TL;DR

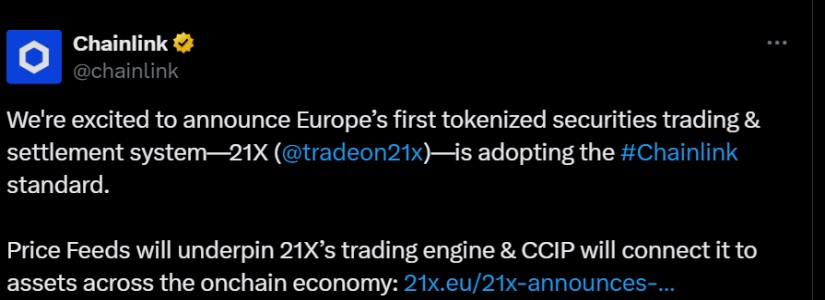

- 21X and Chainlink have fashioned a strategic alliance to launch a tokenized securities buying and selling and settlement system in Europe, the primary of its form to be regulated by the European Union.

- The system can be based mostly on Chainlink’s infrastructure to enhance information high quality and facilitate interoperability between blockchains.

- The launch is scheduled for the primary quarter of 2025 underneath the supervision of BaFin, with the objective of selling the adoption of tokenized property.

21X has introduced a strategic partnership with Chainlink as a part of preparations for the launch of its tokenized securities buying and selling and settlement system in Europe, the primary of its form to be regulated by the European Union.

This system, which will present order matching, buying and selling, settlement, and registry companies for tokenized cash and securities, will leverage Chainlink’s infrastructure to enhance information high quality and facilitate interoperability between totally different blockchains.

Chainlink Will Present Dependable Knowledge and Interoperability

The collaboration contains the implementation of real-time value information for property traded on 21X’s new buying and selling system, with secondary value feeds for purchase and promote orders. As well as, Chainlink will contribute its Cross-Chain Interoperability Protocol (CCIP), permitting 21X members to entry property and stablecoins issued on varied blockchain platforms. It will strengthen 21X’s technique to create a tokenized securities market accessible from a number of networks, offering larger flexibility and liquidity.

The launch of 21X is scheduled for the primary quarter of 2025, and the platform can be supervised by BaFin, Germany’s Federal Monetary Supervisory Authority. With this launch, 21X expects to determine itself within the European tokenized securities market, leveraging the EU regulatory framework to advertise the adoption of digital property by institutional traders.

Driving Digital Belongings in Europe

Max Heinzle, founder and CEO of 21X, expressed his enthusiasm for the partnership, highlighting that this settlement permits the corporate to adjust to European regulatory necessities and supply purchasers entry to all kinds of tokenized property. For her half, Angie Walker, World Head of Banking and Capital Markets at Chainlink Labs, emphasised that the collaboration will improve the safety and reliability of 21X’s infrastructure, making certain that the info used for transactions is correct and reliable.

Each corporations goal to put the groundwork for the event of regulated blockchain markets in Europe, opening new prospects for the trade and settlement of digital property