TL;DR

- A brand new collaboration goals to present American traders extra choices to realize publicity to CRO.

- Regardless of the disclosure, the token’s valuation is down 6% for the day, coinciding with the broader decline of the digital asset market.

The Deal’s Specifics

The favored cryptocurrency trade Crypto.com shook palms with the funding administration agency Canary Capital to determine the Canary CRO Belief.

The monetary car is designed explicitly for eligible particular person and institutional accredited traders in america and can present them with publicity to CRO – the native token of the Cronos community.

Steven McClurg, CEO of Canary Capital, praised Crypto.com for its efforts to “set the bar for what it means to carry institutional-grade entry to crypto markets.” He thinks the initiative will improve the demand for CRO and “will mirror the broader success” of the platform.

Eric Anziani, President and COO of Crypto.com, mentioned that offering merchants with extra choices to interact with the digital asset sector is “central” to the corporate’s imaginative and prescient.

“We’re extremely excited to accomplice with Canary Capital to allow extra traders within the U.S. to contribute to the Cronos journey forward,” he added.

CRO Heads South

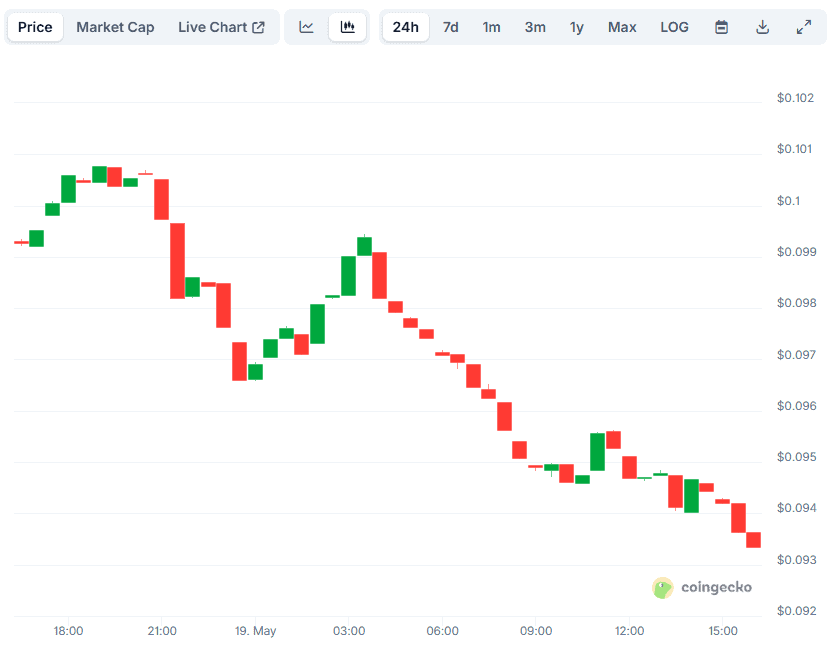

Regardless of the announcement, the worth of CRO stays in pink territory on a each day scale. At the moment, it trades at round $0.09 (per CoinGecko’s knowledge), representing a 6% lower on a 24-hour scale.

One doubtless purpose contributing to the downtrend is the general decline of the whole cryptocurrency market noticed previously a number of hours. Recall that bitcoin (BTC) surged previous $107,000 however was violently rejected and was pushed south to below $102,500. Ethereum (ETH), Solana (SOL), Cardano (ADA), and lots of different main altcoins additionally dropped, registering even larger each day declines than the most important cryptocurrency.

It’s price noting that CRO’s worth reacted rather more positively and spiked by double digits following Crypto.com’s earlier partnership, inked in March. Again then, the corporate teamed up with Trump Media and Know-how Group (TMTG) – the media firm whose majority proprietor is US President Donald Trump.

Their aim is to launch sure exchange-traded funds (ETFs) and exchange-traded merchandise (ETPs) with BTC and CRO as underlying cryptocurrencies.

“We purpose to create creative funds incorporating companies that think about fast development, technological innovation, and strengthening the U.S. financial system, unencumbered by woke nonsense and political posturing,” TMTG’s CEO Devin Nunes said on the time.