The thrill surrounding the rollout of XRP spot ETFs continues to develop, however analysts are urging holders to stay affected person.

As anticipation builds for extra XRP ETF listings, market commentators stress that the present atmosphere doesn’t help sudden worth explosions to $10, $50, and even $589, as some group members have circulated.

In a tweet, Johnny, co-host of the Good Night Crypto present, cautioned that XRP holders should mood their expectations forward of every new ETF launch.

Whereas the Canary Capital XRP ETF grew to become the primary amongst a number of listings to go stay, he emphasised that single ETF occasions hardly ever translate into prompt worth rallies.

His feedback align with earlier explanations from different analysts who’ve argued that, by design, ETF launches don’t create instant surges in open-market demand for XRP. As a substitute, inflows enter the market step by step by means of a course of that takes days or perhaps weeks earlier than any significant affect is seen.

ETF Issuers Can not Pre-Purchase XRP in Massive Portions

In the meantime, one main misunderstanding within the XRP group has been the assumption that ETF issuers would accumulate large quantities of XRP forward of launch day, creating instant purchase strain.

In accordance with data Johnny obtained from Gemini, issuers buy solely a really small quantity of XRP prematurely, often called seed capital.

Seed capital represents the minimal quantity required to start buying and selling on an trade. Issuers should not allowed to pre-purchase months’ value of anticipated XRP inflows. This implies the large-scale acquisitions that many buyers assumed have been taking place behind the scenes merely don’t happen.

Earlier stories confirmed this dynamic as nicely. ETF flows matter solely when licensed individuals create or redeem shares, not when issuers put together for launch. As a result of these early purchases are restricted, launch-day worth shocks don’t happen.

Why XRP Hasn’t Spiked But

With Canary Capital and Bitwise XRP ETFs now stay, many are questioning why the worth of XRP has not surged regardless of growing inflows.

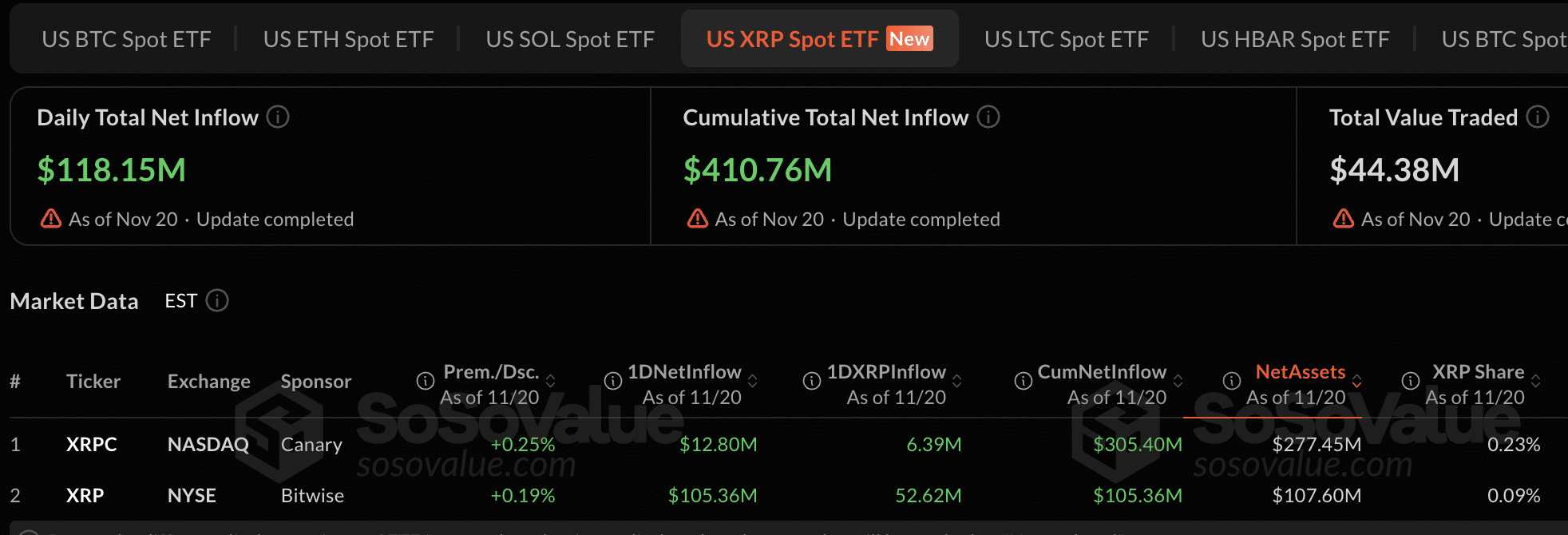

As an illustration, Canary Capital noticed $12.8 million in inflows yesterday, bringing its complete XRP belongings to $305 million. In the meantime, Bitwise debuted with an enormous first-day influx of $105.36 million.

Cumulatively, XRP ETFs have seen $410 million in inflows only one week after launching. Nevertheless, regardless of these large inflows, XRP’s worth dipped to below $2 during the last 24 hours. Many are actually questioning the disparity.

XRP Influx File

Neighborhood analysts like VanQish and Nick beforehand warned that ETF inflows don’t translate into prompt shopping for strain. ETF shares commerce on conventional exchanges, however this exercise doesn’t transfer actual XRP.

XRP will start responding solely when ETF creation demand rises sharply, when licensed individuals can not supply XRP cheaply by means of personal channels however should buy it immediately from crypto exchanges. That is the purpose at which a provide squeeze emerges.

Bitcoin adopted the identical sample in early 2024: costs dipped after ETF launches, solely to rally later as soon as ETFs started accumulating BTC at scale.