Arthur Hayes is a well-known crypto investor, government and influencer, co-founder of BitMEX and CIO of his household workplace Maelstrom Fund. Only in the near past, Hayes dumped over $10 million of the Ethena (ENA) cryptocurrency, a venture he has funded and helps.

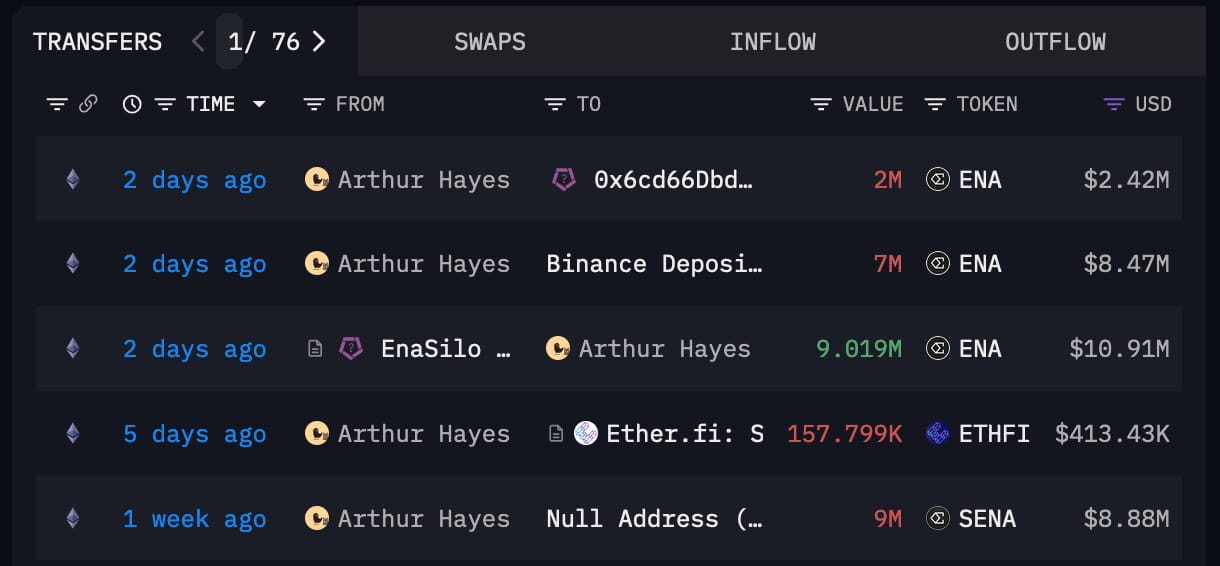

In keeping with knowledge Finbold retrieved from Arkham Intelligence, the well-known investor obtained 9 million ENA from an Ethena sensible contract on December 22 and deposited this quantity to 2 centralized alternate addresses.

First, Hayes despatched 7 million ENA, value $8.47 million, to Binance after receiving $10.91 million from the contract. Then, the chief despatched 2 million ENA, value $2.42 million, to an deal with Lookonchain recognized as belonging to Bybit.

It’s attainable that this quantity comes from unstaking 9 million sENA from Ethena’s liquid staking protocol. It is because Hayes’s deal with has an sENA exercise from one week in the past value $8.88 million at the moment.

Arthur Hayes helps Ethena (ENA)

Notably, Arthur Hayes can also be a recognized Ethena supporter in lots of fronts. For instance, he impressed USDe’s creation by means of a paper describing a stablecoin that might work equally to what Ethena designed.

Nevertheless, Hayes’s drafts urged utilizing Bitcoin (BTC) automated trades as an alternative of the Staked Ethereum (sETH) utilized by Ethena’s stablecoin USDe.

The millionaire investor has supported the venture since its launch, not solely by inspiring it along with his paper but additionally with funding and advisory. As CoinDesk reported, the Maelstrom Fund was considered one of Ethena’s traders in a $6 million funding spherical led by Dragonfly.

As of this writing, Arthur Hayes holds $36.44 million in his recognized addresses, in accordance with Arkham Intelligence. Out of that, sENA makes the third largest place, at present with 7.919 million sENA, value $8.35 million. Hayes additionally has 18,580 ENA, value $19,680.

Subsequently, the investor’s latest Ethena dump accounted for greater than half of his whole ENA and sENA recognized place. This represents a major exercise that raised warning out there, given Hayes’s assist for the venture.

Beforehand, Finbold reported how the investor dumped hundreds of thousands of {dollars} of Pendle (PENDLE) proper after publicly selling the token on X.

As issues develop, the market will carefully watch Arthur Hayes’s addresses to grasp if this represents simply opportunistic swing buying and selling or one thing greater, like a long-term repositioning and even potential insider buying and selling.

Featured picture from Shutterstock.