All information is rigorously fact-checked and reviewed by main blockchain specialists and seasoned business insiders.

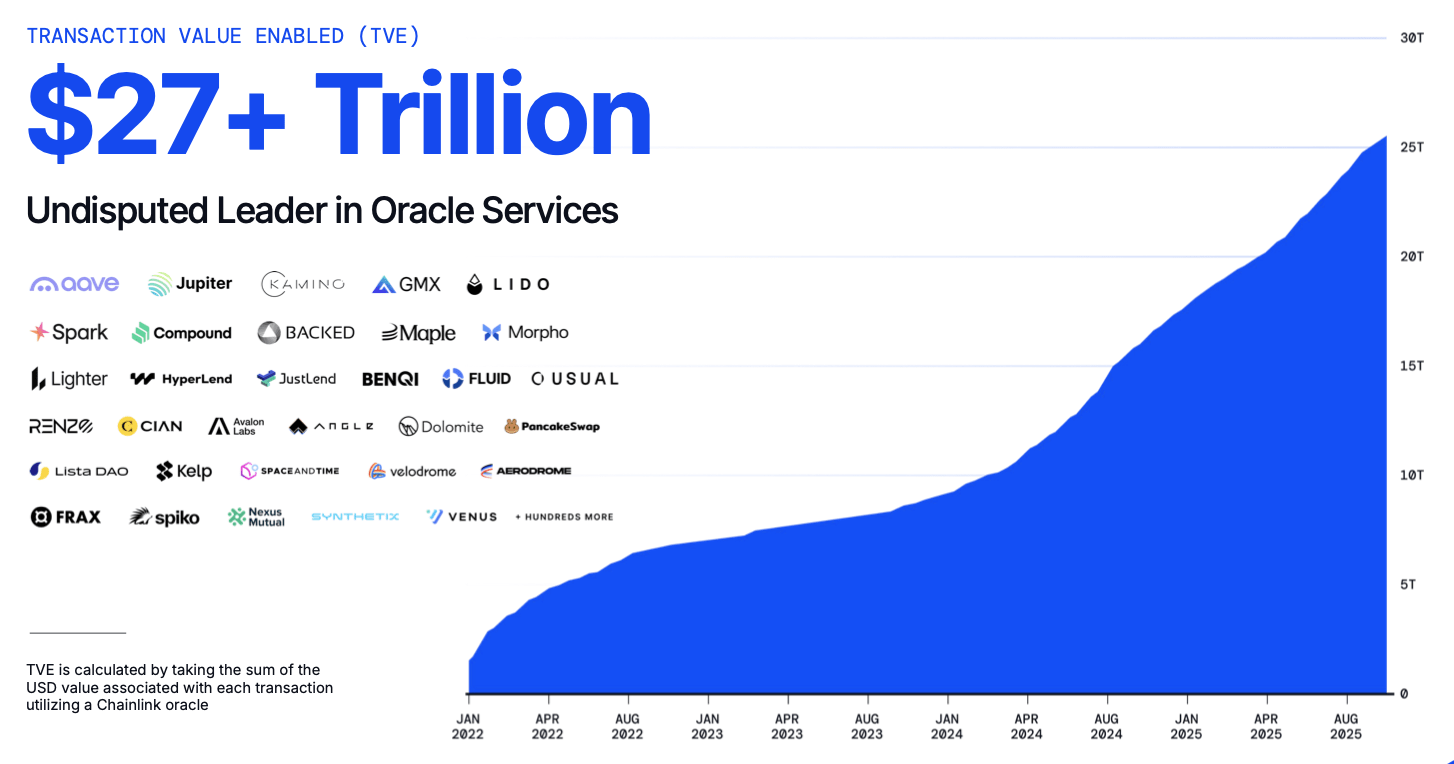

- Chainlink’s oracle community permit over $27 trillion in transactions, result in broader institutional adoption of tokenized property.

- CRE and Confidential Compute empower banks and asset managers to addressing compliant, cross-chain sensible contracts sooner and safer.

In early November 2025, Chainlink offered Chainlink Runtime Atmosphere (CRE), a unified improvement atmosphere which authorize establishments in deploying sensible contracts throughout a number of blockchains whereas integrating finance protocols, compliance guidelines, and real-time information on the identical time.

The info from December 2025, additional confirmed this transfer since Chainlink’s oracle infrastructure has now supported greater than $27 trillion in verified transaction worth, displaying how deeply it has change into embedded in actual monetary techniques. As tokenization accelerates throughout international markets, banks, asset managers, and fintech companies are extremely rely upon Chainlink because the connective layer between conventional techniques and blockchain rails.

Beforehand, our spotlight on CRE, along with UBS enabling in-production tokenized fund automation throughout the Hong Kong Framework, famous that

the system delivers real-time transparency and operational effectivity whereas sustaining full alignment with regulatory necessities.

Chainlink Connects Blockchains to the Actual World

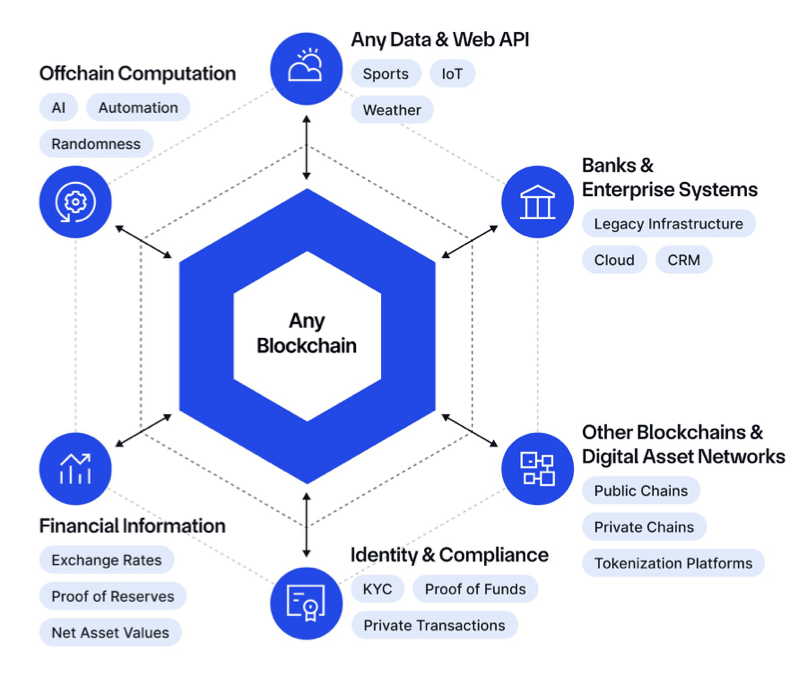

Chainlink efficiently resolves isolation of blockchains by delivering authenticated information, cross-chain messaging, and automatic compliance logic with unified oracle framework. Establishments may also hyperlink settlement techniques, identification instruments, pricing feeds, and custody platforms on to blockchain networks with out rebuilding their know-how stacks.

As displayed within the picture beneath, this structure unlocks superior use instances corresponding to tokenized funds, real-time NAV updates, atomic settlement, programmable property, and on-chain danger administration—capabilities that conventional infrastructure can not obtain by itself.

Supply: Chainlink Overview December 2025

In line with Chainlink’s current launch of Confidential Compute permits non-public sensible contracts on any blockchain, permitting establishments to tokenize delicate property and run compliance-heavy workflows, but nonetheless with out exposing information for public, which complementing CRE and expands Chainlink’s enterprise-grade choices to totally assist privateness and regulatory necessities.

Chainlink’s $27T+ TVE Milestone

In line with the information, Chainlink’s Transaction Worth Enabled (TVE) surpassing $27 trillion displaying how central its companies have change into within the broader tokenization economic system.

Every Chainlink-powered transaction, from DeFi collateral updates to institutional settlement workflows, contribute to this updates, indicating each scale and actual financial publicity. In line with a current 2025 institutional-platform overview, Chainlink helps roughly 2,400+ integrations and holds ~69.9% of the oracle-service market by worth secured.

Supply: Chainlink Overview December 2025

Furthermore, World demand can also be growing with monetary establishments and buying and selling occasions, together with from Deutsche Börse Group, that pushing reside market information onto blockchain networks by means of Chainlink’s DataLink service.

This adoption is empowered with fast settlements, operational price financial savings, and enhanced transparency, advantages that tokenization affords in contrast with legacy techniques. Lastly, Chainlink’s management can also be bolstered by its full-service method, offering oracles, CCIP, Proof-of-Reserve, and cross-chain interoperability, multi functional infrastructure, based on CoinShare.

As of now, Chainlink (LINK) is buying and selling at $14.40, reflecting a rise of 1.91% previously day and 7.54% previously week. See LINK value chart beneath.