Solely 0.04 Sol are wanted to start out successful rewards in Wenia.

The rewards rely upon the conduct of the Solana community, says the platform.

Wenia, Bancolombia’s cryptocurrency arm, enabled Solana’s staking, providing her shoppers rewards for many who take part in this system.

As introduced by the platform, customers will be capable of win rewards “whereas contributing to the operation of the Solana community.” To begin, clients solely must have 0.04 Sol.

Staking is a course of by which customers block their cryptocurrencies to keep up the security and performance of a public or personal community, receiving rewards in return.

On this case, with solely 0.04 solar, equal to USD 9.6, customers can take part in Staking by way of Wenia, delegating their belongings to dependable validators contained in the Solana Crimson.

In keeping with the platform, buyer rewards “rely upon the conduct of the community.” Due to this fact, Wenia reminds customers “reviewing the dangers of this exercise.”

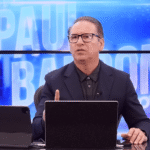

Juan Pablo Ramírez, CEO of Wenia, talked about that the staking is “the chance they had been ready for” the customers of that platform in order that their cryptocurrencies solar They assist them generate rewards Whereas serving to Crimson Solana to develop.

Competitors grows

With this novelty, Bancolombia squeezes competitors for cryptocurrencies in Latin America, highlighting the position of the banking sector on this market.

Giants such because the Brazilian cloud have already got a whole lot of approach traveled on this space. Cloud is without doubt one of the Latin American banks that has approximated probably the most cryptocurrencies, providing buy, sale, custody and switch providers from a single account. As well as, it additionally affords rewards to its customers in the event that they use the circle stablcoin, USDC, as Cryptonotic reviews a couple of days in the past.

Nonetheless, Clenk has not enabled the standking service for any of the cryptocurrencies with which it operates, One thing desired amongst its personal neighborhood of customers.

In a discussion board, a number of shoppers manifested optimism to the likelihood that this Neobanco lashes these reward providers. Certainly one of them commented: “Nicely, it would not harm to dream. I see Clenk working and taking essential steps within the implementation of latest functionalities, who is aware of, proper? ”

Different customers, reminiscent of Edson Bezerra, don’t see it so doubtless, because of the presence of the world’s largest cryptocurrency change, Binance, which already affords “a superb variety of cryptocurrency -based merchandise”.

“However that is positively not the perfect of cloud, since even the quantity of cryptocurrencies is decreased and chosen by hand,” he mentioned.

This Wenia transfer not solely represents a step ahead within the integration of conventional monetary providers with cryptocurrency applied sciences in Colombia, however might additionally affect how different banks within the area handle their cryptoactive methods. The competitors intensifies, with every establishment in search of to distinguish and provide extra worth to its clients in a market that continues to broaden shortly.

The introduction of Staking by Wenia might function a catalyst for extra individuals in Latin America to change into acquainted and take part within the cryptocurrency ecosystem, Benefiting from the belief and infrastructure of one of many largest banks within the espresso nation. Time will say how this and different initiatives will impression the adoption and regulation of cryptocurrencies on the regional degree.

(Tagstotranslate) Banking and Insurance coverage (T) Colombia