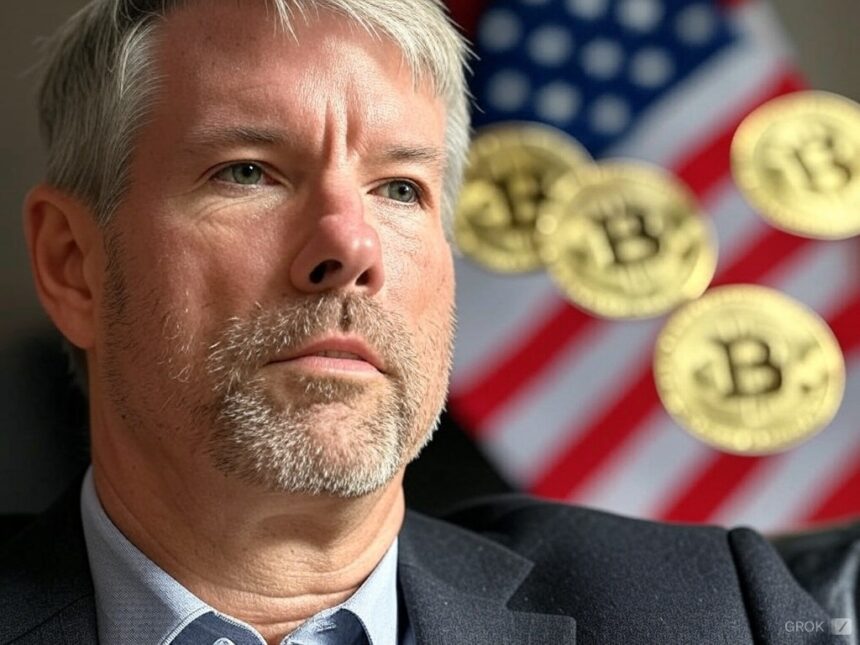

In July 2024, Michael Saylor, president of the Technique firm (previously Microstrategy), participated within the Bitcoin convention in Nashville, United States, and in its dissertation projected millionaire costs for the forex created by Satoshi Nakamot in 20 years.

Saylor, a acknowledged Bitcoiner maximalist, initiatives that Bitcoin (BTC) may have a value of three million {dollars} on a bearish stage, 13 million {dollars} in an optimistic and as much as 50 million {dollars} in essentially the most excessive case.

Earlier than persevering with, you will need to notice that Technique is presently the general public firm with the most important Bitcoin reserve, with 499,096 BTC in its treasury.

Because of this enterprise mannequin, The agency occupies the 14th place among the many corporations of the S&P500the index that brings collectively essentially the most invaluable corporations in america.

Aside from the keenness that these projections generate between the Bitcoiner neighborhood, it’s value asking What’s the evaluation that Saylor carried out to succeed in an goal value of 13 million per BTC.

Jesse Myers, monetary market analyst, reveals that the businessman used a examine he had performed in February 2023, which gave him vital knowledge, similar to an estimate of 900 billion {dollars} distributed in worth reserve property on this planet.

As well as, Myers used its “most potential evaluation” body to forecast the long run worth of the forex created by Satoshi Nakamoto, suggesting that Its adoption as a reserve asset might result in seize a major a part of that marketduring which bonds, gold, actions, actual property or artworks are discovered.

As seen within the following graph, if BTC continues with an adoption trajectory as a worth reserve, its value might improve within the subsequent twenty years. The purple line represents the annual progress charge, whereas the yellow bars are the value of the digital forex.

Myers factors out in his report that, with this start line, Saylor wanted to find out how a lot capital might soak up BTC of different reserve property teams, at what velocity and what components might change this course of.

At the moment, the president of the corporate centered on pc providers acknowledged via his X account that Bitcoin “is competing in opposition to gold, collectible articles, artwork, actions, actual property, bonds and cash as a worth deposit within the twenty first century.”

The whole worth of all These property in circulation add 900 billion {dollars}. For Myers, “whereas BTC maintains essentially the most enticing traits as an asset of worth reserve within the funding panorama, it’s going to proceed to be. BTC is a black gap on this planet stability. ” As well as, he thinks:

“What makes Bitcoin as totally different (as an asset of worth on the whole, and as a specific uncooked materials) is that the market has to soak up half of the brand new supply from mining each 4 years. In 2016, an annual provide progress of three.6 %. In the present day, 1.8 %. In 2024, 0.9 %. In 2028, 0.45 %, and so forth. And nobody on this planet can alter that relentless rhythm, ever. ”

Jesse Myers, monetary market analyst.

The specialist additionally emphasizes that BTC is a financial savings know-how for its rising scarcity and early adoptionnot like Fíat cash. “The greenback design makes it a foul financial savings know-how, which is why everybody saves actions and actual property,” he says.

As cryptootics has reported, Bitcoin has a restricted provide of 21 million items, whose broadcast is lowered by the occasion that happens each 4 years often called the halving. It is a issue that impacts the value of asset within the medium and long run

That inherent shortage is what attracts each massive and little buyers.

One other difficulty that generates curiosity is that, not like Fíat cash, BTC shouldn’t be always devalued by the issuance or financial insurance policies of the central banks.

Bitcoin to 13 million {dollars}

To achieve the value of 13 million {dollars} per BTC, Myers takes worth reserve property, and proposes to research every of those classes to estimate how a lot capital might migrate to BTC to, in that manner, calculate its whole potential evaluation in present {dollars}. Thus, it’s obtained a “cheap and conservative” projection of its future progress.

Within the first column, worth reserve property similar to gold, collectible articles, artworks, actual property, bonds, fíat cash and inventory market are positioned.

The second column reveals the overall worth of every sort of asset, whereas the third column signifies the share that, in keeping with Myers estimates, BTC might seize. For instance, within the case of gold, which has a worth of 12 billion {dollars}, it’s estimated that BTC might soak up 50 % of that whole, which is equal to six billion {dollars} (fourth column).

Including all asset classes, the evaluation means that Bitcoin might seize as much as 200 billion {dollars} in whole worth. Based mostly on this projection, the value of BTC would attain 10 million {dollars}. “If this occurs, it will likely be an important occasion within the historical past of finance,” says the specialist.

For its half, Michael Saylor, making use of the identical methodology, initiatives a fair higher estimate, putting the value of BTC at 13 million {dollars}.

Lastly, the analyst highlights: “Bitcoin’s whole potential is to soak up roughly 25 % of the world worth, whereas right now it represents solely 0.05 %. It’s absurd. Because of this I feel Bitcoin might multiply by 500 within the coming many years, in actual phrases (adjusted to inflation). ”

(tagstotranslate) bitcoin (BTC)