This can be a section from the Ahead Steering e-newsletter. To learn full editions, subscribe.

January’s FOMC assembly minutes had been launched this week, offering loads of fodder for financial plumbing nerds to piece collectively what the Fed thinks about financial institution reserves and its ongoing marketing campaign of quantitative tightening (QT).

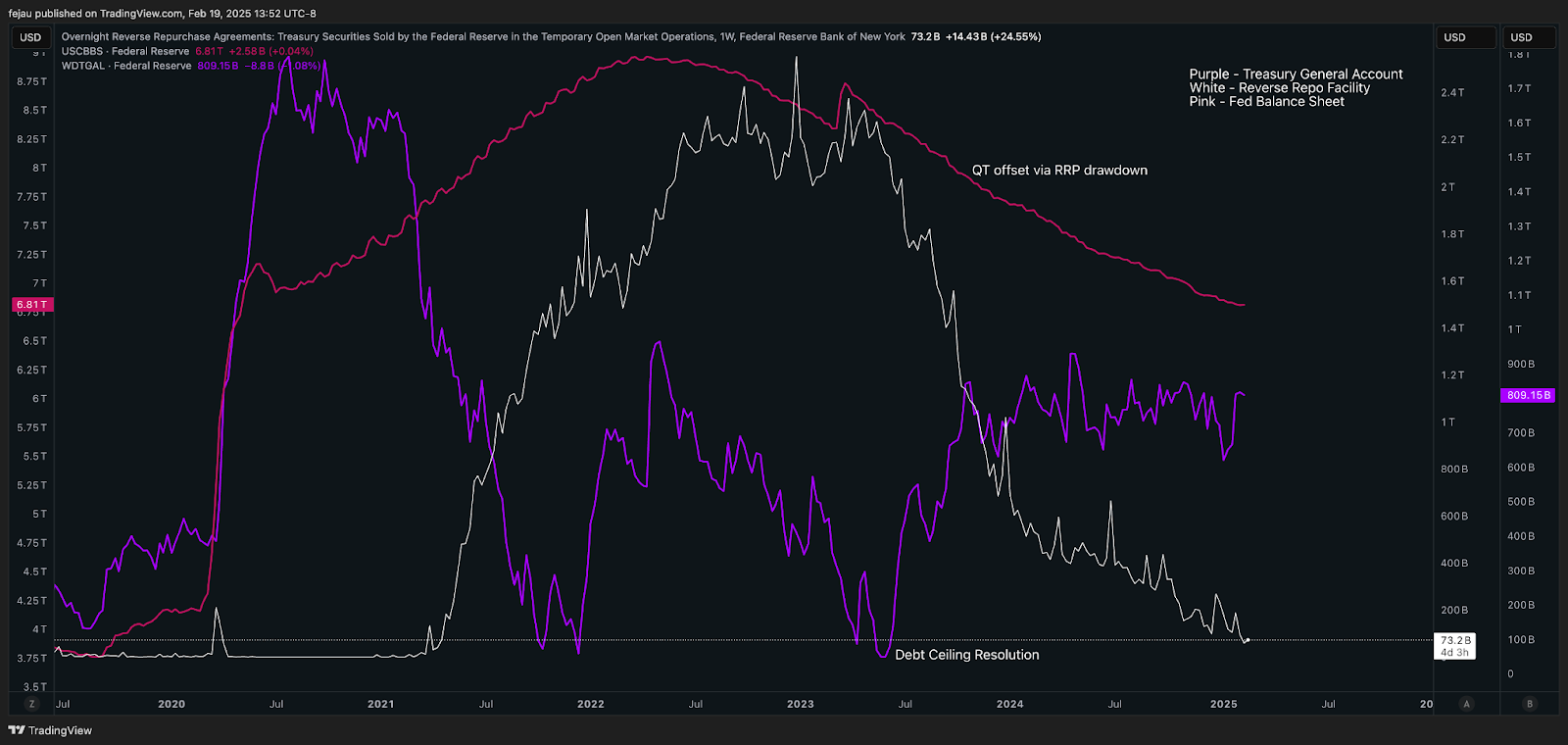

As seen within the chart under, the QT marketing campaign has been fraught with nuance and idiosyncratic offsetting. As QT occurred, the overwhelming majority of it has been offset by the reverse repo facility (RRP) steadiness as seen by the white line under.

Additional, this has been hiccuped by the debt ceiling debacle of 2023 and the SVB banking disaster that led to the financial institution time period funding program’s creation.

All that stated, we’re getting near the top objective of QT when it comes to the financial institution reserve ranges the Fed is concentrating on. There are plenty of methods to measure this, however a easy shorthand is that the Fed has been concentrating on a perfect reserve degree of $3 trillion that features each financial institution reserves and the RRP. At the moment, that nets us at $3.27 trillion.

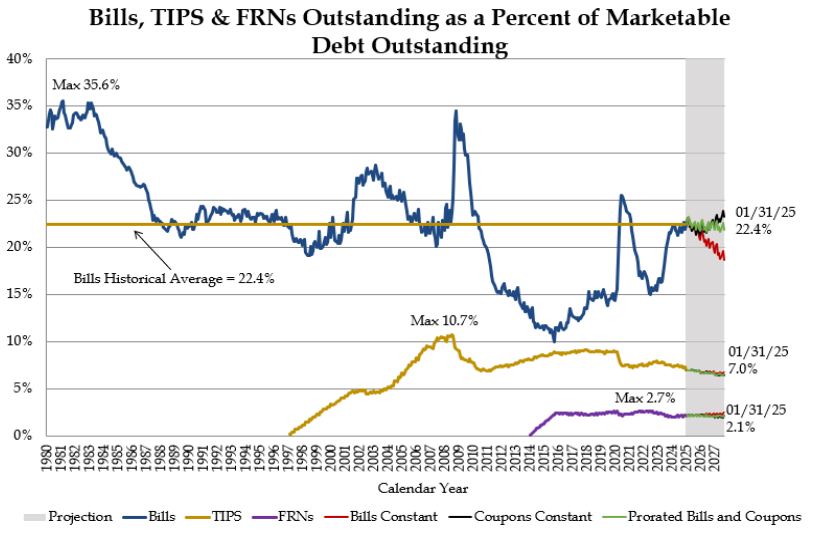

Given this context, there’s been plenty of speak about when the Fed may finish QT altogether. And with the discharge of this week’s FOMC assembly minutes, we obtained our first trace:

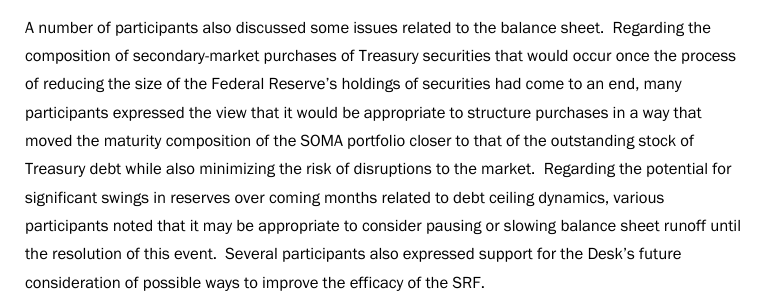

Now, there’s so much to unpack right here because it comprises plenty of nuances. Let’s run by way of them:

- The Fed is re-thinking the period of the bonds it holds. Ideally, it needs to run again to a degree of period that was pre-2008 and pre-QE. That’s what they meant by saying “applicable to construction purchases in a means that moved the maturity composition of the SOMA portfolio nearer to that of the excellent inventory of Treasury debt…”

As of proper now, that SOMA portfolio consists of 5% in T-bills. Nonetheless, treasury issuance is at 22.4%.

- The Fed is anxious concerning the implications of the debt ceiling and the following treasury basic account (TGA) drawdown, in addition to the next TGA rebuild as soon as the debt ceiling is resolved. Merely put, for the TGA to be rebuilt again to the extent it was earlier than the debt ceiling, Treasury must concern a ton of T-bills. In 2023 it was ready to do that simply as a result of the RRP was stuffed to the brim and acted as a dampener for it. Now, sitting at $73 million, there’s no buffer. As such, the next assertion was included within the minutes: “Relating to the potential for vital swings in reserves over coming months associated to debt ceiling dynamics, varied members famous that it might be applicable to think about pausing or slowing steadiness sheet run-off till decision of this occasion…”

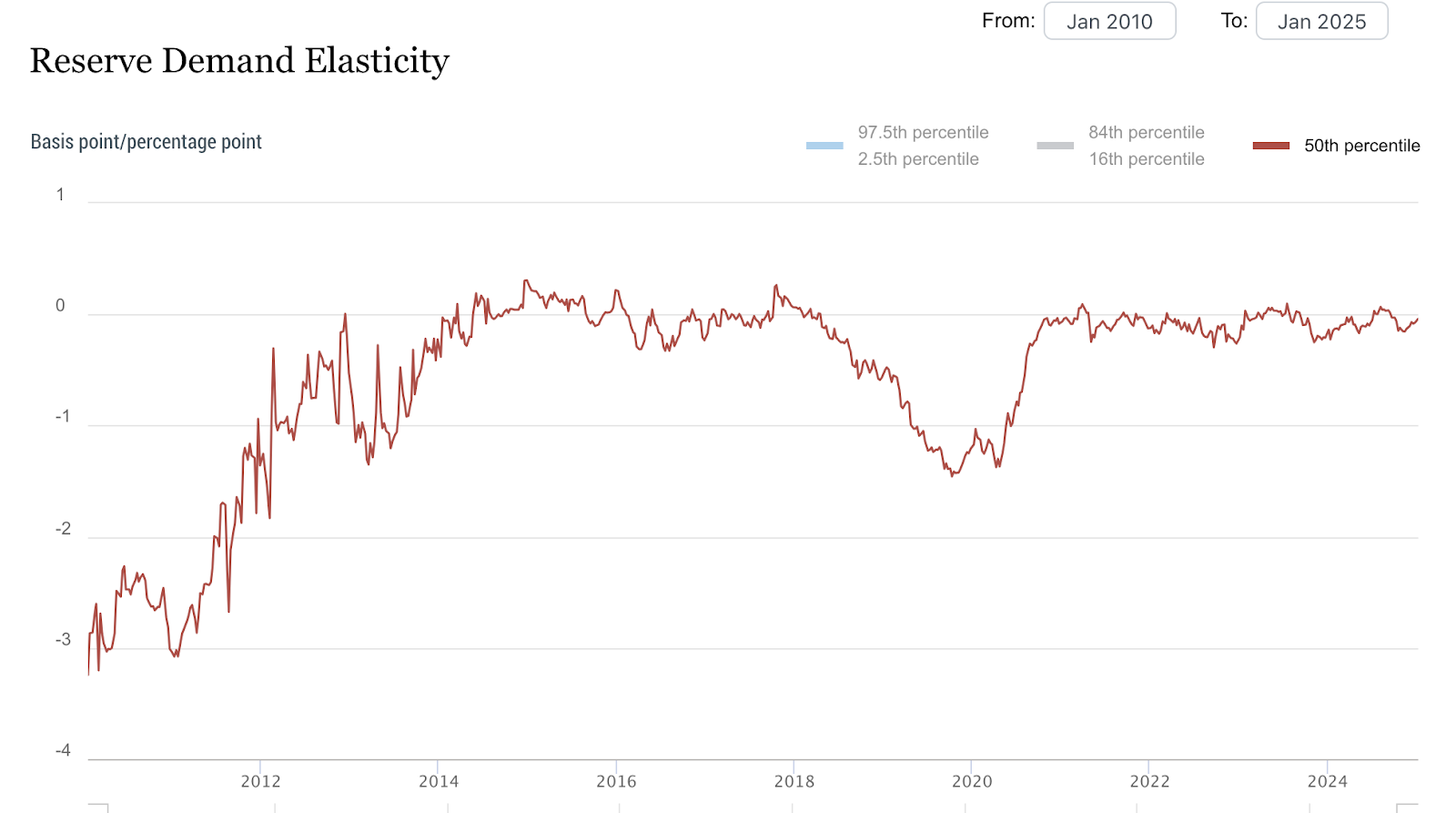

- Though not a urgent concern, the Fed is getting nearer and nearer to order ranges the place “liquidity hiccups” are inclined to occur. The final time this occurred was September 2019 when reserves had been too scarce and triggered a significant repo spike, stopping QT in its tracks. Nonetheless, trying on the present reserve demand elasticity dashboard under (top-of-the-line metrics for gauging threat of a repo blowup), so long as we’re close to that zero degree there are not any short-term issues. That stated, the Fed is conscious that point is ticking and it doesn’t need a repeat of September 2019 — therefore its point out that “a number of members additionally expressed help for the Desk’s future issues of attainable methods to enhance the efficacy of the SRF…” The SRF, or standing repo facility, is a brand new everlasting device the Fed has in place to behave as a shock absorber throughout occasions resembling in September 2019. By mentioning its intention to enhance efficacy, we will surmise that the Fed is concentrated on making certain all the right instruments are in place to proceed gradual steadiness sheet run-off.

For a comparatively quick quantity of textual content, we certain had been capable of glean so much as to how the Fed is considering its steadiness sheet and financial institution reserves within the coming months.