Aster, an on-chain buying and selling platform, is celebrating over 200k on-chain holders of its native token. This follows the launch of Protect Mode, a protected buying and selling function that enables customers to execute high-leverage perpetual trades with out broadcasting their positions to the market.

200,000+ $ASTER onchain holders 🎯

A brand new milestone. A rising group that reveals up. pic.twitter.com/bFamkFwA5Y

— Aster (@Aster_DEX) January 5, 2026

The decentralized perpetual trade took the information to X, citing 200,642 on-chain holders as of at this time. This interprets to a 0.24% every day acquire, with a complete of 24.9 million transfers. The platform’s multichain perpetual futures buying and selling, that includes as much as 1001x leverage and MEV-free execution, drove this progress.

Aster expands Protect Mode to gold and silver pairs

Aster DEX has moreover introduced the enlargement of Protect Mode to XAUUSDT (gold) and XAGUSDT (silver) perpetual futures. This can allow as much as 100x leverage for on-chain buying and selling of those commodities.

Protect Mode expanded 🔥

XAUUSDT (gold) • XAGUSDT (silver) now reside, with as much as 100x leverage.✨ one faucet LONG/SHORT, prompt execution

✨ Orders keep off public books

✨ PnL Sharing Price Construction🗓 Buying and selling hours:

– 5 days × 24h

– Markets closed on Saturdays and Sundays… pic.twitter.com/9uwWHKK2r2— Aster (@Aster_DEX) January 5, 2026

Aster said that with the brand new pairs, Protect Mode will proceed to emphasise privateness with orders executed off public books, one-tap lengthy/brief positions, prompt fills, and a PnL-sharing payment mannequin. Buying and selling is reside and can function 24 hours a day, 7 days every week, in UTC.

The platform launched the Protect Mode mid-last month, with leverage of as much as 1,001 instances on Bitcoin (BTC) and Ether (ETH) pairs. As reported by Cryptopolitan, the mode enabled prompt execution and nil slippage whereas holding orders off public order books.

“Protect Mode displays our perception that the way forward for on-chain buying and selling isn’t nearly leverage or velocity—it’s additionally about management, discretion, and safety,” stated Leonard, CEO of Aster. “We’re constructing a buying and selling platform that enables merchants to carry out on the highest degree with out being pressured to broadcast their methods to the market.”

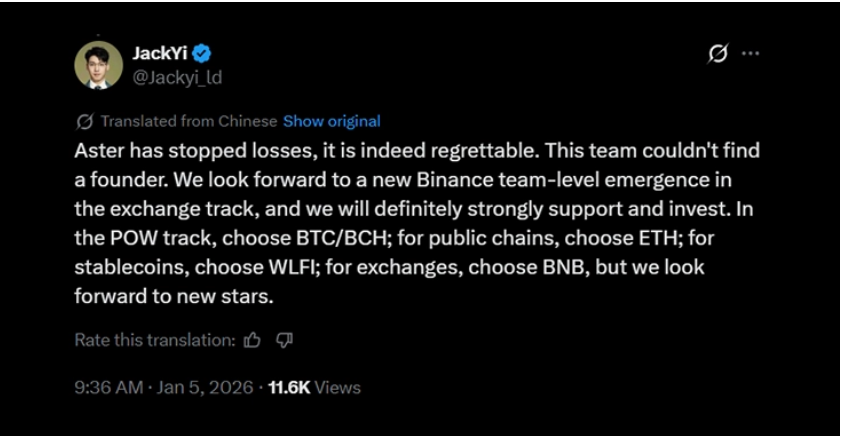

This replace attracts curiosity in non-public high-leverage trades however highlights dangers, as seen in earlier whale losses exceeding $35 million on the platform. The founding father of Liquid Capital, Yi Lihua, additionally stated in a tweet that he has chosen to surrender on the Aster decentralized trade undertaking.

The tweet that has since been deleted revealed that he couldn’t get in contact with Aster’s founder. This made him nervous, so he pulled out of the funding.

Supply: by way of X

Nonetheless, Aster is main within the general buying and selling quantity with roughly $38.8 billion within the final 24 hours. Hyperliquid follows carefully with a buying and selling quantity of roughly $34.8 billion. Nevertheless, the open curiosity of the Hyperliquid platform is manner greater, presently sitting at $81.7 billion, as Asters sits at $26 billion.

Aster climbs 10% however technical indicators present bearish stress

Moreover the perpetual volumes, Aster has remained lively by strategic initiatives. The platform introduced its fifth token buyback programme in December. Aster’s repurchases and burns finance every day charges of as much as 80%.

Aster additionally printed the primary half of the 2026 roadmap. Plans embody the launch of the Layer One AsterChain mainnet. Plans for staking and on-chain governance for ASTER have been put in place. Fiat on- and off-ramps are additionally being thought of.

In consequence, Aster started the yr with a double-digit surge. The token is up 11.44% within the final week. Yesterday, Aster broke previous the $0.78 resistance degree, signaling bullish momentum. In line with analysts, this triggered a rally towards $0.91–$1.39.

Nevertheless, technical indicators present waning bearish stress, which is able to come because of failure to carry the $0.78 degree, risking a retracement to $0.70–$0.75. In the meantime, the token is regular with a small surge of 0.07% within the final 24 hours, and the coin is buying and selling at 0.77.