U.S. President Donald Trump’s presidency has been characterised by a steady stream of attention-grabbing statements and actions. Liberation Day is about to seize the eye of not simply the folks however nations and markets as effectively. Here’s what you must learn about how this extremely anticipated day might form crypto markets.

In This Information:

- What’s Trump’s Liberation Day?

- How did crypto reply to Trump’s Liberation Day?

- How will Liberation Day have an effect on markets?

- Brief-term ache, long-term potential?

What’s Trump’s Liberation Day?

In case you missed it, President Trump plans to implement a number of import taxes on April 2, which has been dubbed Liberation Day.

“Now we have Liberation Day, as you already know, on April 2, as a result of, and I’m not referring to Canada, however many international locations have taken benefit of us — the likes of which no person even thought was potential for a lot of, many a long time. And you already know, that has to cease. ” — U.S. President Donald Trump

Trump’s announcement stems from a earlier resolution to implement tariffs on choose international locations, a lot of which have been postponed till April.

Based mostly on earlier statements, many anticipate reciprocal tariffs, which is able to match different international locations’ charges, whereas the remainder will doubtless goal key areas of producing, manufacturing, and different sectors. The tariffs set for “Liberation Day” will doubtless embrace:

- Prescription drugs, semiconductors, copper, and lumber.

- 25% tariff on any nation that imports oil from Venezuela.

- Separate tariffs on Canada and Mexico to “cease drug trafficking.”

- 20% tariffs on high of the present 10% tariffs on China.

Trump’s historical past of tariffs

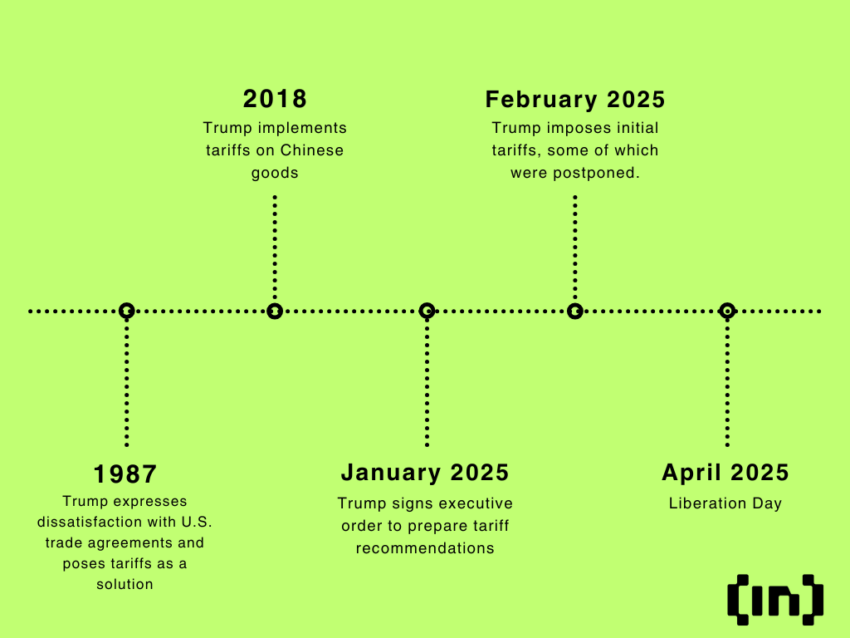

Timeline of Trump’s tariff insurance policies: BeInCrypto

President Trump has been red-pilled on tariffs for the reason that Nineteen Eighties when he publicly criticized commerce practices he believed have been dangerous to the US.

In a 1987 look on Larry King Dwell, Trump remarked, “The very fact is, you don’t have free commerce… Lots of people are bored with watching the opposite international locations ripping off the US.”

On Jan. 20, 2025, Trump signed an govt order to organize tariffs. The primary wave of tariffs was set to debut on Feb. 4, 2025. These included a ten% tax on all Chinese language imports and 25% tariffs on Canada and Mexico.

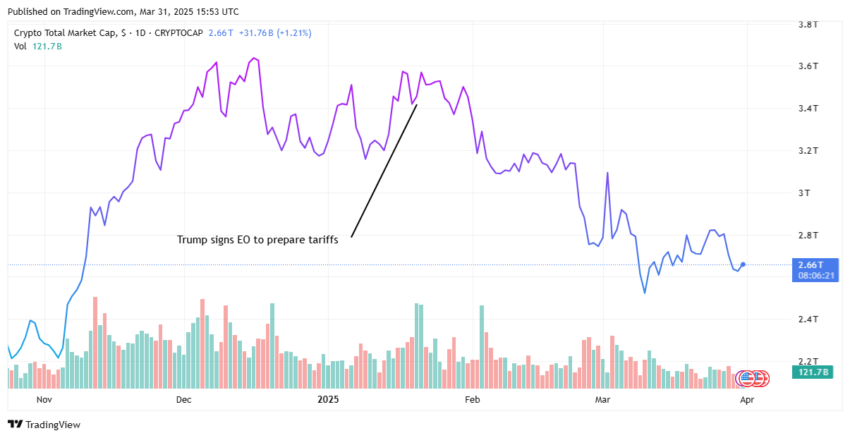

Complete crypto market cap: TradingView

How did crypto reply to Trump’s Liberation Day?

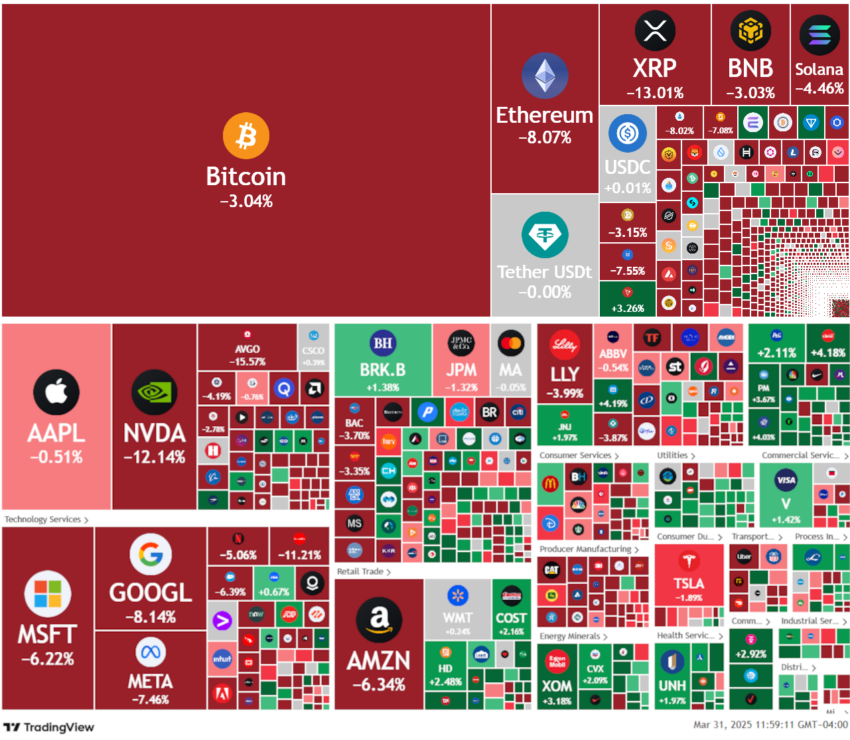

Upon the announcement of Trump’s Liberation Day, crypto and equities markets took an enormous nosedive. Bitcoin (BTC) and Ether (ETH) have been down ~3% and ~8% on the week, respectively, whereas NVDA and GOOGL have been down ~12% and ~8%.

Crypto and shares heatmap: TradingView

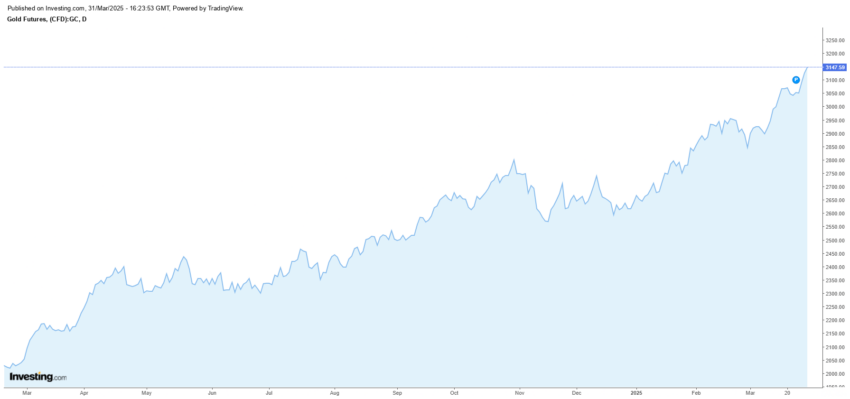

Whereas many markets have taken a success, gold has carried out exceptionally effectively. This may very well be seen as a potential market flight into safer property amidst the looming commerce battle between main economies.

Gold Futures: investing.com

How will Liberation Day have an effect on markets?

Many individuals have urged that Trump’s tariffs are instruments for negotiating commerce and border safety. Others say the revenues will assist scale back the federal price range deficit.

The Federal Reserve admittedly underestimated the results of the tariffs and has additionally revised its expectations for inflation. Throughout its March 2025 assembly, the Fed raised its 2025 core inflation forecast to 2.8%, up from the earlier projection of two.5%.

Trump argues these measures will scale back U.S. reliance on international items and reclaim financial energy. Nonetheless, critics warn of upper client prices and potential retaliation efforts from affected nations. Listed below are the potential results Liberation Day might have on crypto and equities markets.

Continued de-risking

Whereas making projections on the potential end result of tariffs on crypto and different markets may be tough, we have already got some information to work with. In Q1 2025, each tariff announcement has triggered a pullback in riskier property. Right here’s why:

- Tariffs increase the price of commerce

- The U.S. imports greater than it exports (by loads)

- Which means greater costs throughout the board — not only for luxurious, however necessities too

If costs rise quick sufficient, folks will spend much less. That, in flip, places strain on company earnings, particularly for multinationals with tight margins or excessive enter prices. Finally, large cash will transfer away from threat.

Crypto falls squarely in that risk-on class. It thrives in environments the place liquidity is powerful and traders are chasing the upside.

Different situations

Some alternate situations may very well be bullish for crypto, however they’re unsure, particularly contemplating President Trump’s sheer dedication to renegotiate commerce agreements.

Firstly, Trump has been identified to shift course on the drop of a dime. Due to this fact, it’s potential that he might scrap tariffs altogether or not less than some tariffs on sure international locations. This might create a short-lived rally.

Nonetheless, given the fragility of world liquidity and even price cuts from central banks, underlying circumstances persist. Tariffs will not be sufficient to offset the higher macroeconomic panorama.

Secondly, if tariffs have a terrific sufficient influence (e.g., decreased liquidity, discretionary spending, and so forth.), alongside different circumstances, this might result in a recession within the U.S.

If a recession have been to happen or is more likely to happen, you might see decreased rates of interest from the Fed and even authorities stimulus and bailouts to backstop the financial system. This might trigger elevated demand for threat property, which crypto would doubtless soak up, resulting in a potential bull market.

Brief-term ache, long-term potential?

Trump’s Liberation Day is a part of an ongoing technique to renegotiate commerce relationships and discount with main U.S. commerce companions. Nonetheless, this “America first” coverage has sparked a commerce battle with many main economies. In anticipation of continued inflation and a potential recession, many traders are de-risking from property like crypto. Whereas it’s more than likely that tariffs might not directly negatively influence crypto within the quick time period, in the long run, Bitcoin’s function as a hedge in opposition to such measures might improve, particularly in the event that they set off financial instability. Conversely, this will likely enhance the crypto market.

Within the quick time period, guarantee your portfolio is well-diversified and that you’ve got solely invested what you possibly can afford to lose. By no means be in a state of affairs the place it’s a must to exit the market at a loss.