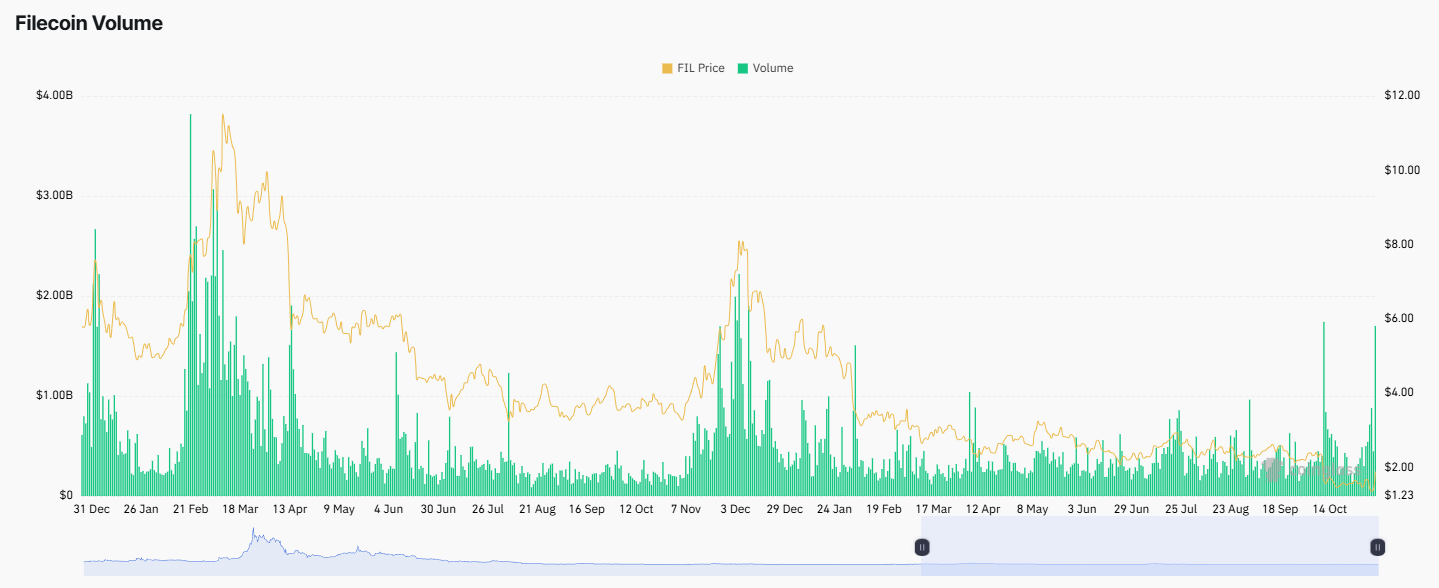

Filecoin Value & Quantity. Supply: Coinglass

Traditionally, such excessive buying and selling volumes have solely occurred a number of occasions up to now two years. Every time the amount exceeded $1 billion, it was adopted by a robust value rally, as seen in February 2024 and December 2024.

The return of billion-dollar day by day buying and selling quantity in November displays rising market exercise and renewed investor curiosity. Market sentiment has additionally shifted dramatically.

Traders are more and more favoring tasks with sensible use instances which have survived a number of cycles. This development explains the current positive aspects in altcoins resembling Zcash (ZEC), Sprint (DASH), and Web Pc (ICP).

“Look, Filecoin awakened after months of silence. Up greater than fifty % in twenty-four hours as DePIN and AI storage narratives collide. For years folks dismissed it as outdated infrastructure, however the reality is AI wants storage that’s huge, decentralized, and quick. FIL was constructed for that earlier than it was cool,” investor Justin Wu mentioned.

Grayscale’s Filecoin (FIL) Holdings Attain New Excessive

Additional proof of Filecoin’s rising recognition could be seen in Grayscale’s actions. Grayscale Investments — one of many world’s largest crypto funds — has been steadily accumulating FIL over the previous two years. In November, its holdings reached an all-time excessive of greater than 2.2 million tokens.

Grayscale Funding FIL Holding. Supply: Coinglass

Apparently, Grayscale continued to extend its FIL place even because the token’s value fell from above $10 to beneath $2. For the fund, the decline seemed to be a chance to build up extra of this altcoin.

The Grayscale Filecoin Belief is likely one of the first funding autos permitting traders to achieve publicity to Filecoin (FIL) within the type of a safety. It provides a technique to take part in FIL’s efficiency with out dealing straight with the challenges of buying, storing, or safeguarding the token.

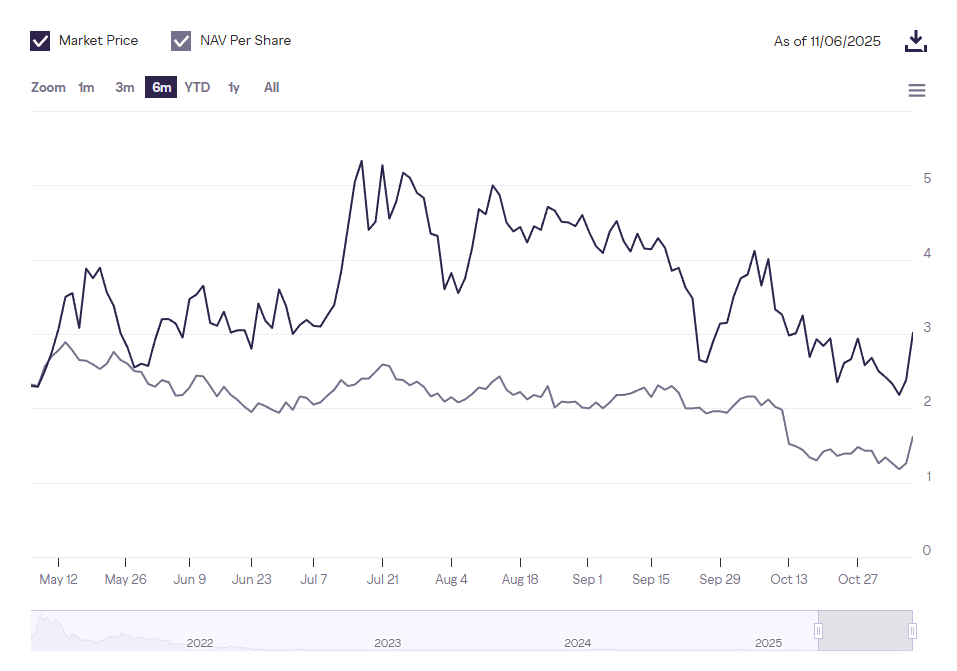

The Grayscale Filecoin Belief Efficiency. Supply: Grayscale

Presently, the Grayscale Filecoin Belief trades above $3 per share — larger than FIL’s spot market value. In the meantime, its NAV per share stays decrease than the belief market value, a state of affairs that has continued for years. This implies the belief’s shares are buying and selling at a premium, implying that traders are keen to pay greater than the precise worth of the property held by the fund.

Analysts recommend that institutional traders usually settle for such premiums as a result of they consider the underlying asset is value that value — or doubtlessly much more.

Regardless of these constructive alerts, Galaxy Analysis experiences that FIL stays one of many worst-performing altcoins among the many high 100, having fallen as a lot as 99% from its peak. The restoration journey, subsequently, might take time and is unlikely to occur in a single day.

The publish Grayscale’s Filecoin (FIL) Holdings Hit Document Excessive as Value Reveals Indicators of Restoration appeared first on BeInCrypto.